US Stock MarketDetailed Quotes

RMBS Rambus

- 63.250

- -1.250-1.94%

Trading Jan 23 15:31 ET

6.74BMarket Cap39.29P/E (TTM)

63.820High62.350Low451.09KVolume62.970Open64.500Pre Close28.40MTurnover0.43%Turnover Ratio21.01P/E (Static)106.58MShares73.62052wk High6.49P/B6.70BFloat Cap37.42552wk Low--Dividend TTM105.93MShs Float127.000Historical High--Div YieldTTM2.28%Amplitude3.080Historical Low62.959Avg Price1Lot Size

Rambus Stock Forum

Welcome back to "Max Learns to Invest" – our story-driven series that explores moomoo's features through the eyes of Max, our avatar representing new investors like you. Got thoughts or questions? Share them below! We're rewarding 88 points for every comment that provides actionable suggestions or answers to our end-of-article questions. (Offer valid for one week after posting...

94

47

59

$Rambus (RMBS.US)$

newsfilter.io

They look undervalued to me.

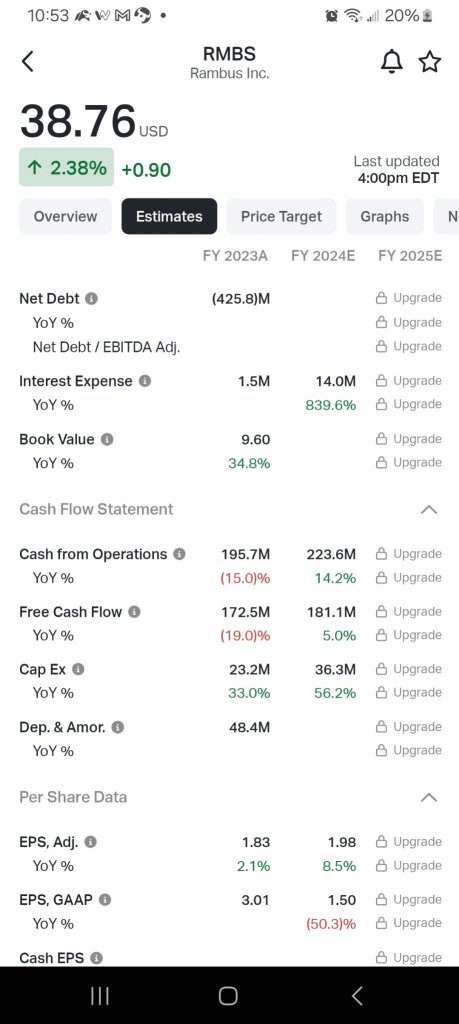

unless I'm missing something, the key problem is the interest expense, +839% yoy, so they will benefit rate cuts

newsfilter.io

They look undervalued to me.

unless I'm missing something, the key problem is the interest expense, +839% yoy, so they will benefit rate cuts

2

$Rambus (RMBS.US)$

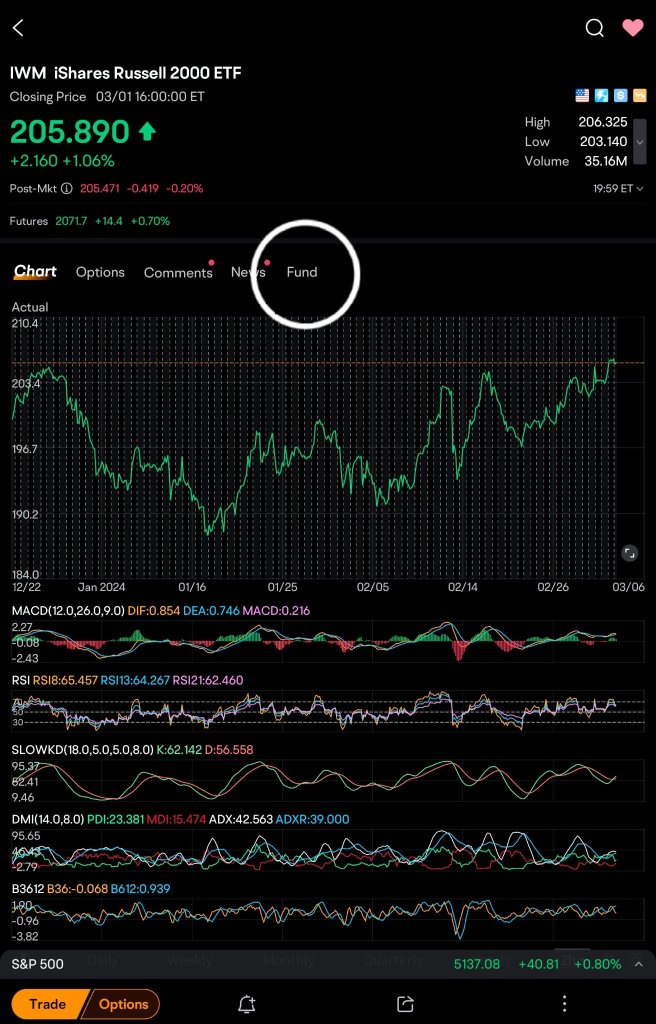

Long-Term Bullish Trend

The long-term trend is bullish. You can see this with the monthly candles. I believe this trend will continue since RMBS is ripping with other semiconductor stocks.

Dip and Then Rip

We just experienced a dip in this name. I wish I had gotten in on Friday because the price really ripped after climbing out of the consolidation period. Personally, I think it is headed up to retest 52-week highs. That would be a nice gain in itself. I...

Long-Term Bullish Trend

The long-term trend is bullish. You can see this with the monthly candles. I believe this trend will continue since RMBS is ripping with other semiconductor stocks.

Dip and Then Rip

We just experienced a dip in this name. I wish I had gotten in on Friday because the price really ripped after climbing out of the consolidation period. Personally, I think it is headed up to retest 52-week highs. That would be a nice gain in itself. I...

+1

15

I'm going to try something new. I'm going to make a Sunday post so that it can be read before the market opens. I hope to still do my update before the market opens on Monday, I always want to see how futures move overnight.

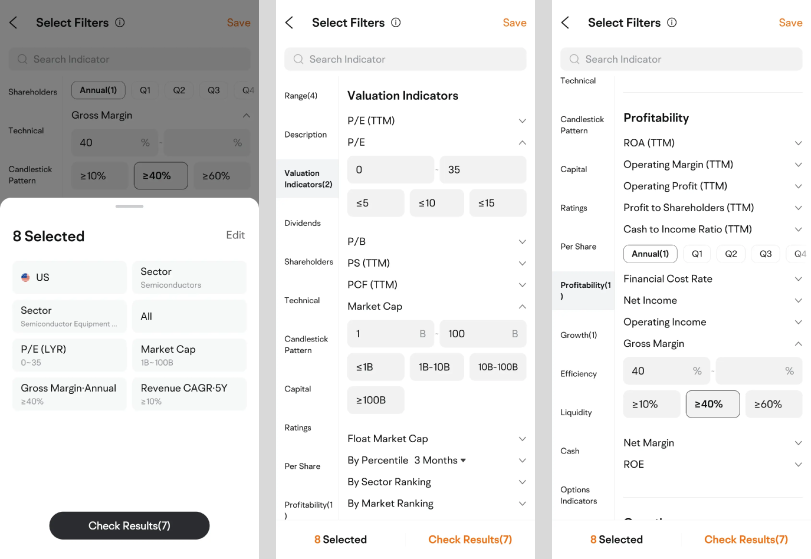

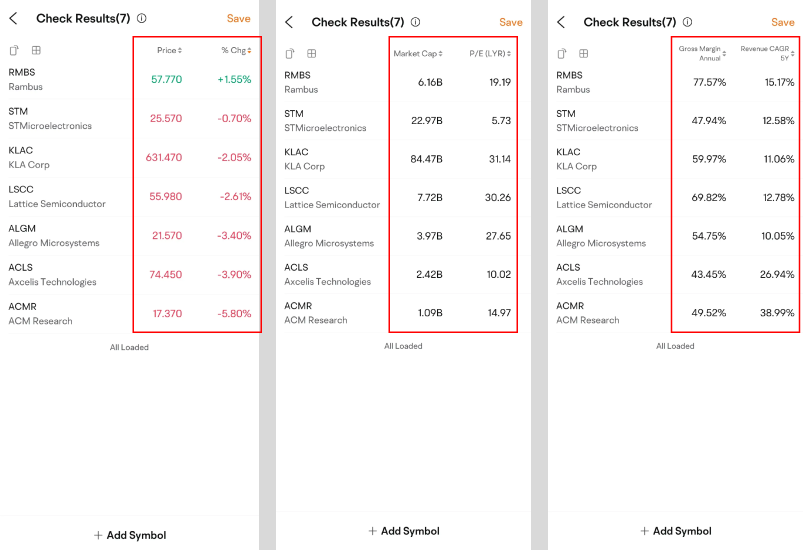

This new thing I'm trying will be some random thoughts about the market. How to use some features on moomoo (a request by some) to do research and develop trading levels. To show this I will introduce some stocks iam in or will be starting positions in.

...

This new thing I'm trying will be some random thoughts about the market. How to use some features on moomoo (a request by some) to do research and develop trading levels. To show this I will introduce some stocks iam in or will be starting positions in.

...

+36

55

18

7

Rambus' transition to profitability and its increasing returns on capital employed are positive signs. Despite the company's ROCE being lower than the industry average, its promising fundamentals suggest that it may be worth further investigation.

$Rambus (RMBS.US)$ RMBS is a good stock to day trade. Buy low...watch it go up...sell high. Very volatile stock.

2

Rambus's high beta may present a future buying opportunity, but its negative growth outlook increases risk. Current shareholders may want to de-risk, and it may not be the optimal time for potential investors to buy.

Investors justify Rambus's high price-to-sales ratio due to strong future growth. If analysts' forecasts hold true, high revenue growth should sustain the stock's high share price.

No comment yet

102362254 : My go-to filter on stock screener is the high profit & growth filter. It helps me spot companies with strong revenue growth n solid financial health which are key signs of good future performance. Using this filter, I can easily find stocks that have a better chance of giving great returns over time

JPT 102362254 : Where did you find that?

CNNT : I tried the screener to see if I can use the info as a basis for swing trading because I am interested in trying this out, but find the pre-work is daunting.

I used the screener to find fairly profitable and mid-price range companies that crossed the MACD & RSI golden cross and found about 10 companues in the list to further study, almost all I have never heard of as they are not usually being reported on.

Wow, this saved me so much time and effort!

COCO 2024 : Very good topic, learned

8Ch8mpi8n : It is great indicator that to identify and correcting

View more comments...