No Data

SONY Sony

- 24.100

- +0.690+2.95%

- 24.000

- -0.100-0.41%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Is Nintendo (NTDOY.US) about to release the Switch 2, the most popular product in gaming history?

Investors are betting that Nintendo will launch the largest product in the history of the Industry with the release of the Switch 2.

Trends in ADR on the 13th = Fujifilm, Sony Group Corp, Olympus, etc. are low in yen-denominated values.

On the 13th, the ADRs (American Depositary Receipts) showed a nearly widespread decline compared to the Tokyo closing prices on the same day, when converted to yen. In yen terms, Fujifilm <4901.T>, Sony Group Corp <6758.T>, Olympus <7733.T>, Asics <7936.T>, SoftBank Group <9984.T>, etc. were down. Denso <6902.T>, Murata Manufacturing <6981.T>, Honda <7267.T>, ORIX <8591.T>, Japan Airlines <9201.T>, etc. also showed weakness. Provided by Ue.

Sony Develops Next-Generation Display System With Proprietary Signal Processing Technology for Individual RGB Control of High-Density LED Backlights

The Nikkei average fell by 29 points, weighed down by selling on the wait for a rebound and the strengthening of the yen = 13th afternoon session.

On the 13th, the Nikkei average stock price in the afternoon session fell slightly by 29.06 yen to 36,790.03 yen compared to the previous day, while the TOPIX (Tokyo Stock Price Index) rose by 3.45 points to 2,698.36 points, continuing its upward trend. In the morning, following the rise in the Nasdaq Composite Index, which has a high ratio of tech stocks, and the SOX (Philadelphia Semiconductor Index) which has a significant impact on Japan's semiconductor-related stocks, buying started to take precedence. However, afterwards, it was pressured by profit-taking selling that awaited a rebound.

The Nikkei index is up 390 yen, continuing its strong performance after an initial buy trend = 13 days into the morning session.

On the 13th at around 10:07 AM, the Nikkei Average was trending at approximately 37,210 yen, up about 390 yen from the previous day. At 9:28 AM, it reached 37,326.27 yen, up 507.61 yen. In the U.S. stock market on the 12th, although the Dow Inc fell due to concerns over trade friction, the Nasdaq Composite Index rebounded for the first time in three days as inflation concerns eased following a drop in February's CPI (Consumer Price Index). Japan's semiconductor-related stocks are susceptible to the effects of the SOX.

Market Overview Early Information = Main order conditions before the morning session (1) Toyota, Mitsubishi UFJ, SoftBank Group, etc.

As of 8:50 AM on the 13th, the main pre-market order situation is as follows: Toyota <7203.T> Sell 750,000 shares, Buy 240,000 shares Sony Group Corp <6758.T> Sell 370,000 shares, Buy 440,000 shares Mitsubishi UFJ <8306.T> Sell 680,000 shares, Buy 540,000 shares ENEOS <5020.T> Sell 90,000 shares, Buy 130,000 shares Nissan Motor <7201.T> Sell 190,000 shares, Buy 190,000 shares Softbank Group <9984.T> Sell 140,000 shares, Buy 150,000 shares Provided by Wealth Advisors

Comments

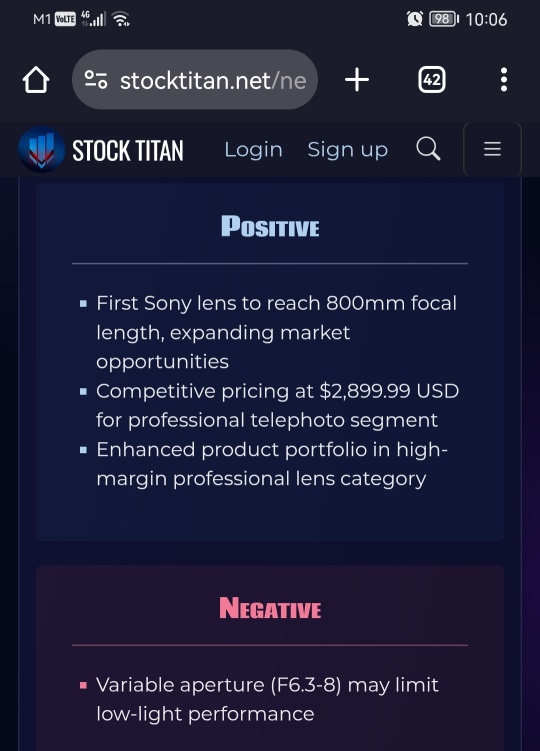

Sony's New 400-800mm Lens Pushes Wildlife Photography Boundaries - Worth the $2,899 Price Tag?

According to authoritative predictions, starting from 2025, smart glasses will rapidly penetrate against the background of steady growth in the traditional glasses market, and annual sales are expected to reach 55 million pairs by 2029, and exceed 1.4 billion pairs by 2035.

At the same ...