US OptionsDetailed Quotes

T250110C18500

- 0.00

- 0.000.00%

15min DelayClose Jan 8 09:30 ET

0.00High0.00Low

0.00Open0.00Pre Close0 Volume0 Open Interest18.50Strike Price0.00Turnover0.00%IV-16.59%PremiumJan 10, 2025Expiry Date3.68Intrinsic Value100Multiplier1DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma7.60Leverage Ratio--Theta--Rho--Eff Leverage--Vega

AT&T Stock Discussion

News Highlights

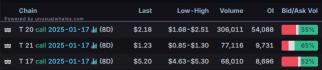

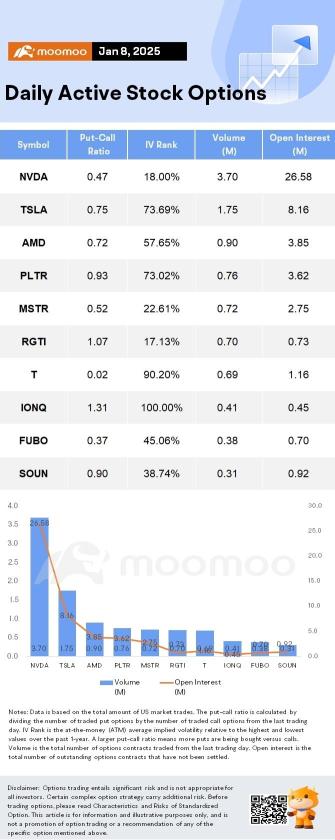

1. $AT&T (T.US)$ stock was flat, down 0.09%, in Wednesday's trading. The most traded calls are contracts of $20 strike price that expire on Jan 17 and the total volume reaching 306,011 with the open interest of 54,088.

Telecom giant AT&T on Wednesday announced that it will offer bill credits to customers who are affected by network outages as part of an initiative to at...

1. $AT&T (T.US)$ stock was flat, down 0.09%, in Wednesday's trading. The most traded calls are contracts of $20 strike price that expire on Jan 17 and the total volume reaching 306,011 with the open interest of 54,088.

Telecom giant AT&T on Wednesday announced that it will offer bill credits to customers who are affected by network outages as part of an initiative to at...

+2

27

5

27

$AT&T (T.US)$

This is an absolute failure in customer service and customer experience. AT&T’s leadership is broken…

PC Mag: AT&T Hits Texas Man With $6,000 Bill for Using 3GB of Data

This is an absolute failure in customer service and customer experience. AT&T’s leadership is broken…

PC Mag: AT&T Hits Texas Man With $6,000 Bill for Using 3GB of Data

1

$AT&T (T.US)$ the company's restructuring projects have been going on for more than 3 years already and still continuing. Ousourcing projects non-stop in all functions. What's next for the business? Sale?

$Verizon (VZ.US)$ $Bitcoin (BTC.CC)$

$Verizon (VZ.US)$ $Bitcoin (BTC.CC)$

5

We saw major U.S. indices showing mixed performance after fresh data showed an uptick in job openings and a slowdown in layoffs in October, signaling resilience in the labor market.

This week, labor job data remain the focus for investors as we expect the November employment report scheduled for release Friday morning.

During much of the trading session, S&P 500 was trading in the negative territory, only to recover in the afternoon ...

This week, labor job data remain the focus for investors as we expect the November employment report scheduled for release Friday morning.

During much of the trading session, S&P 500 was trading in the negative territory, only to recover in the afternoon ...

+3

45

2

2

$AST SpaceMobile (ASTS.US)$ after one month, nobody will remember this company. we already got starlink bro and the youtube promotion video basically telling me to buy $AT&T (T.US)$ which I already have.

2

3

Certain stocks and industries are often considered more resilient to the uncertainties of U.S. elections, as their performance tends to be less impacted by the outcome of the election or political shifts. These sectors often include:

1. Consumer Staples: Companies that produce essential goods, such as food, beverages, household products, and personal care items, tend to be more stable because demand for these products remains consistent regardless of the poli...

1. Consumer Staples: Companies that produce essential goods, such as food, beverages, household products, and personal care items, tend to be more stable because demand for these products remains consistent regardless of the poli...

27

3

$AT&T (T.US)$ the CEO of Corning is on TV right now discussing their 1 billion dollar deal with AT&T for fiber

2

No comment yet

Sinisloth : $Virgin Galactic (SPCE.US)$ $Hyperscale Data (GPUS.US)$

102701962 : Thanks for the dip Jensen

TokenSleep 102701962 : Right, this is 100% the time to buy and hold.

StockPeep : Yeah we don’t need your opinion Jensen, but thinks for the dip. More shares I buy :)

BelleWeather : I sold my second naked calls ever on quantum tickers last week (the first time was only a single contract, and while I had very high conviction, it wasn’t to the point of feeling that “I know,” and so risky that, well, one contract was a fine start. I did have the highest level of conviction that quantum stocks would correct, hugely and soon. Still sold extra time for obvious reasons. The only “new” idea I had going into the New Year with any confidence. I’m happy it worked out, of course, because the opposite would have been very not good. I’m so sorry for others, however. It was odd, as I mentioned, commented, shared the trade and spoke of the correction in a Moo Moo Livestream. And there was only one single response that considered essentially what Huang said possible, and many others who disagreed, most vehemently, some angrily and a few in an ugly fashion. Also, I explained my reasoning (same as Sir Jensen’s, but also others,) and it seemed that those in disagreement had none. I should think that a few hours of reading on the technology and examination of valuations and other fundamentals would have prompted caution at the least? I feel bad that the trade worked, but also, wish I saw more reasoning behind strong conviction trades from others. Unless trading purely junk pennys with TA, these things do matter, I think.