US Stock MarketDetailed Quotes

SHEL Shell

- 73.470

- +1.440+2.00%

Trading Mar 26 11:28 ET

219.91BMarket Cap14.52P/E (TTM)

73.805High73.090Low2.81MVolume73.270Open72.030Pre Close206.12MTurnover0.10%Turnover Ratio14.52P/E (Static)2.99BShares73.80552wk High1.23P/B214.47BFloat Cap59.50652wk Low2.75Dividend TTM2.92BShs Float73.805Historical High3.75%Div YieldTTM0.99%Amplitude15.726Historical Low73.428Avg Price1Lot Size

Shell Stock Forum

$Shell (SHEL.US)$ $Chevron (CVX.US)$ $PETROCHINA (00857.HK)$ $Exxon Mobil (XOM.US)$

Donald Trump said the US would impose a 25 per cent tariff on all imports from any country that buys oil or gas from Venezuela, in a move that could sharply raise levies on goods from China and India, two of Caracas’s biggest oil buyers.

Trump referred to the unprecedented move as a “secondary tariff”, which would take effect from April 2.

Main countries that are affected are China and India

Other affecte...

Donald Trump said the US would impose a 25 per cent tariff on all imports from any country that buys oil or gas from Venezuela, in a move that could sharply raise levies on goods from China and India, two of Caracas’s biggest oil buyers.

Trump referred to the unprecedented move as a “secondary tariff”, which would take effect from April 2.

Main countries that are affected are China and India

Other affecte...

2

3

$Shell (SHEL.US)$ buy now?

$Shell (SHEL.US)$ if buy now can get the dividend?

2

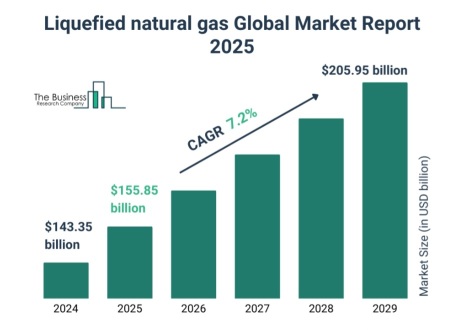

$Venture Global (VG.US)$ Following its market introduction (IPO) this Friday, Venture Global ended it's first day with a 4% drop. Its shares were heavily shorted, the 6th most shorted stock according to Moomoo. Short sales represent in volume 6.98 out of 36.85 millions; the short ratio is 18.94% (which is a lot). The majority of traders bought it at $24. But Friday's decline was attributable to the market as a whole.

Venture Global is THE ...

Venture Global is THE ...

+1

1

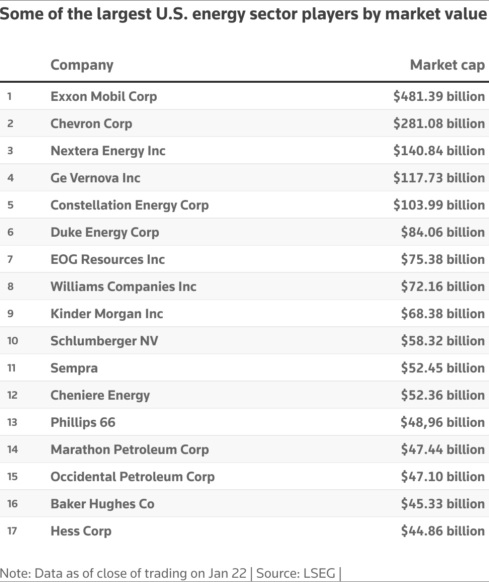

President Donald Trump’s pro-oil policies have significantly impacted various sectors within the energy industry. Companies involved in oil and gas exploration, production, and services have notably benefited from these policy shifts.

Oil and Gas Exploration and Production Companies:

• $Exxon Mobil (XOM.US)$: As a major player in the oil industry, Exxon Mobil stands to gain from policies that encourage increased fossil fuel production and reduced regulatory const...

Oil and Gas Exploration and Production Companies:

• $Exxon Mobil (XOM.US)$: As a major player in the oil industry, Exxon Mobil stands to gain from policies that encourage increased fossil fuel production and reduced regulatory const...

10

1

Investors mostly kept calm and kept buying US tech stocks, shaking off Trump’s three-worded threat on Hamas and tensions rising in South Korea. The tech-heavy Nasdaq 100 $NASDAQ 100 Index (.NDX.US)$ rose 0.3% overnight, taking this year’s gain to 26%. The Nasdaq scaled to a brand-new record high for the first ti...

From YouTube

10

$Indonesia Energy (INDO.US)$ 👈😁 Iran vows to escalate the war after another Hamas leader was bombed and killed by IDF.

$Crude Oil Futures(MAY5) (CLmain.US)$

$Chevron (CVX.US)$

$Shell (SHEL.US)$

$Crude Oil Futures(MAY5) (CLmain.US)$

$Chevron (CVX.US)$

$Shell (SHEL.US)$

2

4

No comment yet

Maaddoo : only Chevron is excepted as they drill in Venezuela ..

机灵的艾德 : Robber logic.