US Stock MarketDetailed Quotes

RTX RTX Corp

- 124.380

- -1.370-1.09%

Close Jan 22 16:00 ET

- 124.100

- -0.280-0.23%

Post 20:01 ET

165.55BMarket Cap35.84P/E (TTM)

125.880High123.645Low5.10MVolume125.680Open125.750Pre Close634.68MTurnover0.42%Turnover Ratio55.78P/E (Static)1.33BShares128.01852wk High2.71P/B151.31BFloat Cap87.43052wk Low2.44Dividend TTM1.22BShs Float128.018Historical High1.96%Div YieldTTM1.78%Amplitude10.106Historical Low124.353Avg Price1Lot Size

RTX Corp Stock Forum

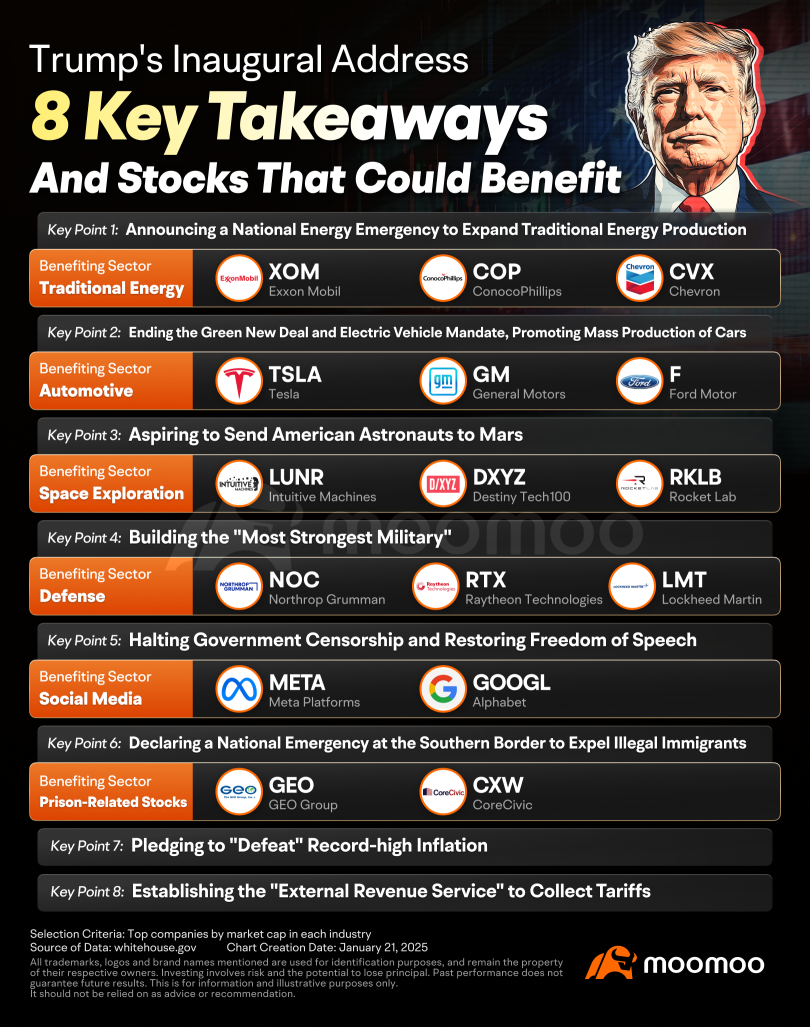

Donald Trump's second term began with bold declarations and swift action. His inaugural address emphasized an "America First" agenda, tackling inflation, energy independence, and border security. On day one, he signed executive orders and outlined policies that set the tone for his presidency. But what does this mean for the markets? Let's break down his priorities and the stocks that ...

95

19

70

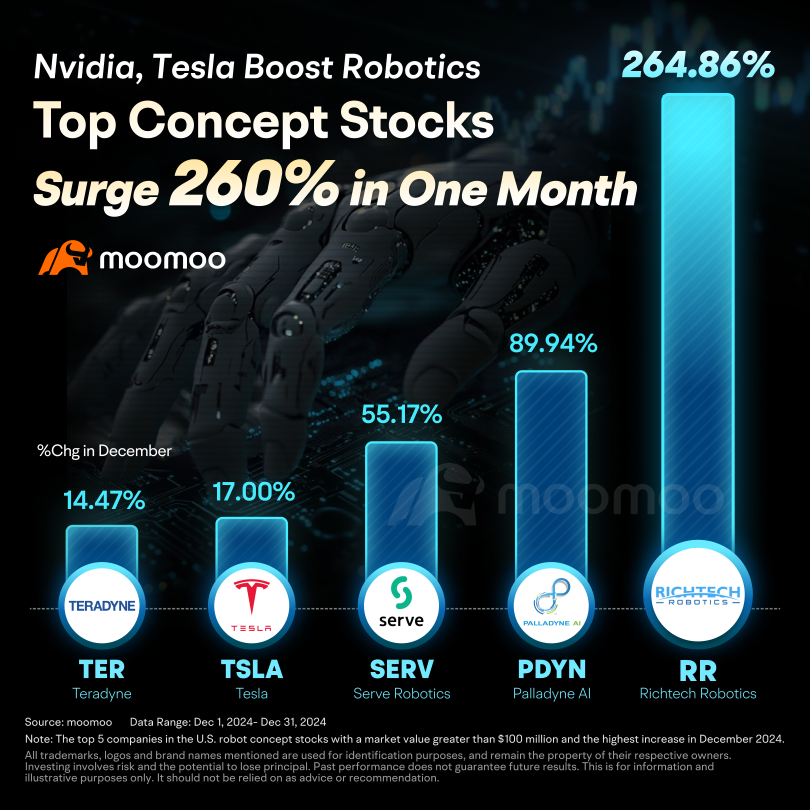

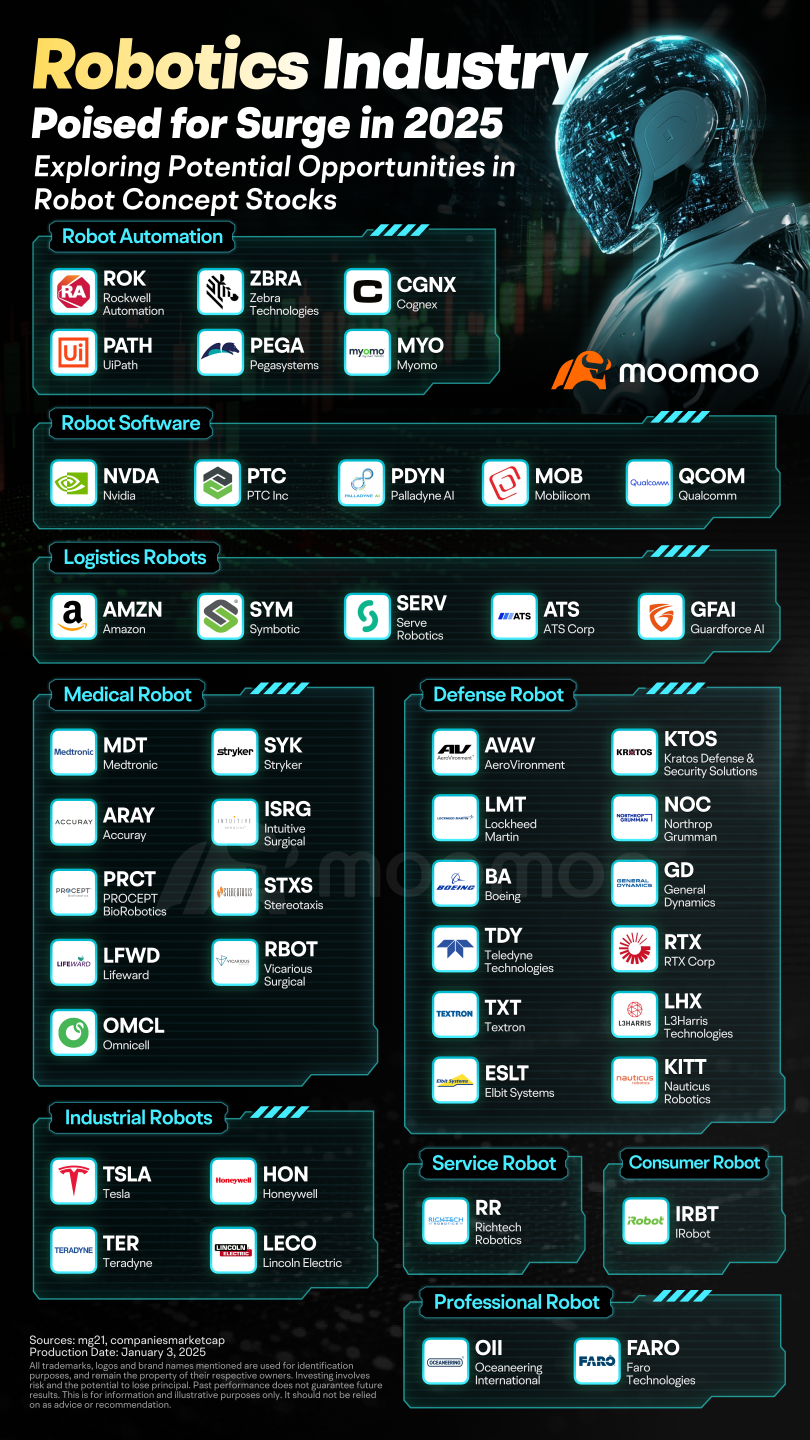

Scheduled to officially start on January 7, 2025, the Consumer Electronics Show (CES)—a premier tech event that showcases both current products and futuristic concepts from large and small tech firms—once again captured global attention.

At CES 2025, $NVIDIA (NVDA.US)$ is undoubtedly one of the brightest stars on stage. Jensen Huang will personally showcase the company's latest breakthroughs in AI, robotics...

At CES 2025, $NVIDIA (NVDA.US)$ is undoubtedly one of the brightest stars on stage. Jensen Huang will personally showcase the company's latest breakthroughs in AI, robotics...

115

8

190

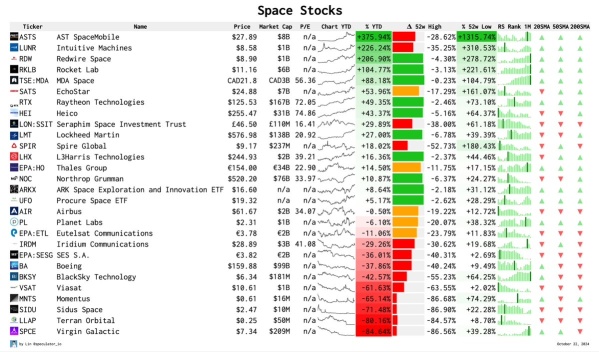

A List of Space Stocks: Copied from Lin posted in X

Launch Services Providers

$RKLB Rocket Lab $Rocket Lab (RKLB.US)$

$SPCE Virgin Galactic $Virgin Galactic (SPCE.US)$

Space Infrastructure and Services

$LUNR Intuitive Machines $Intuitive Machines (LUNR.US)$

$RDW Redwire Space $Redwire (RDW.US)$

$MNTS Momentus $Momentus (MNTS.US)$

$LLAP Terran Orbital

$SIDU Sidus Space $Sidus Space (SIDU.US)$

Satellite Communications

$ASTS AST SpaceMobile $AST SpaceMobile (ASTS.US)$

$SATS EchoStar $EchoStar (SATS.US)$ $IRDM Iri...

Launch Services Providers

$RKLB Rocket Lab $Rocket Lab (RKLB.US)$

$SPCE Virgin Galactic $Virgin Galactic (SPCE.US)$

Space Infrastructure and Services

$LUNR Intuitive Machines $Intuitive Machines (LUNR.US)$

$RDW Redwire Space $Redwire (RDW.US)$

$MNTS Momentus $Momentus (MNTS.US)$

$LLAP Terran Orbital

$SIDU Sidus Space $Sidus Space (SIDU.US)$

Satellite Communications

$ASTS AST SpaceMobile $AST SpaceMobile (ASTS.US)$

$SATS EchoStar $EchoStar (SATS.US)$ $IRDM Iri...

17

3

1

$RTX Corp (RTX.US)$ Huge downside potential for next week trade if friday close bearish.

1

1

How interesting is it that the Treasury Department released its November budget statement, and it was just awful. The budget deficit for the month of November was $-366.8B, which was worse than expected and combined with October's print of $-257.5B totals a deficit of $-624.3B. That by the way makes for the worst two month start to the government's fiscal year (that runs October through September) in the nation's history.

This did not stop the House of Representatives on Wednesday...

This did not stop the House of Representatives on Wednesday...

10

1

$Micron Technology (MU.US)$ At the top of the list is Micron Technology, which saw turnover per share increase by no less than 88%. The gross margin went from just -11% last year to +35% this year. The operating margin also increased considerably. “The stock will outperform through the rest of this year and into 2025 as the market underestimates the improvement in revenue, margins and pricing power,” JPMorgan...

1

Portfolio diversification is the strategy of spreading investments across different assets, sectors, industries, and geographical regions to reduce the overall risk of the portfolio. The idea is that by holding a variety of investments, the overall performance of the portfolio will be less dependent on the performance of any single investment, reducing the risk of large losses.

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

39

1

36

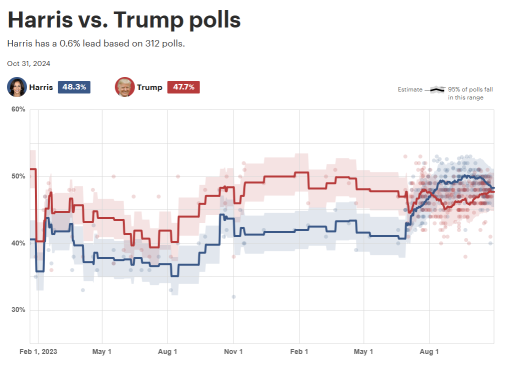

$Kamala Harris (LIST22990.US)$

Harris Trade Investment Opportunities:

1. Core Concept Stocks:

- Clean Energy Leaders: $First Solar (FSLR.US)$ , $NextEra Energy (NEE.US)$, $Bloom Energy (BE.US)$

- Electric Vehicle Supply Chain: $Tesla (TSLA.US)$ , $Rivian Automotive (RIVN.US)$ , $Lucid Group (LCID.US)$

- ESG-themed ETFs: $iShares Global Clean Energy ETF (ICLN.US)$ , �������...

22

14

17

No comment yet

. He did the rate cut.... poor guy, market still crash...

. He did the rate cut.... poor guy, market still crash...

J Servai (JLAPT) : $Petroleo Brasileiro SA Petrobras (PBR.US)$

10baggerbamm : you're incorrect saying that drill baby drill benefits oil companies. they're underlying commodity with an increase in supply will result in significantly lower prices it's economics 101. it's exact same thing that happened during the Trump first administration and if you look at the performance of large oil companies and intermediate oil companies they were down between 30 and 70% under Trump's first term.. I think you should go look at history and see the impact on these companies stock prices as a result of lower oil prices

YZRolling 10baggerbamm : While increased supply can lead to lower commodity prices, large oil companies often offset this with operational efficiencies, diversification, and downstream operations (refining and chemicals), which benefit from cheaper crude. On the other hand, stock prices aren't solely tied to oil prices. Broader economic trends, geopolitical events, and company-specific factors (like debt management and cost control) also influence performance.

A Humble Mooer : I get people WANT to view this positively. I'm trying to find opportunities in Trumps actions too.

This analysis though is so positive it borders on a little delusional.

10baggerbamm A Humble Mooer : well you have to look at it very basic if you're operating a company in one of your biggest expenses is fuel and that price goes down everything else being equal your margins and profits go up.

so that's your cruise liners all your cruise companies pick the best one because as long as discretionary income increases and it will when oil prices fall you have more money people are going to accelerate they're bookings for cruise ships. the cost of their fuel is going to go down significantly. I would tell people to look at that before airlines airlines have a lot of other problems unions at the top of the list Boeing aircraft but the cruise ships don't have to deal with that issue you just have to worry about another epidemic potentially.

additionally you have Federal Express and UPS UPS is played with surprisingly enough union problems Federal Express doesn't have that issue to contend with same thing their profit margins are going to go up when the cost of jet fuel goes down which means the stock price will go up. so go down the list of companies that use the most fuel it's a very basic approach but it absolutely will work.

lastly is the trade that I have a large position in I'm going to be buying every week and it's going to be for me a multi-million dollar position.

I believe what Trump said he will do promises me promises kept

red or blue oil prices will fall that is a fact no they're not going to fall to what they were in the first term because of coded where it went negative $22 a barrel.

you will have oil prices in the low 50s maybe high 40s at some point in time.

DRIP

this is a leveraged ETF that's a inverse ETF to the price of oil. does oil falls and natural gas falls and as the stocks start having their margins deteriorate because the commodity that they're producing is worth less. Lowe's stocks fall and this ETF goes straight up.

this is going to be a slow grind it is not going to spike $2 $3 in a day. it will move up a few pennies and we'll move down a few pennies but if you believe what president Trump said that within 12 months of my inauguration that would be yesterday oil prices will be down 50%.

this ETF will be in the twenties

View more comments...