No Data

RY Royal Bank of Canada

- 166.255

- -0.395-0.24%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

UBS on Canadian Banks -- "Crowding Data Suggests Sentiment Has Inflected More Positive"

Royal Bank Of Canada To Present At National Bank Financial's Conference; Webcast At 9:00 AM ET

Canadian Stock Movers for Tuesday | Torex Gold Resources Inc Was the Top Gainer; Medical Devices & Instruments Led Gains

Build Enduring Wealth With These Canadian Blue Chips

USA bond market: Treasury bonds fell as Trump's comments on tariff reductions raised risk appetite.

U.S. Treasury bonds faced pressure and declined during intraday trading, extending the overnight drop and maintaining the downtrend by the end of the U.S. session, after President Trump indicated he might grant tariff exemptions to several countries. The intensifying Futures Trade exerted downward pressure on prices, and additionally, the tight schedule for corporate bond issuance saw 16 companies raise nearly 25 billion dollars through bonds. Shortly after 3 PM New York time, yields rose across the board by 6-9 basis points, and the yield curve flattened, with the 2s10s and 5s30s yield spreads narrowing by 0.5 basis points and 2.5 basis points respectively; the U.S. 10-Year Treasury Notes Yield ended at approximately 4.325%.

The new slogan of the USA bond market is: "Don't go against the Treasury of Besant!"

Recently, the USA Treasury Secretary Basant has frequently highlighted the 10-year US Treasury yield. In his speeches and interviews over the past few weeks, he has consistently emphasized the government's plan to lower yields and hopes to keep them low. This is somewhat normal, as controlling the government's borrowing costs is part of the Treasury Secretary's job, but Basant's persistent focus on the benchmark US Treasury has led some Wall Street analysts to adjust their forecasts for 2025. In recent weeks, chief rate strategists from Barclays, Royal Bank of Canada, and Industrial Bank have indicated that, given Basant's efforts to push yields down, they have lowered their forecasts for the 10-year US Treasury.

Comments

RBC Q1 2025 earnings conference call is scheduled for February 27 at 8:30 AM ET /February 27 at 9:30 PM SGT /February 28 at 0:30 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from RBC's Q1earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for information an...

The earnings calendar for the upcoming week features a lineup of significant players and AI-related companies in the stock market.

$NVIDIA (NVDA.US)$ is set to release its Q4 2025 financial results, with analysts forecasting $38.13B in revenue (up 72.52% YOY) and $0.80 EPS (up 61.83% YOY). The company's AI-driven data center growth remains a key focus, despite geopolitical concerns abou...

United States President Donald Trump is advocating for a greater presence of American banks in Canada.

Trump posted on Truth Social on Monday that,“Canada doesn't even allow U.S. banks to open or do business there. What's that all about? Many such things, but it's also a DRUG WAR, and hundreds of thousands of people have died in the U.S. from drugs pour...

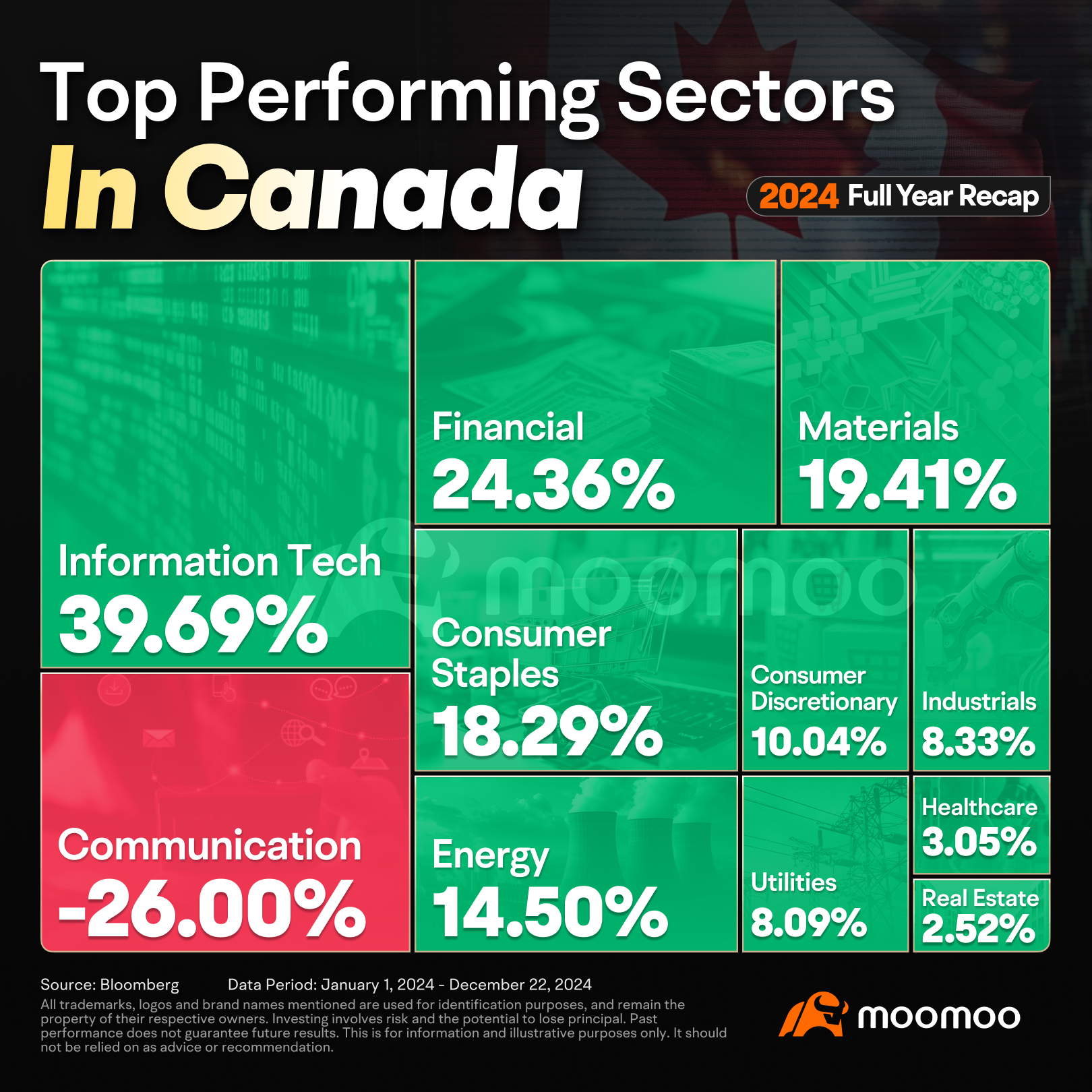

■ How did each sector perform in 2024?

Among all sectors in Canada, t...