US Stock MarketDetailed Quotes

SPG Simon Property

- 174.250

- -0.610-0.35%

Close Jan 24 16:00 ET

- 174.000

- -0.250-0.14%

Post 19:17 ET

56.85BMarket Cap23.17P/E (TTM)

176.450High173.960Low1.05MVolume174.340Open174.860Pre Close183.86MTurnover0.34%Turnover Ratio24.96P/E (Static)326.28MShares183.87452wk High21.28P/B53.32BFloat Cap128.55352wk Low7.90Dividend TTM305.98MShs Float183.874Historical High4.53%Div YieldTTM1.42%Amplitude5.288Historical Low174.923Avg Price1Lot Size

Simon Property Stock Forum

Portfolio diversification is the strategy of spreading investments across different assets, sectors, industries, and geographical regions to reduce the overall risk of the portfolio. The idea is that by holding a variety of investments, the overall performance of the portfolio will be less dependent on the performance of any single investment, reducing the risk of large losses.

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

39

1

36

Hello Mooers! ![]()

In today's discussion, I would like to share one particular financial asset that almost one in two Mooers will invest in and/or trade before the rate cuts come and, at the same time, would like to hear from your comments and opinions.![]()

In my previous survey on which financial assets Mooers will invest and/or trade before the rate cuts come,![]() nearly 50% voted for REITs, wh...

nearly 50% voted for REITs, wh...

In today's discussion, I would like to share one particular financial asset that almost one in two Mooers will invest in and/or trade before the rate cuts come and, at the same time, would like to hear from your comments and opinions.

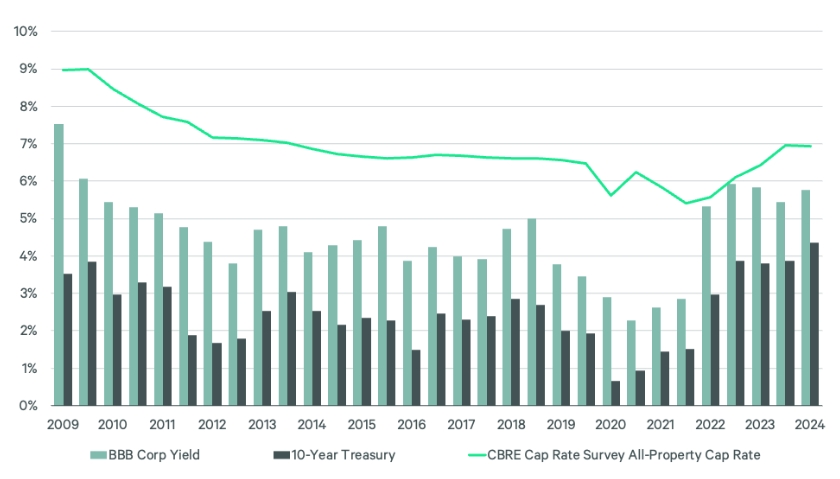

In my previous survey on which financial assets Mooers will invest and/or trade before the rate cuts come,

25

84

2

Hello Mooers! ![]()

I would like to share some financial assets that are on my watchlist and/or in my portfolio and, at the same time, would like to hear from your comments and opinions.![]()

With many mentioning that a rate cut may happen, probably within the next 12 months, my plan would be to invest in the following:

![]() High-yield bonds

High-yield bonds

![]() Crypto

Crypto

![]() REITs

REITs

![]() Small-cap stocks

Small-cap stocks

Let me go through eac...

I would like to share some financial assets that are on my watchlist and/or in my portfolio and, at the same time, would like to hear from your comments and opinions.

With many mentioning that a rate cut may happen, probably within the next 12 months, my plan would be to invest in the following:

Let me go through eac...

45

42

11

Hello Mooers! ![]()

I would like to share with you all two ETFs that are currently on my watchlist and, at the same time, would also like to hear your comments and suggestions.![]()

These two ETFs that I would like to share are: $UNUSUAL WHALES SUBVERSIVE DEMOCRATIC TRADING ETF (NANC.US)$ and $UNUSUAL WHALES SUBVERSIVE REPUBLICAN TRADING ETF (KRUZ.US)$.

These two ETFs can be traded on the U.S. stock exchange, and ...

I would like to share with you all two ETFs that are currently on my watchlist and, at the same time, would also like to hear your comments and suggestions.

These two ETFs that I would like to share are: $UNUSUAL WHALES SUBVERSIVE DEMOCRATIC TRADING ETF (NANC.US)$ and $UNUSUAL WHALES SUBVERSIVE REPUBLICAN TRADING ETF (KRUZ.US)$.

These two ETFs can be traded on the U.S. stock exchange, and ...

10

1

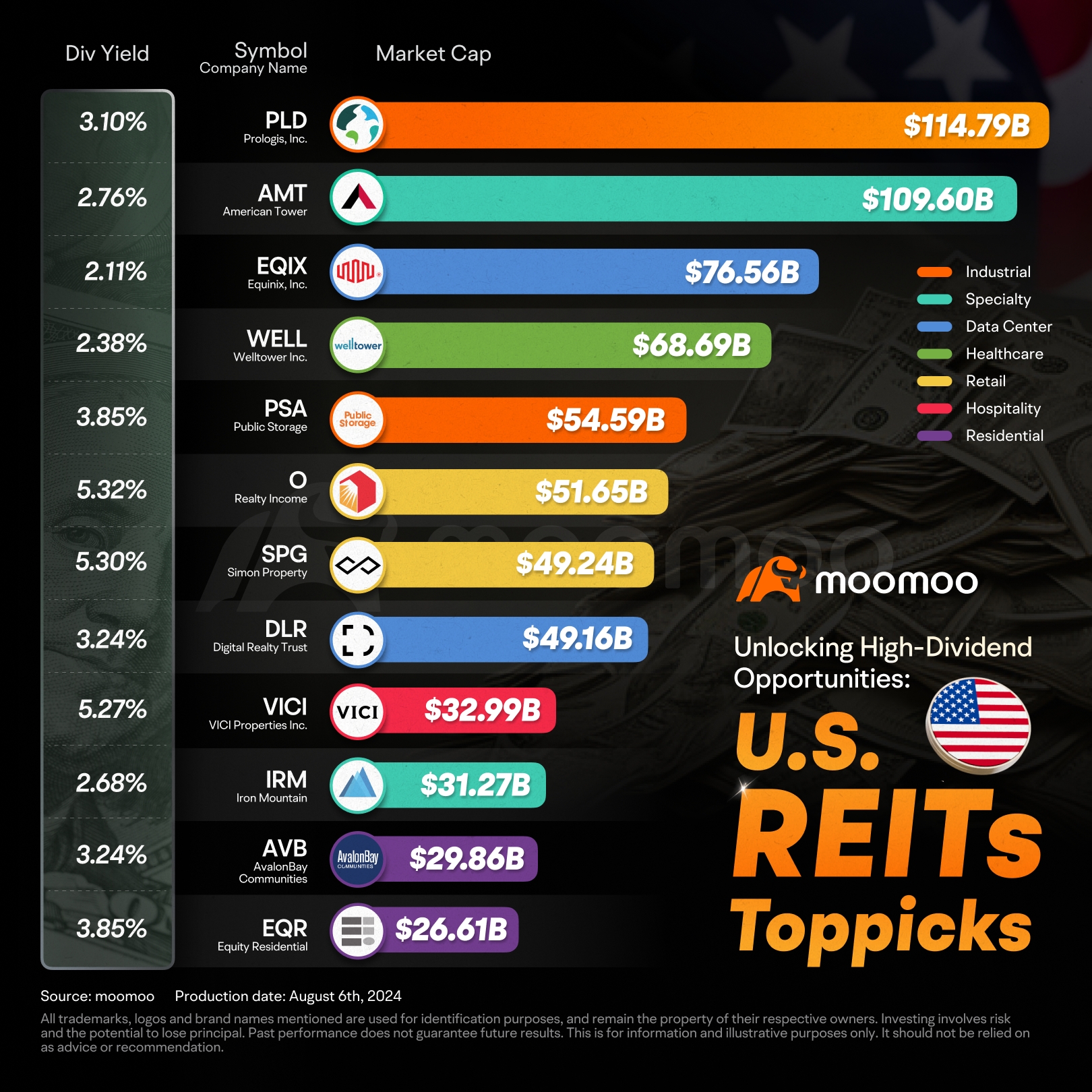

$Simon Property (SPG.US)$ $Welltower Inc (WELL.US)$ $Equinix Inc (EQIX.US)$ a few to consider before October

$Prologis (PLD.US)$ $American Tower Corp (AMT.US)$ $Equinix Inc (EQIX.US)$ $Public Storage (PSA.US)$ $Realty Income (O.US)$ $Simon Property (SPG.US)$ $AvalonBay Communities Inc (AVB.US)$ $Equity Residential (EQR.US)$

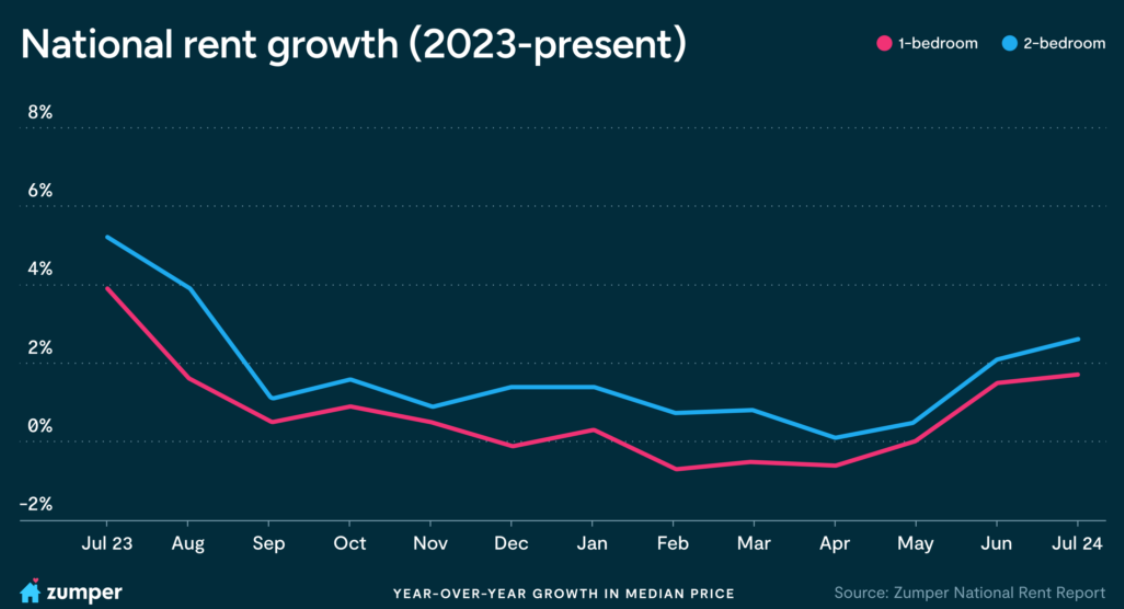

With Friday's nonfarm payroll data significantly lower than expected, the market has even started pricing in a 50bp rate cut in September. REITs, with their stable cash flows and high dividend yields, may so...

With Friday's nonfarm payroll data significantly lower than expected, the market has even started pricing in a 50bp rate cut in September. REITs, with their stable cash flows and high dividend yields, may so...

48

5

28

As the domestic real estate market enters a downturn cycle, the difficulty of making money from real estate as an investment asset has soared exponentially in the country. Meanwhile, in overseas markets, Real Estate Investment Trusts (REITs) offer investors a unique investment tool that provides a broad entryway into the real estate market.

By pooling together various real estate investment portfolios, investors can purchase REITs just li...

By pooling together various real estate investment portfolios, investors can purchase REITs just li...

+6

26

5

4

$Vanguard Real Estate ETF (VNQ.US)$

It looks like it may be time to find the outperformed in this ETF to possibly find some profitable trades.

$SPDR S&P 500 ETF (SPY.US)$ $Prologis (PLD.US)$ $Redfin (RDFN.US)$ $Simon Property (SPG.US)$ $Vornado Realty Trust (VNO.US)$ $Real Estate Select Sector Spdr Fund (The) (XLRE.US)$ $Real Estate Select Sector Index (.SIXRE.US)$ $Real Estate Select Sector Index Settlement Value (.SISRE.US)$ $Real Estate (LIST20762.US)$

It looks like it may be time to find the outperformed in this ETF to possibly find some profitable trades.

$SPDR S&P 500 ETF (SPY.US)$ $Prologis (PLD.US)$ $Redfin (RDFN.US)$ $Simon Property (SPG.US)$ $Vornado Realty Trust (VNO.US)$ $Real Estate Select Sector Spdr Fund (The) (XLRE.US)$ $Real Estate Select Sector Index (.SIXRE.US)$ $Real Estate Select Sector Index Settlement Value (.SISRE.US)$ $Real Estate (LIST20762.US)$

4

$Vanguard Real Estate ETF (VNQ.US)$

Potential Rebound

It looks like we are seeing a breakout on the very short timeframes. The price of VNQ has climbed above the resistance of a price channel that has held down the price action for several weeks.

Are we about to see a rebound? Or will we see more consolidation before a rebound? If the price falls back down into the price channel and makes new lows, then the rebound prospects will look a lot slimme...

Potential Rebound

It looks like we are seeing a breakout on the very short timeframes. The price of VNQ has climbed above the resistance of a price channel that has held down the price action for several weeks.

Are we about to see a rebound? Or will we see more consolidation before a rebound? If the price falls back down into the price channel and makes new lows, then the rebound prospects will look a lot slimme...

+1

4

7

3

No comment yet

Money Thrill : Very good overview and diversification![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)