No Data

SPXW241213P5845000

- 0.05

- -0.10-66.67%

- 5D

- Daily

News

Meet 2 of the Newest Additions to the S&P 500 Index. Their Stocks Have Rocketed 868% and 460% Since Their IPOs, Although Things Could Change in 2025, According to Wall Street.

Apple, Alphabet, Meta, Nvidia Lead in Stock Buybacks in S&P 500 in Q2

Weekly Buzz: Tech stocks hit high scores on ominous day

Friday the 13th Ends with Flat S&P 500 | Wall Street Today

Market Mixed on Friday the 13th | Livestock

Wall Street's “last bear” Stifel: U.S. stocks will fall to 5,000 points by the end of 2025.

① Barry Bannister, the chief investment strategist at Stifel, one of the few bears on Wall Street, expects that U.S. stocks will be below current levels by the end of 2025; ② Bannister believes that persistently high inflation may prompt the Federal Reserve to maintain high interest rates, impacting the stock market's upward momentum; ③ In contrast, other strategists are focusing on the trajectory of economic growth rather than the extent of interest rate cuts.

Comments

Make Your Choice

Weekly Buzz

The market finished the week with all-time records for tech stocks, yet again. Prices were muted until CPI numbers came out Wednesday, high enough above expectations to secure hope for further rate cuts at the FOMC meet...

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ closed flat the $Dow Jones Industrial Average (.DJI.US)$ fell 0.20%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.12%.

MACRO

In macro, trade index numbers arrived from the U.S. Department of Labor. Prices, both export and import came in ab...

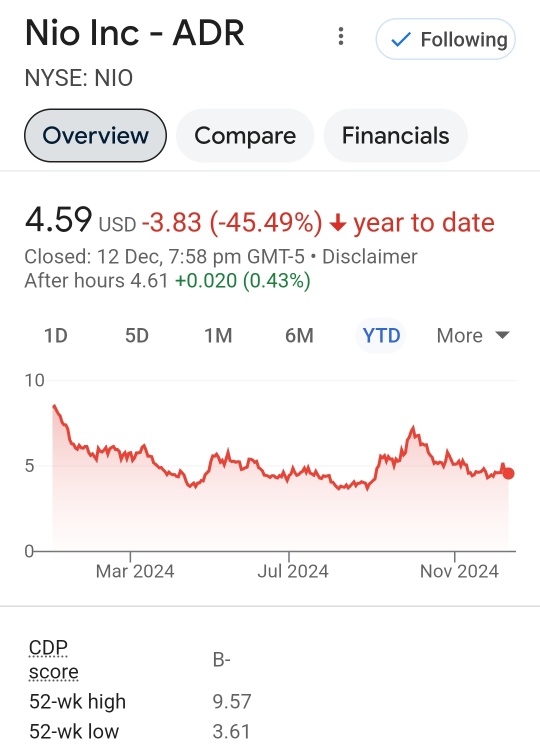

The article highlighted 4 reasons why you should avoid Nio stock:

1) Outperformance Fizzled Out

NIO's outperformance has fizzled out as the market sent its investors back to reality on its unprofitable business.

However, the company's optimism about its updated product cycle and lower-priced segments has failed to follow through. Accordingly, NIO's revised guidance for Q4 revenue i...

$Broadcom (AVGO.US)$ climbed upwards of 20%, the highest reaching percentage climber on the S&P 500 after the firm reported earnings that beat estimates Thursday, with revenue that climbed 51% from a year ago. AAI revenue for the fiscal year climbed 220%. The climb sent the stock to over $1T in ma...

$Tesla (TSLA.US)$seems unstoppable at above 425.

$NVIDIA (NVDA.US)$looks to have hit its head at 140.

Made a capital secured Put strategy as I see a good entry point. Effectively the stock price 133 - premium 21.30 = 112. Close to my entry target for $NVIDIA (NVDA.US)$. with an annual return of 15%.

HuatLady : The choice between long-term and short-term stocks largely depends on one's goals, risk tolerance and time horizon. Personally, I lean towards long-term investments as they provide several advantages. They are the best way to weather tough times and ride out markets volatility. Established companies often pay consistent dividends, offering a stable income stream. While infrequent trading minimizes transection costs, enhancing overall returns. and thriving makes them perfect

and thriving makes them perfect  for long term investors like me

for long term investors like me ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

For instance, when I hold stocks like $Apple (AAPL.US)$ and $Coca-Cola (KO.US)$, timing the market becomes less of a concern. I am confident these "bullet-proof" stocks can meet the challenges, whether it's a market recession or a global pandemic. Their track records of staying strong

ZnWC :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

HuatEver : Balancing short and long-term investment goals is challenging, but I prefer long-term investments for their ability to weather market fluctuations, generate dividends and capitalise on growth opportunities. They also encourage discipline and reduce impulsive decisions driven by short-term volatility.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

That said, short-term investments have strategic value, offering quick liquidity and flexibility to address immediate needs or market opportunities. By combining the stability of long-term investments with the agility of short-term plays, I aim to strike a balance that aligns with both immediate needs and future wealth-building goals.

102362254 : I prefer long-term investments for the growth and stability they offer, but I’m open to short-term opportunities when they pop up. It’s all about staying flexible and adapting to what works best for my goals and the market

Bird007 : @Author, please correct, the adjustment announcement of the NASDAQ 100 Index will be published at 8:00 PM Eastern Time this Friday (9:00 AM Peking Time).

View more comments...