US OptionsDetailed Quotes

SQQQ241213C36500

- 0.02

- 0.000.00%

15min DelayClose Dec 11 16:00 ET

0.00High0.00Low

0.02Open0.02Pre Close0 Volume85 Open Interest36.50Strike Price0.00Turnover164.26%IV25.97%PremiumDec 13, 2024Expiry Date0.00Intrinsic Value100Multiplier1DDays to Expiry0.02Extrinsic Value100Contract SizeAmericanOptions Type0.0183Delta0.0144Gamma1449.50Leverage Ratio-0.0199Theta0.0000Rho26.56Eff Leverage0.0009Vega

ProShares UltraPro Short QQQ ETF Stock Discussion

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$ Market is bad, it went up a little. Market is good, it drop a lot. WTH

2

1

Or more drops are coming.

PPI - How will it fare? Anyone knows ?

PPI - How will it fare? Anyone knows ?

2

4

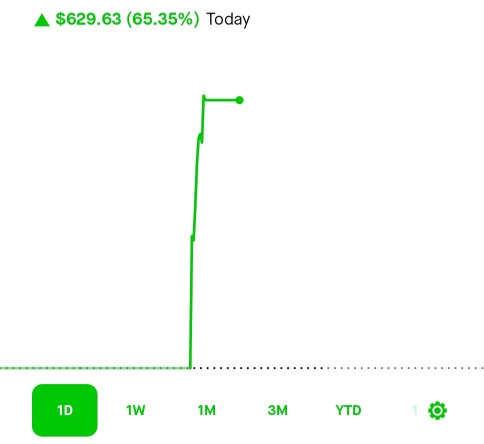

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

Terrible Day

Terrible Day

1

10

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

What is happening?

What is happening?

3

for my trading pc if not because of $ProShares UltraPro Short QQQ ETF (SQQQ.US)$![]()

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

loading...

3

4

No comment yet

Warren Buffed : cut. so the debt of gov more cheaper to pay

暗号 : Cutting interest rates reduces interest expenses, while also pushing up inflation to resolve debt. In November, the USA's largest tax revenue type (individual income tax) reached 62.5%, used to pay interest. The USA government can only lower interest rates.

Warren Buffed 暗号 : Mainly owing too much money, constantly issuing national debt, the GDP and tax revenue of its own people are not enough, still engaging in trade wars. Then lowering interest rates leads to currency devaluation, and the devalued money flows into the stock market seeking high ROI to resist inflation.

When a company's performance cannot keep up with its valuation, bubbles appear. I'm waiting for that day, maybe I will go bankrupt, but at least I have tried. I would rather go bankrupt than be the victim of buying overvalued stocks.

Daring Lu OP Warren Buffed : True.

but Inflation is a concern now

Trump has won the election.

They should focus on the real issue now

Warren Buffed Daring Lu OP : its not. debt is concern...