No Data

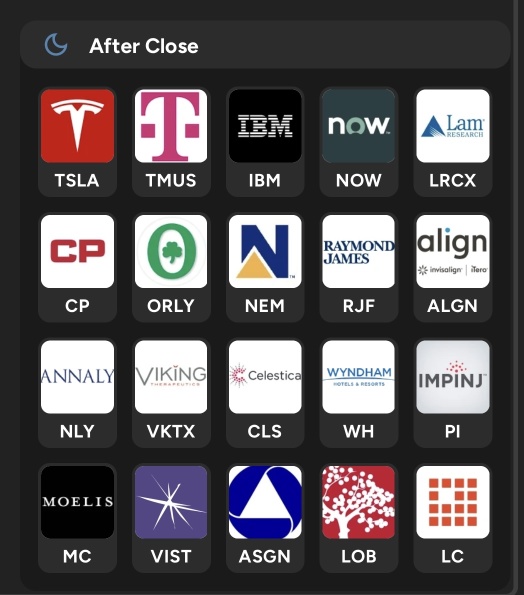

RJF250117P110000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Wall Street follows the guidance of the Federal Reserve, and major institutions predict a decline in US Treasury yields next year.

Wall Street is responding to messages from the Federal Reserve, predicting that even if Trump's trade and tax policies pose risks to the bond market, the short-term US Treasury yields will still decline by 2025. Strategists' forecasts are largely in agreement, believing that the 2-year Treasury yield, which is more sensitive to the Federal Reserve's interest rate policies, will decrease. They also expect that the yield will drop by at least 0.5 percentage points from its current level in 12 months. David Kelly and others from the Morgan Asset Management team stated, "Although investors might be myopically focused on the speed and extent of interest rate cuts next year, they should take a step back and consider the Federal Reserve in 2025."

Global M&A to Improve in 2025: 3 Investment Bank Stocks to Consider

KBW Maintains Raymond James Financial(RJF.US) With Hold Rating, Raises Target Price to $170

Raymond James' Paul Reilly: What I Got Right in 14 Years as CEO -- Barrons.com

Raymond James' Paul Reilly: What I Got Right in -2-

Friday Opens With Falling Prices, but Market Turns Around | Live Stock

Comments

U.S. Treasury yields edged up last week, with the benchmark 10-year Treasury yield hold...

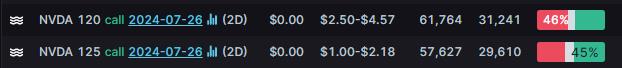

$NVIDIA (NVDA.US)$ fell 0.77%. Its options trading volume was 1.95 million. Call contracts account for 56.9% of the total trading volume. The $120 calls expiring July 26 were traded most actively.

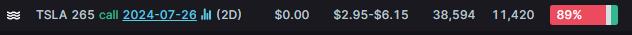

$Tesla (TSLA.US)$ fell 2.04%. Its options trading volume was 1.47 million. Call contracts account for 56.8% of the total trading volume. The $265 calls expiring July 26 were traded most act...

莉莉家的铭星 : If it's really that good, does it mean that Buffett is blind and sold bank stocks too early?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

71425974 : STOP

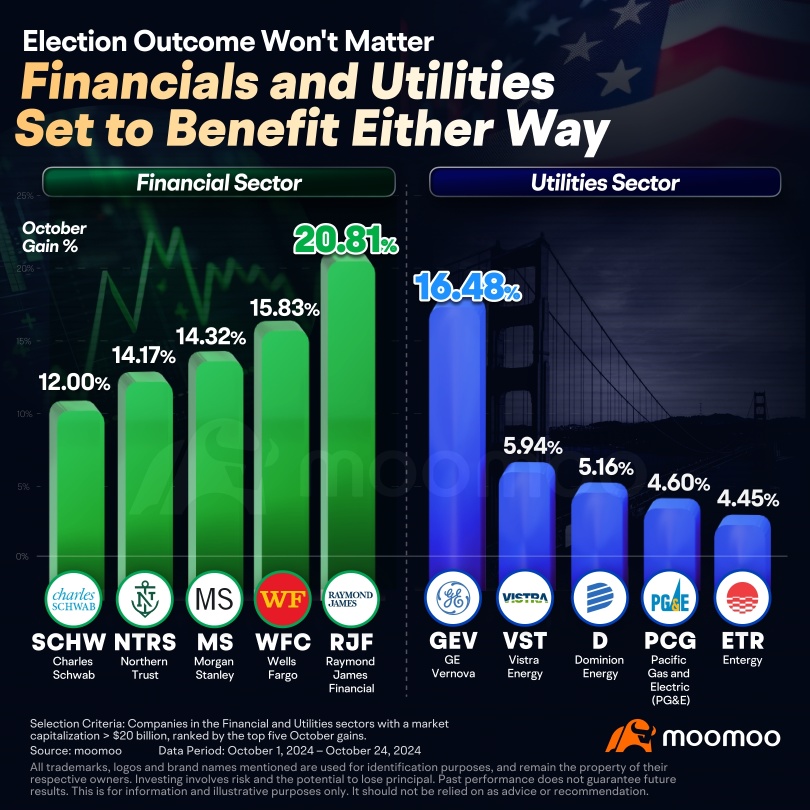

Name Unimportant : Dems= Banks, M.I.C (war for profit), Gas

Reps.= Banks, Tech, Utilities, Crypto

Laine Ford : good stock to have