No Data

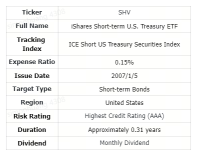

SHV Short-Treasury Bond Ishares

- 110.565

- +0.015+0.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

US Treasury bonds head towards their worst monthly performance in over two years: Is Trump becoming the biggest 'nightmare' for the bulls?

① As the US presidential election approaches, the price of US Treasury bonds may face its worst monthly performance in over two years; ② As the US presidential election on November 5 approaches, Republican presidential candidate Trump seems to have become the biggest 'nightmare' in the minds of US bond bulls.

Ray Dalio warns against buying U.S. bonds on dips, citing the risk of a 'surprisingly sustained' rise in yields.

Neuberger Berman warns against buying US Treasury bonds on dips, stating that recent sell-offs may just be the beginning of a surprisingly sustained rise in yields.

How to Play Fixed Income Ahead of Election and Fed Meeting

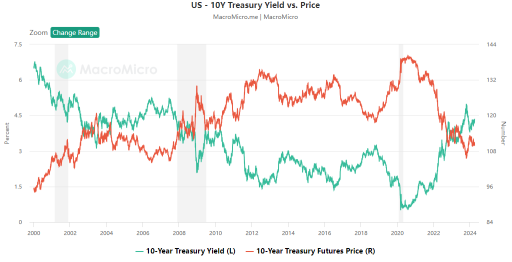

10-year Treasury Yields Rise Above 4.3% Ahead of Inflation and Jobs Data

A hedge fund betting on Trump's victory bought US dollars and Japanese stocks.

Singapore-based hedge fund Vantage Point Asset Management is increasing exposure to the US dollar and Japanese stocks, betting on Republican presidential candidate Trump to win in next week's US election.

China Galaxy Securities: Will the US bond yield challenge 5% again?

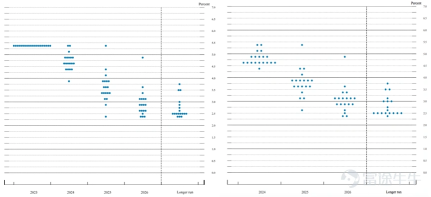

The central tendency of the 10-year US Treasury yield is still around 3.7%-4.3%, with 4.3% already representing the upper bound under the high assessment of natural interest rates and term premiums.

Comments

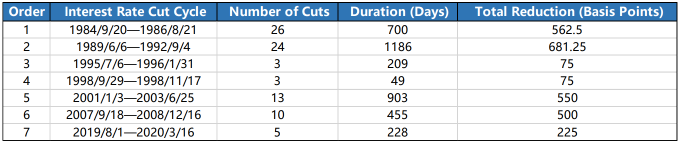

The release of the U.S. Consumer Price Index (CPI) data for August has once again confirmed market expectations regarding inflation trends.The year-over-year growth rate of the overall CPI has fallen to 2.5%, while core CPI remains stable. This not only indicates that market supply and demand are gradually balancing, but also provides investors with a good opportunity to rea...

When central banks embark on an easing cyc...

One way to deal with inflation is to buy inflation-protected securities, such as Treasury Inflation-Protected Securities(TIPS) in the U.S. and Index-linked Gilts in the U.K. These...

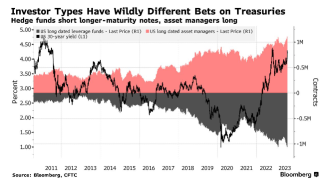

Which asset members are buying longer duration treasuries right now?

I'm on HF side, and so are Ackman & Buffett apparently

Before LT rates go down, ST rates have to drop too since the curve is likely inverted. Or LT have to go up to the new "normal".

The latter seems likely $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

Alen Kok : o

太泪了 : Now buy got dividen?