US ETFDetailed Quotes

SHY iShares 1-3 Year Treasury Bond ETF

- 82.020

- +0.090+0.11%

Close Nov 15 16:00 ET

82.090High81.930Low

82.090High81.930Low3.30MVolume81.960Open81.930Pre Close270.63MTurnover1.20%Turnover Ratio--P/E (Static)274.30MShares82.74052wk High--P/B22.50BFloat Cap78.17852wk Low3.17Dividend TTM274.30MShs Float82.740Historical High3.87%Div YieldTTM0.20%Amplitude54.715Historical Low82.016Avg Price1Lot Size

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ It isn't just the major banks. Bonds are sniffing out something really stinky. 🦨

4

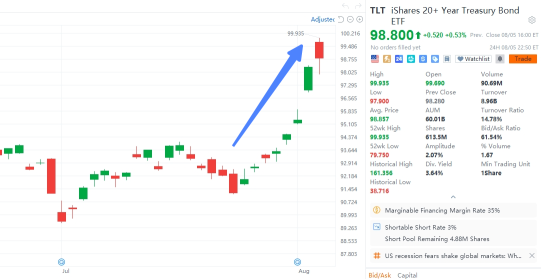

In early August, global stock markets plummeted, sparking fears of an economic recession and a looming bear market. Meanwhile, the bond market quietly surged, with the $iShares 20+ Year Treasury Bond ETF (TLT.US)$ achieving an eight-day winning streak by August 5th.

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

Why did bonds attract investment while stocks were falling? Bonds benefi...

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

Why did bonds attract investment while stocks were falling? Bonds benefi...

+5

285

79

With recent turbulent changes on the world stage, it is difficult to predict what may happen. Conflict in the Middle East continues to escalate, while the Horn of Africa faces severe humanitarian crises. The resurgence of left-wing politics in Latin America is met with right-wing opposition, and economic and security challenges in Asia present a shifting landscape. The ongoing conflict between Russia and Ukraine remains unresolve...

+10

61

4

With recent turbulent changes on the world stage, it is difficult to predict what may happen. Conflict in the Middle East continues to escalate, while the Horn of Africa faces severe humanitarian crises. The resurgence of left-wing politics in Latin America is met with right-wing opposition, and economic and security challenges in Asia present a shifting landscape. The ongoing conflict between Russia and Ukraine remains unresolve...

+10

4

$Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$

The bigger the drop, then the bigger the rebound.

The bigger the drop, then the bigger the rebound.

9

8

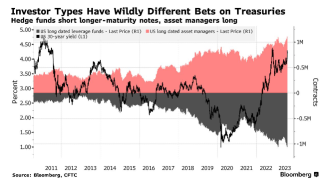

Hedge Funds are shorting treasuries at historic levels while asset managers are doing the exact opposite 👀

Which asset members are buying longer duration treasuries right now?

I'm on HF side, and so are Ackman & Buffett apparently

Before LT rates go down, ST rates have to drop too since the curve is likely inverted. Or LT have to go up to the new "normal".

The latter seems likely $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

Which asset members are buying longer duration treasuries right now?

I'm on HF side, and so are Ackman & Buffett apparently

Before LT rates go down, ST rates have to drop too since the curve is likely inverted. Or LT have to go up to the new "normal".

The latter seems likely $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

4

I'm with Ackman.![]()

![]()

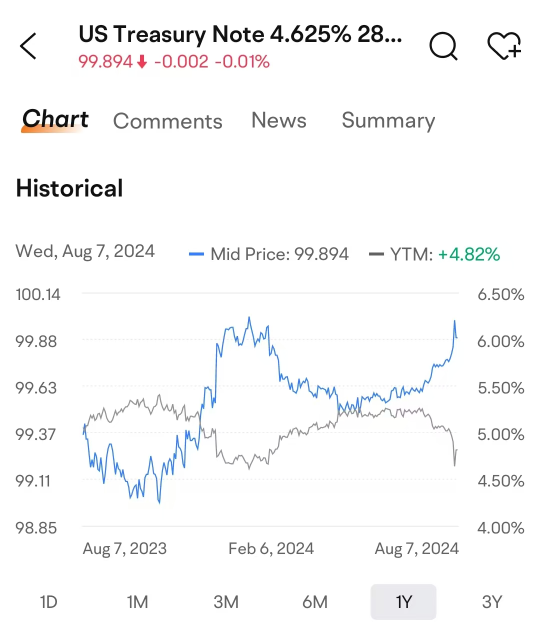

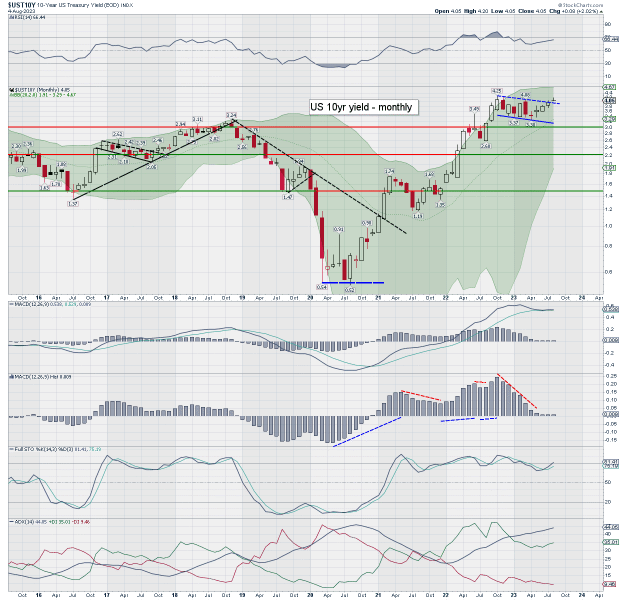

Multi-month structure on the US 10yr yield is a bull flag, and its playing out. Friday... was just some cooling. Soft target... around 4.70%, psy'5.00%, then 7.00%.

I'm starting to wonder if Buffett will live long enough to ever see the Fed cut rates again.

$Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$

Multi-month structure on the US 10yr yield is a bull flag, and its playing out. Friday... was just some cooling. Soft target... around 4.70%, psy'5.00%, then 7.00%.

I'm starting to wonder if Buffett will live long enough to ever see the Fed cut rates again.

$Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$

4

Only one can be right. Billionaire investor Bill Ackman says he is shorting US Treasuries. if long-term inflation is 3% not 2%, the 30y Treasury yield could rise to 5.5%. In contrast, Warren Buffett has announced buying positions in 10y US Treasuries. Shorting US 10y bonds seems to be one of the most crowded trades at the moment.

$Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$

$Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$

2

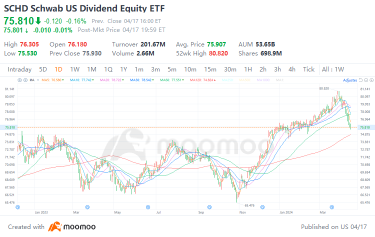

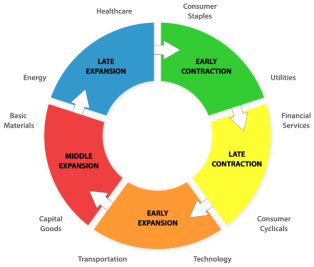

Sector Rotation

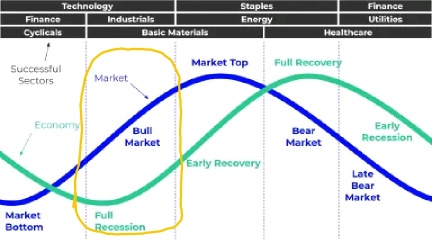

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

+2

107

36

No comment yet

Georgehx : What do you mean?

Derpy Trades OP Georgehx : JP Morgan and at least one other major bank are selling off while Treasury yields are falling. That tends to be a strong sign of flight to safety.

Georgehx Derpy Trades OP : You’ve got a valid point but I’m holding mainly bonds atm bcz of the volatility in market rn & bonds tend to rise when interest rates fall so doesn’t really matter 25 or 50 basis points, bonds esp longer ones will do well am I right to say that?

Derpy Trades OP Georgehx : The bond market is very complex, and so that is a very difficult question to answer. In most scenarios bonds will rally when or even in anticipation of rate cuts, but if there were ever a black swan event in which the Fed had to monetize our government's debt, long-term interest rates would likely skyrocket and bonds would depreciate quickly.