No Data

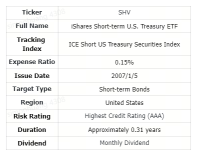

SHV Short-Treasury Bond Ishares

- 110.390

- +0.010+0.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Ten-Year U.S. Treasury Yield Seen Rangebound for Now -- Market Talk

Treasury Yields, Dollar Gain as U.S. Growth Fears Ease -- Market Talk

US Treasuries Fall on Signs That Trump Will Dilute April Tariffs

U.S. Treasury Yields Rise; Concerns About Stagflationary Risks Remain -- Market Talk

Rare! Inflow into USA Bonds ETF funds is approaching that of Stocks ETF, and AI Datacenter Bonds are popular.

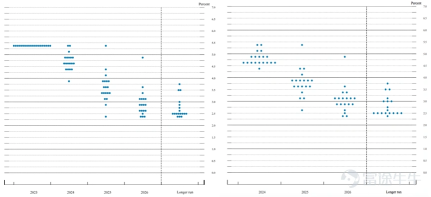

As US stocks experience a significant correction, investors are turning to US Bonds for safe havens, with AI Datacenter related Bonds and short-term government bonds being favored by 'smart money'. In particular, 'ultra-short-term' government Fund, this year, the Inflow into ultra-short-term Bond ETFs accounts for over 40% of the total Inflow into Fixed Income ETFs.

Is the market currently exaggerating expectations of a recession in the USA?

Morgan Stanley believes that investors' panic over a USA economic recession is likely exaggerated, and the real economic slowdown has yet to fully manifest. There is still significant uncertainty (such as immigration policy) that has not materialized, and investors should focus on hard data, especially non-farm payroll data.

Comments

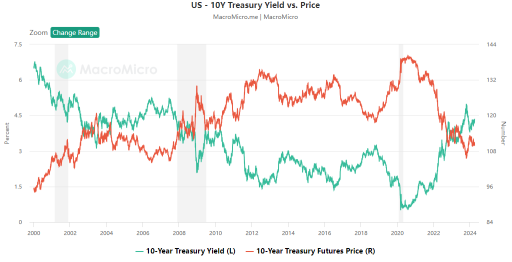

The release of the U.S. Consumer Price Index (CPI) data for August has once again confirmed market expectations regarding inflation trends.The year-over-year growth rate of the overall CPI has fallen to 2.5%, while core CPI remains stable. This not only indicates that market supply and demand are gradually balancing, but also provides investors with a good opportunity to rea...

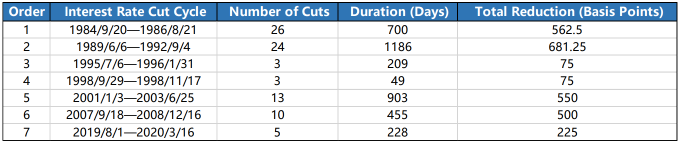

When central banks embark on an easing cyc...

One way to deal with inflation is to buy inflation-protected securities, such as Treasury Inflation-Protected Securities(TIPS) in the U.S. and Index-linked Gilts in the U.K. These...

FrankQ : I also don't understand why I am still losing money.

AllenLee156 : Dividend distribution