US OptionsDetailed Quotes

SPXW241213P6130000

- 79.01

- +2.52+3.29%

15min DelayClose Dec 13 17:00 ET

79.01High55.00Low

55.00Open76.49Pre Close29 Volume135 Open Interest6130.00Strike Price191.41KTurnover233.20%IV0.00%PremiumDec 13, 2024Expiry Date78.91Intrinsic Value100Multiplier0DDays to Expiry0.10Extrinsic Value100Contract SizeEuropeanOptions Type-0.9965Delta0.0004Gamma73.93Leverage Ratio-97.8846Theta-0.0003Rho-73.67Eff Leverage0.0013Vega

S&P 500 Index Stock Discussion

Happy weekend investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market finished the week with all-time records for tech stocks, yet again. Prices were muted until CPI numbers came out Wednesday, high enough above expectations to secure hope for further rate cuts at the FOMC meet...

Make Your Choice

Weekly Buzz

The market finished the week with all-time records for tech stocks, yet again. Prices were muted until CPI numbers came out Wednesday, high enough above expectations to secure hope for further rate cuts at the FOMC meet...

+9

35

14

12

The market was mixed Friday, with a tech climb bringing the Nasdaq to fresh highs. The S&P 500 was dead flat Friday, while the Dow fell.

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ closed flat the $Dow Jones Industrial Average (.DJI.US)$ fell 0.20%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.12%.

MACRO

In macro, trade index numbers arrived from the U.S. Department of Labor. Prices, both export and import came in ab...

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ closed flat the $Dow Jones Industrial Average (.DJI.US)$ fell 0.20%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.12%.

MACRO

In macro, trade index numbers arrived from the U.S. Department of Labor. Prices, both export and import came in ab...

39

6

5

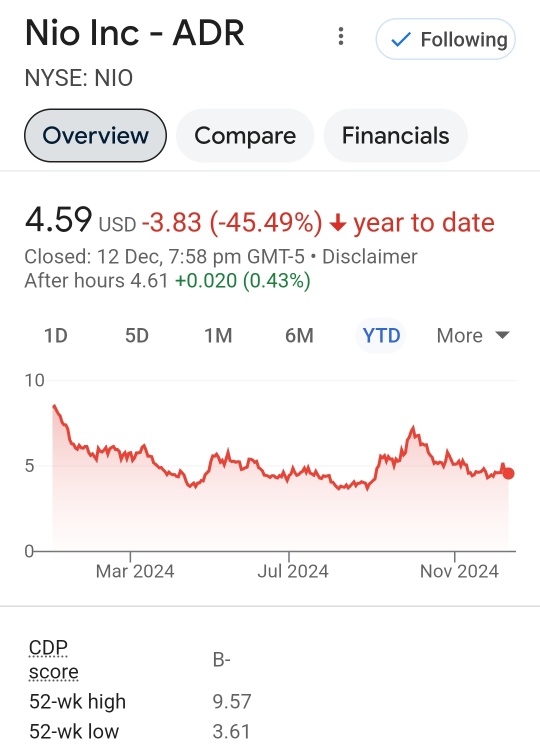

$NIO Inc (NIO.US)$ $Tesla (TSLA.US)$ $BYD COMPANY (01211.HK)$ $XPeng (XPEV.US)$

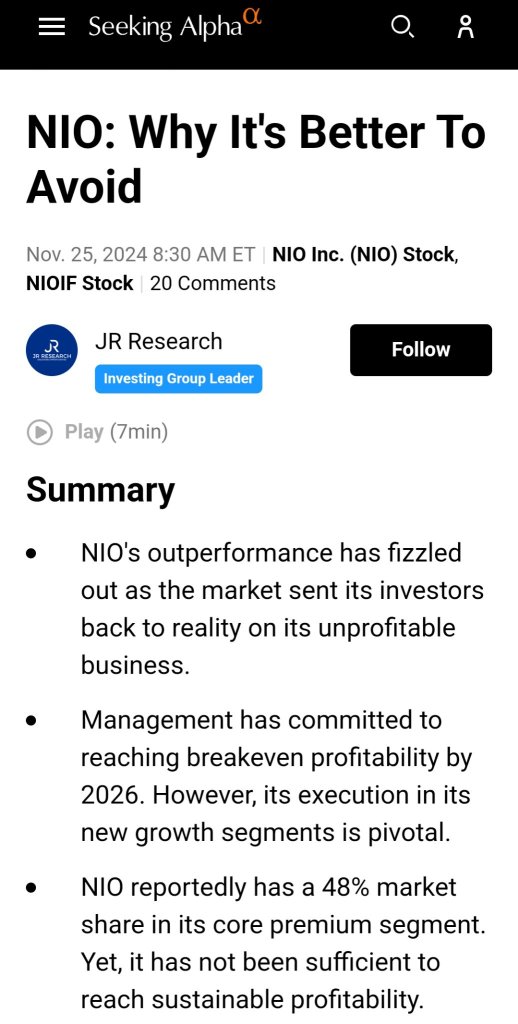

The article highlighted 4 reasons why you should avoid Nio stock:

1) Outperformance Fizzled Out

NIO's outperformance has fizzled out as the market sent its investors back to reality on its unprofitable business.

However, the company's optimism about its updated product cycle and lower-priced segments has failed to follow through. Accordingly, NIO's revised guidance for Q4 revenue i...

The article highlighted 4 reasons why you should avoid Nio stock:

1) Outperformance Fizzled Out

NIO's outperformance has fizzled out as the market sent its investors back to reality on its unprofitable business.

However, the company's optimism about its updated product cycle and lower-priced segments has failed to follow through. Accordingly, NIO's revised guidance for Q4 revenue i...

10

2

It's finally Friday, December 13th, and the market fell from a climb this morning into a light fall. Here are stories you may have missed moving markets today:

$Broadcom (AVGO.US)$ climbed upwards of 20%, the highest reaching percentage climber on the S&P 500 after the firm reported earnings that beat estimates Thursday, with revenue that climbed 51% from a year ago. AAI revenue for the fiscal year climbed 220%. The climb sent the stock to over $1T in ma...

$Broadcom (AVGO.US)$ climbed upwards of 20%, the highest reaching percentage climber on the S&P 500 after the firm reported earnings that beat estimates Thursday, with revenue that climbed 51% from a year ago. AAI revenue for the fiscal year climbed 220%. The climb sent the stock to over $1T in ma...

12

1

It’s Friday, $S&P 500 Index (.SPX.US)$ looks to be holding at 6060+ ![]() . Be mindful and take profits whenever possible. Don’t want to juggle too much and lose focus.

. Be mindful and take profits whenever possible. Don’t want to juggle too much and lose focus. ![]()

$Tesla (TSLA.US)$seems unstoppable at above 425.![]()

$NVIDIA (NVDA.US)$looks to have hit its head at 140.![]()

Made a capital secured Put strategy as I see a good entry point. Effectively the stock price 133 - premium 21.30 = 112. Close to my entry target for $NVIDIA (NVDA.US)$. with an annual return of 15%.![]() Too lo...

Too lo...

$Tesla (TSLA.US)$seems unstoppable at above 425.

$NVIDIA (NVDA.US)$looks to have hit its head at 140.

Made a capital secured Put strategy as I see a good entry point. Effectively the stock price 133 - premium 21.30 = 112. Close to my entry target for $NVIDIA (NVDA.US)$. with an annual return of 15%.

+3

22

________________________________________

Dow Jones Index: Breaching 44,000, Downside Looms

As anticipated, the Dow Jones Industrial Average has decisively broken below the 44,000 level, reinforcing the bearish outlook. This breach underscores weakening sentiment in industrial and financial sectors, aggravated by mixed economic data, including weaker-than-expected manufacturing output and ongoing global uncertainty. Without significan...

Dow Jones Index: Breaching 44,000, Downside Looms

As anticipated, the Dow Jones Industrial Average has decisively broken below the 44,000 level, reinforcing the bearish outlook. This breach underscores weakening sentiment in industrial and financial sectors, aggravated by mixed economic data, including weaker-than-expected manufacturing output and ongoing global uncertainty. Without significan...

4

From YouTube

6

1

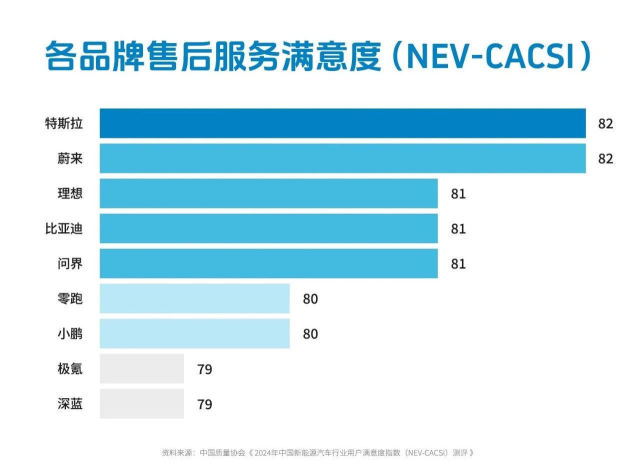

$Tesla (TSLA.US)$ $BYD COMPANY (01211.HK)$ $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$

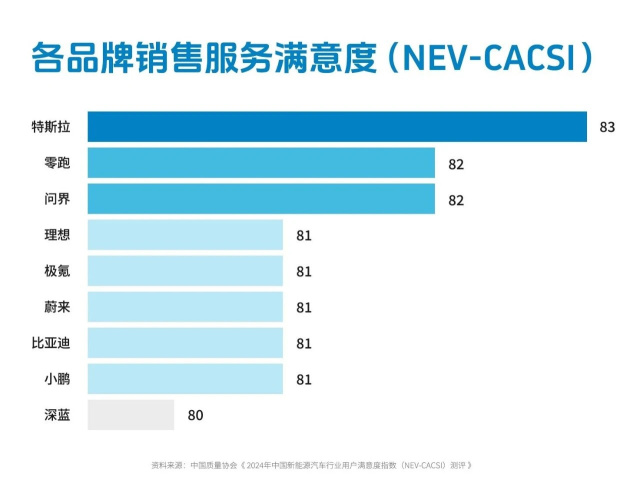

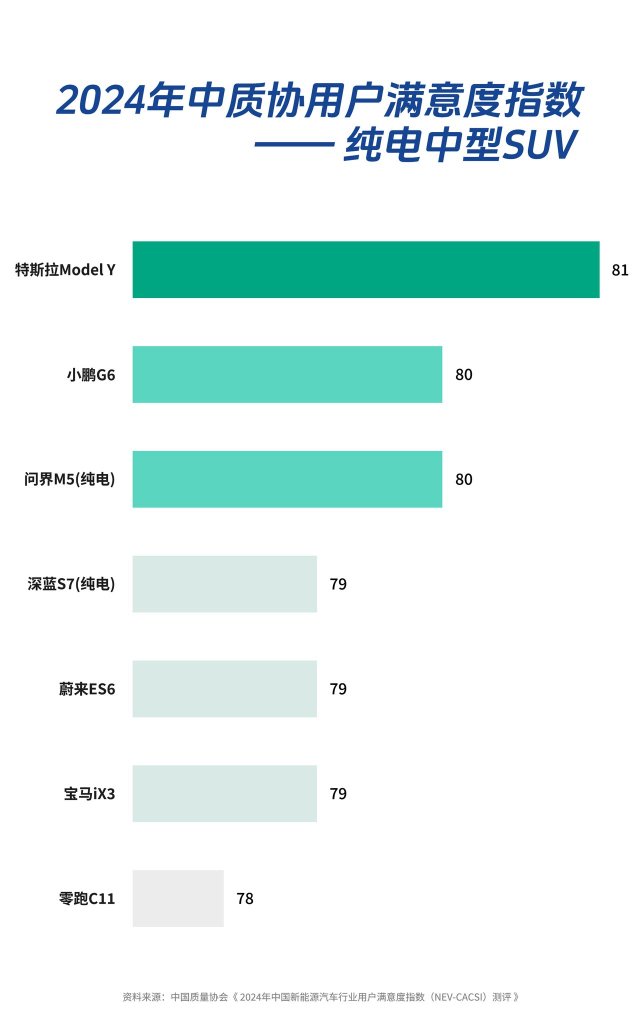

According to ThinkerCar, in the latest "2024 China NEV Industry Customer Satisfaction Index" (NEV -CACSI) evaluation results released by the China Quality Association, Tesla has won first place in four categories:

🥇Model 3 is the BEV midsize sedan with the highest user satisfaction

🥇Model Y is the B...

According to ThinkerCar, in the latest "2024 China NEV Industry Customer Satisfaction Index" (NEV -CACSI) evaluation results released by the China Quality Association, Tesla has won first place in four categories:

🥇Model 3 is the BEV midsize sedan with the highest user satisfaction

🥇Model Y is the B...

+2

2

4

2

$Tesla (TSLA.US)$ $BYD COMPANY (01211.HK)$ $NIO Inc (NIO.US)$ $NIO Inc (NIO.US)$

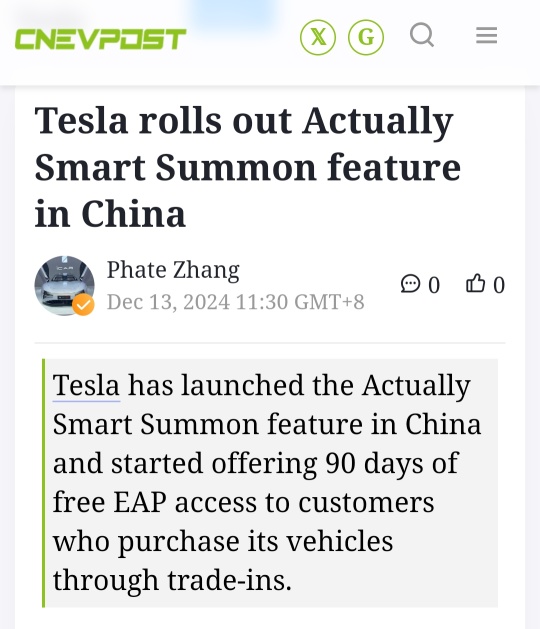

Saywer Merritt:

NEWS: Tesla China has officially announced the launch of Actually Smart Summon (ASS) in China.

CNEV Post:

Tesla has launched the ASS feature in China and started offering 90 days of free EAP access to customers who purchase its vehicles through trade-ins. Tesla ASS feature is also available in the US, Europe and the Middle East.

Notably, the featur...

Saywer Merritt:

NEWS: Tesla China has officially announced the launch of Actually Smart Summon (ASS) in China.

CNEV Post:

Tesla has launched the ASS feature in China and started offering 90 days of free EAP access to customers who purchase its vehicles through trade-ins. Tesla ASS feature is also available in the US, Europe and the Middle East.

Notably, the featur...

1

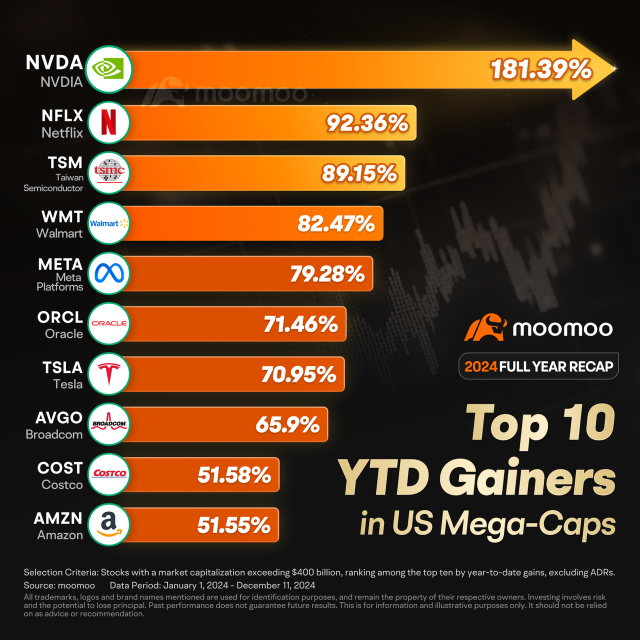

As 2024 wraps up, U.S. stocks have seen a robust rally, with the $S&P 500 Index (.SPX.US)$ climbing over 26% year-to-date. This surge was driven by the AI boom and strategic plays in rate cuts, Trump-related trades, and recession hedges, each taking the spotlight at different times.

AI advertising firm $Applovin (APP.US)$ led gains with an almost 750% rise. AI data analytics company $Palantir (PLTR.US)$ jumped more than 320%, w...

AI advertising firm $Applovin (APP.US)$ led gains with an almost 750% rise. AI data analytics company $Palantir (PLTR.US)$ jumped more than 320%, w...

63

2

62

No comment yet

Gonna stay in my lane.

Gonna stay in my lane.

HuatLady : The choice between long-term and short-term stocks largely depends on one's goals, risk tolerance and time horizon. Personally, I lean towards long-term investments as they provide several advantages. They are the best way to weather tough times and ride out markets volatility. Established companies often pay consistent dividends, offering a stable income stream. While infrequent trading minimizes transection costs, enhancing overall returns. and thriving makes them perfect

and thriving makes them perfect  for long term investors like me

for long term investors like me ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

For instance, when I hold stocks like $Apple (AAPL.US)$ and $Coca-Cola (KO.US)$, timing the market becomes less of a concern. I am confident these "bullet-proof" stocks can meet the challenges, whether it's a market recession or a global pandemic. Their track records of staying strong

ZnWC : Thanks for the event![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

I trade in both short-term and long-term. The inclination will depend on the market condition.

Think short term:

Under a bull market, I am likely to sell most of the overvalued stocks to take profit. Occasionally I will buy call options to earn a profit in the short term and no intention to buy the stock when it is in the money (ITM). As the stock value appreciates quickly, my investment strategy tells me not to buy which may end up holding a stock at a high price. My inclination is short term.

Think long term:

Under a bear market, I can find many undervalued stocks (based on PE ratio and other FA/TA indicators). My investment strategy tells me to buy and hold. I like to use Value averaging (VA) to accumulate stock - buy when the share dip and hold/sell when the share price is up. I will buy put options to protect my lower end and may exercise the contract if it is ITM - buy more with intention to hold. My inclination tends to be long term.

Bottom line

My investment principle -

"To be fearful when others are greedy and be greedy when others are fearful".

It is not easy to buy at dip because you need to DYODD and invest in a stock with conviction. When the share price dips further, most will "panic sell" in fear that you may catch a falling knife. I also don't use short term trading strategies like short selling or sell options because it is beyond my risk appetite.

HuatEver : Balancing short and long-term investment goals is challenging, but I prefer long-term investments for their ability to weather market fluctuations, generate dividends and capitalise on growth opportunities. They also encourage discipline and reduce impulsive decisions driven by short-term volatility.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

That said, short-term investments have strategic value, offering quick liquidity and flexibility to address immediate needs or market opportunities. By combining the stability of long-term investments with the agility of short-term plays, I aim to strike a balance that aligns with both immediate needs and future wealth-building goals.

102362254 : I prefer long-term investments for the growth and stability they offer, but I’m open to short-term opportunities when they pop up. It’s all about staying flexible and adapting to what works best for my goals and the market

Bird007 : @Author, please correct, the adjustment announcement of the NASDAQ 100 Index will be published at 8:00 PM Eastern Time this Friday (9:00 AM Peking Time).

View more comments...