US Stock MarketDetailed Quotes

REGN Regeneron Pharmaceuticals

- 701.850

- -6.400-0.90%

Close Dec 20 16:00 ET

- 706.330

- +4.480+0.64%

Post 20:01 ET

77.13BMarket Cap17.36P/E (TTM)

717.610High700.830Low1.89MVolume710.200Open708.250Pre Close1.33BTurnover1.79%Turnover Ratio20.19P/E (Static)109.89MShares1211.20052wk High2.63P/B73.98BFloat Cap693.00052wk Low--Dividend TTM105.40MShs Float1211.200Historical High--Div YieldTTM2.37%Amplitude4.610Historical Low704.467Avg Price1Lot Size

Regeneron Pharmaceuticals Stock Forum

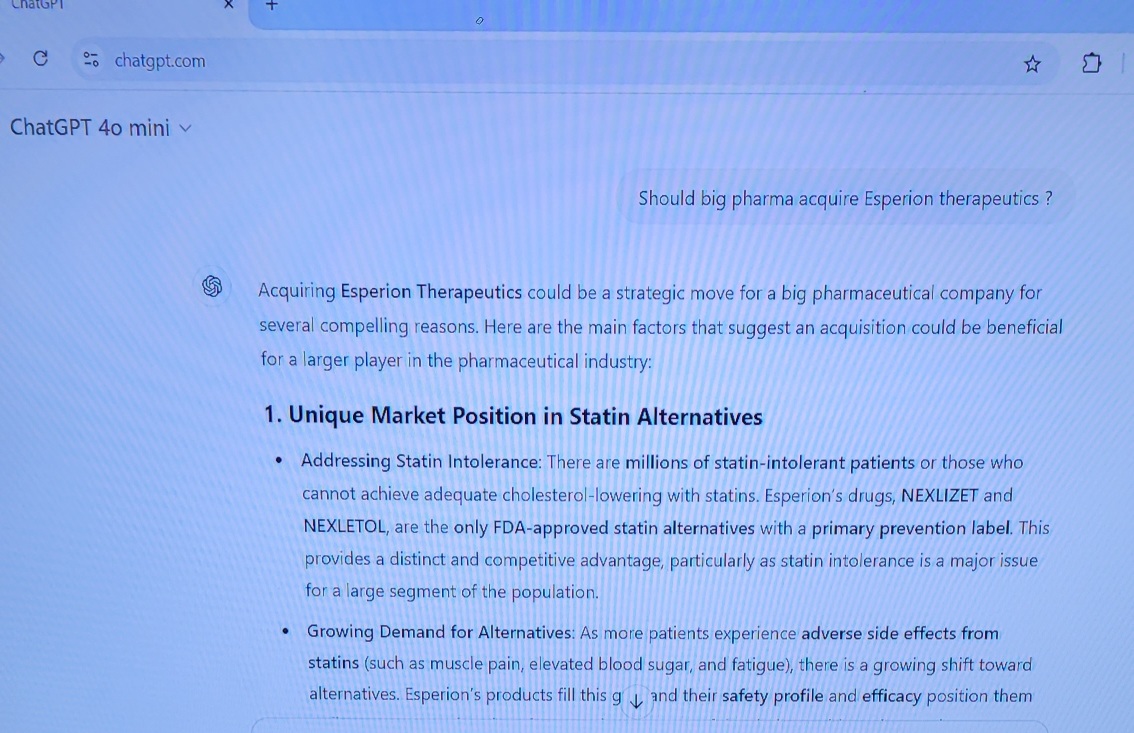

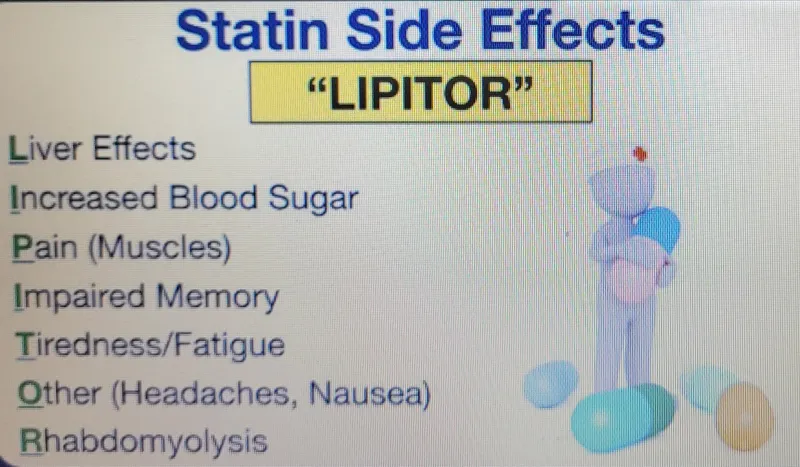

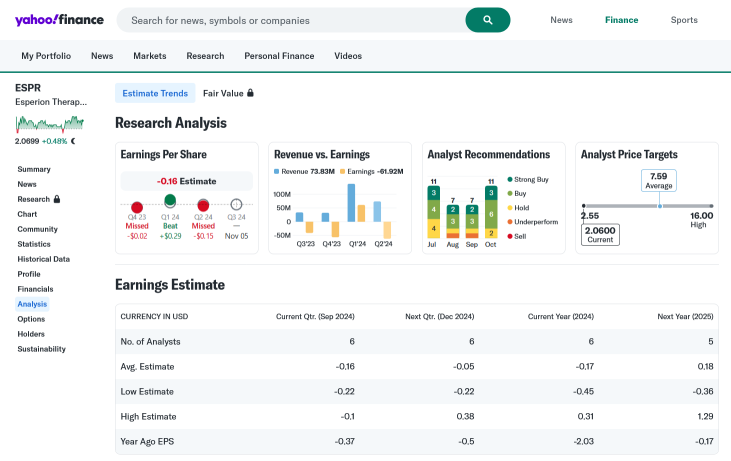

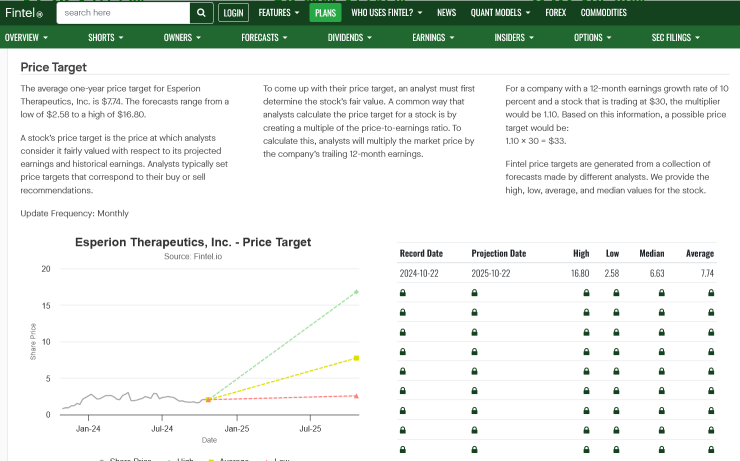

$Esperion Therapeutics (ESPR.US)$ Acquiring Esperion Therapeutics could be a strategic move for a big pharmaceutical company for several compelling reasons. Here are the main factors that suggest an acquisition could be beneficial for a larger player in the pharmaceutical industry:

1. Unique Market Position in Statin Alternatives

– Addressing Statin Intolerance: There are millions of statin...

1. Unique Market Position in Statin Alternatives

– Addressing Statin Intolerance: There are millions of statin...

10

1

4

This unique biotech $Esperion Therapeutics (ESPR.US)$ Esperion has the only FDA approved statin alternative drugs NEXLIZET & NEXLETOL for Primary Prevention, Statins are a class of prescription drugs that help lower cholesterol levels. They are the most common treatment for high cholesterol, an estimated 21 Million Americans are Statin intolerant and or maxed out on Statin drugs and need additional lowering. Over 71 ...

+2

13

1

4

🔥 We go over 5 stocks that look undervalued, i show you the numbers for yourself, i own 1 of the stocks on the list, but i try to go over stocks you’ve probably never heard of before! LMK ur thoughts :)

$Hershey (HSY.US)$ $Celsius Holdings (CELH.US)$ $Regeneron Pharmaceuticals (REGN.US)$ $Yelp Inc (YELP.US)$ $Innovative Industrial Properties Inc (IIPR.US)$

$Hershey (HSY.US)$ $Celsius Holdings (CELH.US)$ $Regeneron Pharmaceuticals (REGN.US)$ $Yelp Inc (YELP.US)$ $Innovative Industrial Properties Inc (IIPR.US)$

From YouTube

1

Utilities: $NextEra Energy (NEE.US)$ $Duke Energy (DUK.US)$ $Southern (SO.US)$ $Consolidated Edison (ED.US)$ $Public Service Enterprise Group (PEG.US)$

Crypto: $Coinbase (COIN.US)$ $GEMINI GROUP GLOBAL CORP (GMNI.US)$ $Riot Platforms (RIOT.US)$

Financials: $JPMorgan (JPM.US)$ $Morgan Stanley (MS.US)$ $Wells Fargo & Co (WFC.US)$

Traditional Energy: $Exxon Mobil (XOM.US)$ $Chevron (CVX.US)$ $ConocoPhillips (COP.US)$

Biotechnology: $Amgen (AMGN.US)$ $Gilead Sciences (GILD.US)$ $ROCHE HOLDING AG (RHHBY.US)$ $Biogen (BIIB.US)$ $Regeneron Pharmaceuticals (REGN.US)$

���������...

Crypto: $Coinbase (COIN.US)$ $GEMINI GROUP GLOBAL CORP (GMNI.US)$ $Riot Platforms (RIOT.US)$

Financials: $JPMorgan (JPM.US)$ $Morgan Stanley (MS.US)$ $Wells Fargo & Co (WFC.US)$

Traditional Energy: $Exxon Mobil (XOM.US)$ $Chevron (CVX.US)$ $ConocoPhillips (COP.US)$

Biotechnology: $Amgen (AMGN.US)$ $Gilead Sciences (GILD.US)$ $ROCHE HOLDING AG (RHHBY.US)$ $Biogen (BIIB.US)$ $Regeneron Pharmaceuticals (REGN.US)$

���������...

7

4

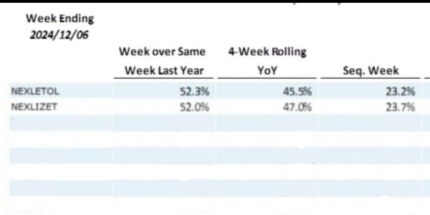

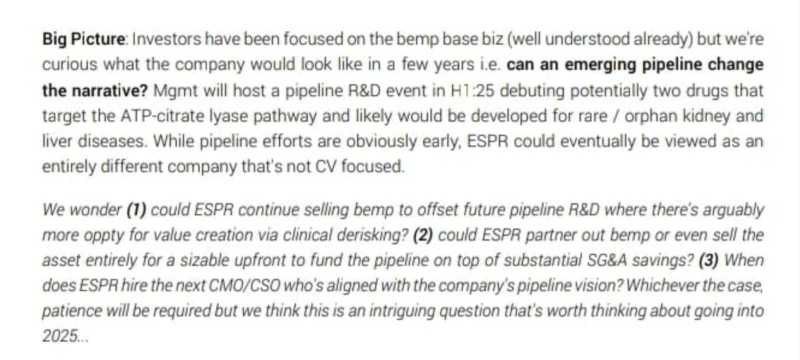

Esperion $Esperion Therapeutics (ESPR.US)$ We reiterate Strong Buy rating. Esperion has the only FDA approved statin alternative drugs NEXLIZET & NEXLETOL for Primary Prevention, an estimated 21 Million Americans are Statin intolerant and or maxed out on Statin drugs and need additional lowering. Over 71 million Americans take statin drugs, we see continued prescription growth & expect over 5...

+20

14

🚨 This Week’s PDUFAs:

$Heron Therapeutics (HRTX.US)$ : 🤔

⇨ ZYNRELEF® Vial Access Needle

‣ Postoperative pain

‣ PDUFA: 9/23/24 (sNDA)

$Bristol-Myers Squibb (BMY.US)$ : 🤔

⇨ KarXT (xanomeline-trospium)

‣ Schizophrenia

‣ PDUFA: 9/26/24 (NDA)

$Sanofi (SNY.US)$ $Regeneron Pharmaceuticals (REGN.US)$ : 🤔

⇨ Dupixent

‣ Chronic obstructive pulmonary disease

‣ PDUFA: 9/27/24 (sBLA)

$BeiGene (BGNE.US)$ $Merck & Co (MRK.US)$ & $Bristol-Myers Squibb (BMY.US)$ : 🤔

⇨ Tislelizumab, KEYTRUDA, OPDIVO & YER...

$Heron Therapeutics (HRTX.US)$ : 🤔

⇨ ZYNRELEF® Vial Access Needle

‣ Postoperative pain

‣ PDUFA: 9/23/24 (sNDA)

$Bristol-Myers Squibb (BMY.US)$ : 🤔

⇨ KarXT (xanomeline-trospium)

‣ Schizophrenia

‣ PDUFA: 9/26/24 (NDA)

$Sanofi (SNY.US)$ $Regeneron Pharmaceuticals (REGN.US)$ : 🤔

⇨ Dupixent

‣ Chronic obstructive pulmonary disease

‣ PDUFA: 9/27/24 (sBLA)

$BeiGene (BGNE.US)$ $Merck & Co (MRK.US)$ & $Bristol-Myers Squibb (BMY.US)$ : 🤔

⇨ Tislelizumab, KEYTRUDA, OPDIVO & YER...

9

1

Didn't manage to post yesterday but here was how I approached last night. (I am an amateur investor) Comment below what you think or what I should do next!

Day 1 passed quickly, when I first looked at the US market, it was in the reds. I was at a lost to choose what stocks or ETFs to buy.

I first placed an order in $SPDR S&P 500 ETF (SPY.US)$ to act as a buffer, and managed to get it at the price I wanted.

I then found $Regeneron Pharmaceuticals (REGN.US)$ was dropping quite a bit s...

Day 1 passed quickly, when I first looked at the US market, it was in the reds. I was at a lost to choose what stocks or ETFs to buy.

I first placed an order in $SPDR S&P 500 ETF (SPY.US)$ to act as a buffer, and managed to get it at the price I wanted.

I then found $Regeneron Pharmaceuticals (REGN.US)$ was dropping quite a bit s...

16

5

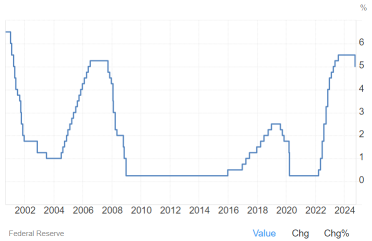

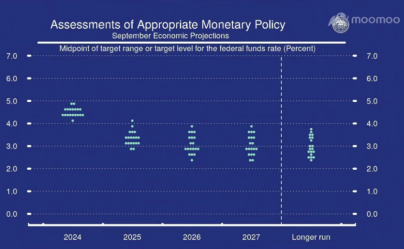

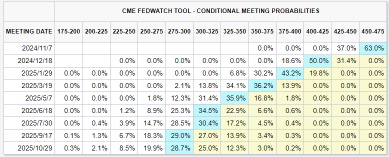

The Federal Reserve on Wednesday implemented its first rate cut in over four years, reducing the benchmark rate by 50 basis points to a range of 4.75%-5%.

The move surpassed Wall Street's expectations. Analysts had generally anticipated a 25 basis point cut, while the futures market had priced in a 61% probability of a 50 basis point cut and a 39% probability of a 25 basis point reduction.

Market Response to First Rate Cut

St...

The move surpassed Wall Street's expectations. Analysts had generally anticipated a 25 basis point cut, while the futures market had priced in a 61% probability of a 50 basis point cut and a 39% probability of a 25 basis point reduction.

Market Response to First Rate Cut

St...

+7

75

9

84

$Broadcom (AVGO.US)$ $Salesforce (CRM.US)$ $T-Mobile US (TMUS.US)$ $Advanced Micro Devices (AMD.US)$ $Workday (WDAY.US)$ $Restoration Hardware (RH.US)$ $HP Inc (HPQ.US)$ $Okta (OKTA.US)$ $Regeneron Pharmaceuticals (REGN.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $FedEx (FDX.US)$ $Lennar Corp (LEN.US)$ $Schlumberger (SLB.US)$ $Texas Pacific Land (TPL.US)$

From YouTube

3

1

1

📣 ITRM AdCom 9/9 meeting ongoing 🚗

👀 stay tuned for updates on meeting outcomes

See 👇 for further info.

🚨 This Week’s AdCom:

$Iterum Therapeutics (ITRM.US)$ : Meeting ongoing 🤔

⇨ Sulopenem

‣ uUTI (Uncomplicated Urinary Tract Infection)

‣ AdCom: 9/9/24

🚨 Last Week’s PDUFAs:

$Travere Therapeutic (TVTX.US)$ : Approved 9/5 🎉

⇨ FILSPARI (Sparsentan)

‣ IgA nephropathy (IgAN)

‣ PDUFA: 9/5/24

$Avadel Pharmaceuticals (AVDL.US)$ : Awaiting decision 🤔

⇨ LUMRYZ (sodium oxybate)

‣...

👀 stay tuned for updates on meeting outcomes

See 👇 for further info.

🚨 This Week’s AdCom:

$Iterum Therapeutics (ITRM.US)$ : Meeting ongoing 🤔

⇨ Sulopenem

‣ uUTI (Uncomplicated Urinary Tract Infection)

‣ AdCom: 9/9/24

🚨 Last Week’s PDUFAs:

$Travere Therapeutic (TVTX.US)$ : Approved 9/5 🎉

⇨ FILSPARI (Sparsentan)

‣ IgA nephropathy (IgAN)

‣ PDUFA: 9/5/24

$Avadel Pharmaceuticals (AVDL.US)$ : Awaiting decision 🤔

⇨ LUMRYZ (sodium oxybate)

‣...

5

1

No comment yet

Heat List

Overall

Symbol

Price

% Chg

No Data

Alwayslearning5 : LOL