No Data

AU Stock MarketDetailed Quotes

SCG Scentre Group

- 3.430

- -0.040-1.15%

20min DelayMarket Closed Dec 19 16:00 AET

17.84BMarket Cap100.88P/E (Static)

3.440High3.370Low14.03MVolume3.390Open3.470Pre Close47.91MTurnover3.88052wk High0.27%Turnover Ratio5.20BShares2.68452wk Low0.082EPS TTM17.78BFloat Cap3.880Historical High100.88P/E (Static)5.18BShs Float1.089Historical Low0.034EPS LYR2.02%Amplitude0.17Dividend TTM1.00P/B1Lot Size4.84%Div YieldTTM

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Scentre Group's Shareholding Shifts Highlight Market Dynamics

Australia's House Prices Face Sober Outlook -- Market Talk

Australian Retail Real-Estate Stocks Look Cheap

Scentre Could Benefit From Familiar Cyclical Tailwinds -- Market Talk

Scentre Target Price Raised 2.1% to A$4.44/Share by Morgan Stanley>SCG.AU

How ASX Shares Vs. Property Performed in November

Comments

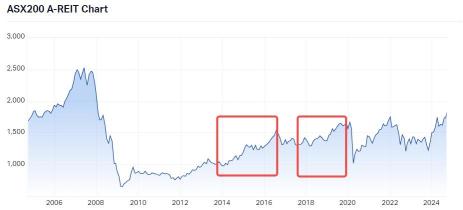

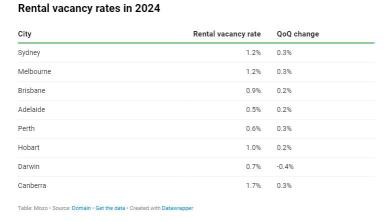

Australian Real Estate Investment Trusts (A-REITs) offer investors a way to engage in the commercial real estate market without directly holding physical property. These A-REITs own, operate, or finance a range of real estate sectors, generating income as a result.

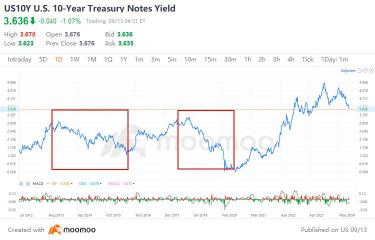

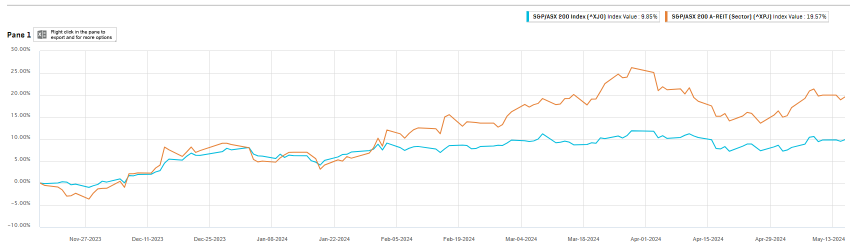

Is it the right time to invest in A-REITs amidst US Federal Reserve rate cuts? To answer this, we need to look at three questions:

1.How is the US Fede...

Is it the right time to invest in A-REITs amidst US Federal Reserve rate cuts? To answer this, we need to look at three questions:

1.How is the US Fede...

+2

10

1

4

G'day, mooers! Check out the latest news on today's stock market!

• Market Pulls Back From After Eyeing Records

• ASX falls but WiseTech, Brambles soar

• Stocks to watch: STO, DMP, IAG, etc.

Wall Street Summary

After opening to a green, ninth session of gains, the market pulled away from all-time highs. If the $S&P 500 Index (.SPX.US)$ closed higher, it would be its longest winning streak for the year, but short...

• Market Pulls Back From After Eyeing Records

• ASX falls but WiseTech, Brambles soar

• Stocks to watch: STO, DMP, IAG, etc.

Wall Street Summary

After opening to a green, ninth session of gains, the market pulled away from all-time highs. If the $S&P 500 Index (.SPX.US)$ closed higher, it would be its longest winning streak for the year, but short...

7

1

1

G'day, mooers! Check out the latest news on today's stock market!

• Apple, Microsoft push S&P 500, Nasdaq to new highs

• ASX rises ahead of RBA decision; Fortescue falls over 4%

• Stocks to watch: Tamboran Resources, Fortescue

Wall Street Summary

The S&P 500 and Nasdaq resumed their rally to fresh all-time highs, buoyed by gains in tech giants $Apple (AAPL.US)$ and $Microsoft (MSFT.US)$.

The $S&P 500 Index (.SPX.US)$ rose to a...

• Apple, Microsoft push S&P 500, Nasdaq to new highs

• ASX rises ahead of RBA decision; Fortescue falls over 4%

• Stocks to watch: Tamboran Resources, Fortescue

Wall Street Summary

The S&P 500 and Nasdaq resumed their rally to fresh all-time highs, buoyed by gains in tech giants $Apple (AAPL.US)$ and $Microsoft (MSFT.US)$.

The $S&P 500 Index (.SPX.US)$ rose to a...

15

1

Stay Connected.Stay Informed. Follow me on MooMoo!![]()

![]()

![]()

Introduction

Amidst the global capital wave seeking asset diversification and stable returns, Real Estate Investment Trusts (REITs) have emerged as a popular option pursued by investors. As an innovative financial instrument, REITs enable a wide range of investors to participate in the traditionally high-cost, high-barrier commercial real estate sector with a lower t...

Introduction

Amidst the global capital wave seeking asset diversification and stable returns, Real Estate Investment Trusts (REITs) have emerged as a popular option pursued by investors. As an innovative financial instrument, REITs enable a wide range of investors to participate in the traditionally high-cost, high-barrier commercial real estate sector with a lower t...

+5

28

It's music to markets ears. The Fed hints it will make three rates cuts, the RBA hints it's done with rate hike, but today's Aussie employment data shows the RBA will probably keeps rates where they are this year. But there is why you need to pay attention to the themes of stocks hitting new highs.

Good news from the Fed

Overnight in the US, the S&P 500 c...

Good news from the Fed

Overnight in the US, the S&P 500 c...

15

7

3

Read more

Trending AU Stocks

ASX High Dividend ASX High Dividend

Nisdey : There is only 1 way the RBA will cut rates in 2025, and that's if the corrupt Albanese government legislated away their independence and stacks the RBA board with union organisers. (this is their current plan to reduce interest rates, since they refuse to cut government spending to lower inflation).

The disconnection of interest rates from inflation to trick voters into giving this lunatic another term in office, combined with the absurd spending on "renewables" and "infrastructure" all of which is 100% inflationary (since neither generate any revenue) guarantees that REITs as well as any other deflationary asset (like gold, or Bitcoin) will skyrocket.

Since the underlying cause will be hyperinflation in the AUD, holding literally anything that is not denominated in AUD, like US dollars or stocks will also "skyrocket" if viewed through the lens of Australian Dollars.

This might sound like a way to get rich while everyone else gets poorer, but it doesn't work like that in Australia.

Here, we believe in Survival of the Weakest. A form of anti-evolution.

FACT: the average NDIS participant receives "benefits" equivalent to nearly double the average workforce participant's before-tax income. Who's better off working? Not many.

DM me for advice on SMSFs and offshore holdings, to limit your exposure to the "Robbin Hood" taxation scheme that's coming out way.