No Data

SHY iShares 1-3 Year Treasury Bond ETF

- 81.960

- -0.020-0.02%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Investors Dump Long-Dated Treasury ETF At Record Pace Ahead Of Trump's White House Return

Treasury Yields Start New Year Little Changed -- Market Talk

What does a 1.7% yield on a 10-year government bond signify?

Xinda Securities believes that the recent pricing of the 10-year government bond yields reflects the potential for a decline in the OMO rate next year. Based on the economic outlook and monetary policy environment for 2025, it is anticipated that a reduction of 50 basis points in the OMO rate may be necessary to achieve a marginal easing similar to that of 2024, which suggests that the 1.7% yield on the 10-year government bonds does not appear to be overly priced.

Treasury Yields Dip, but Remain Near Seven-month Highs, as New Trading Year Gets Underway

Treasury Yields Fall on First Trading Day of 2025

GTJA: Will US bonds and US stocks once again show a "teeter-totter" effect?

Compared to last April, the market is clearly more optimistic about the USA economy and the US stock market, which in some way also implies a more pessimistic view on the Bonds market.

Comments

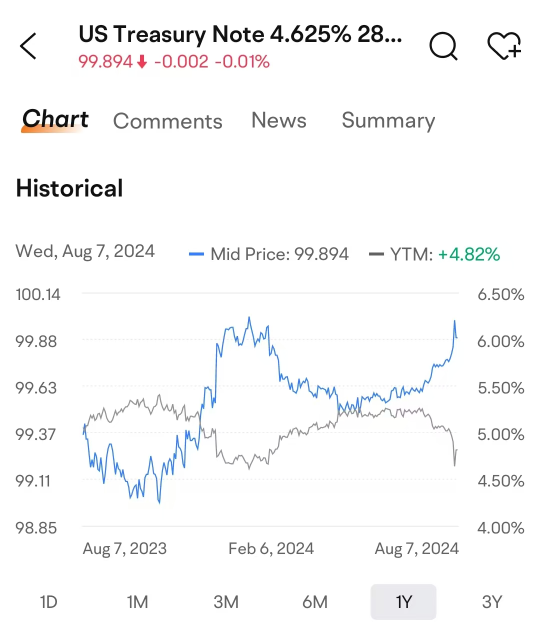

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

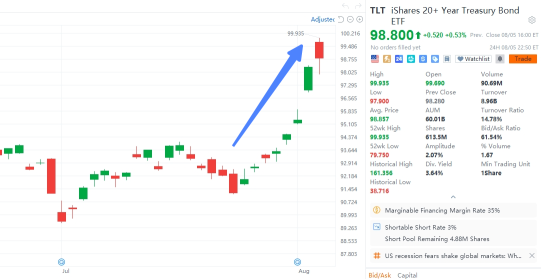

Why did bonds attract investment while stocks were falling? Bonds benefi...

Georgehx : What do you mean?

Derpy Trades OP Georgehx : JP Morgan and at least one other major bank are selling off while Treasury yields are falling. That tends to be a strong sign of flight to safety.

Georgehx Derpy Trades OP : You’ve got a valid point but I’m holding mainly bonds atm bcz of the volatility in market rn & bonds tend to rise when interest rates fall so doesn’t really matter 25 or 50 basis points, bonds esp longer ones will do well am I right to say that?

Derpy Trades OP Georgehx : The bond market is very complex, and so that is a very difficult question to answer. In most scenarios bonds will rally when or even in anticipation of rate cuts, but if there were ever a black swan event in which the Fed had to monetize our government's debt, long-term interest rates would likely skyrocket and bonds would depreciate quickly.