No Data

T250110C18500

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

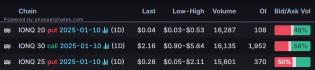

Options Market Statistics: IonQ Stock Plunges After Nvidia CEO Sees 'Useful' Quantum Is Decades Away; Options Pop

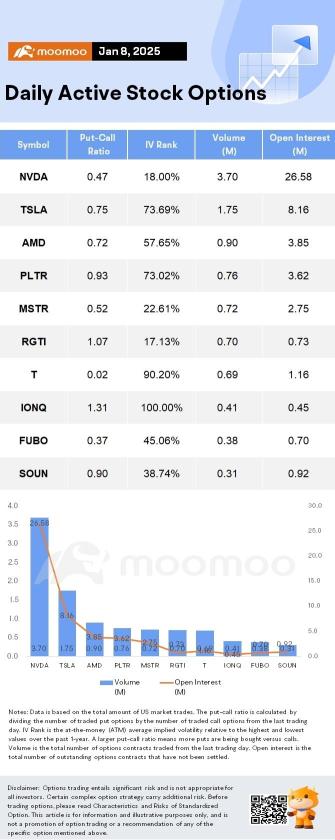

AT&T Options Spot-On: On January 8th, 694.27K Contracts Were Traded, With 1.16 Million Open Interest

S&P 500 Positive for 'First Five Days,' Huang Sees Decades till Quantum | Wall Street Today

AT&T to Offer Bill Credits for Network Outages, Reuters Says

Oak Tree Capital's Marks: New things are prone to bubbles, currently private equity buying S&P 500, with a 10-year yield of only ±2%.

Max recently released a memorandum titled "Revisiting the Bubble," stating that investors are currently betting on the leading high-tech companies to maintain their dominance. However, he believes that it is not easy to stay ahead, as new technologies and competitors can surpass existing market leaders at any time. When people assume that "things can only get better" and Buy based on that, the impact of negative news can be particularly severe. He specifically pointed out the frenzy over AI and how this positive sentiment may spread to other Technology sectors.

Five Largest S&P 500 Stocks Surpass 60-year High in Market Concentration

Comments

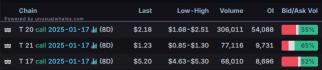

1. $AT&T (T.US)$ stock was flat, down 0.09%, in Wednesday's trading. The most traded calls are contracts of $20 strike price that expire on Jan 17 and the total volume reaching 306,011 with the open interest of 54,088.

Telecom giant AT&T on Wednesday announced that it will offer bill credits to customers who are affected by network outages as part of an initiative to at...

This is an absolute failure in customer service and customer experience. AT&T’s leadership is broken…

PC Mag: AT&T Hits Texas Man With $6,000 Bill for Using 3GB of Data

$Verizon (VZ.US)$ $Bitcoin (BTC.CC)$

This week, labor job data remain the focus for investors as we expect the November employment report scheduled for release Friday morning.

During much of the trading session, S&P 500 was trading in the negative territory, only to recover in the afternoon ...

Sinisloth : $Virgin Galactic (SPCE.US)$ $Hyperscale Data (GPUS.US)$

102701962 : Thanks for the dip Jensen

TokenSleep 102701962 : Right, this is 100% the time to buy and hold.

StockPeep : Yeah we don’t need your opinion Jensen, but thinks for the dip. More shares I buy :)

BelleWeather : I sold my second naked calls ever on quantum tickers last week (the first time was only a single contract, and while I had very high conviction, it wasn’t to the point of feeling that “I know,” and so risky that, well, one contract was a fine start. I did have the highest level of conviction that quantum stocks would correct, hugely and soon. Still sold extra time for obvious reasons. The only “new” idea I had going into the New Year with any confidence. I’m happy it worked out, of course, because the opposite would have been very not good. I’m so sorry for others, however. It was odd, as I mentioned, commented, shared the trade and spoke of the correction in a Moo Moo Livestream. And there was only one single response that considered essentially what Huang said possible, and many others who disagreed, most vehemently, some angrily and a few in an ugly fashion. Also, I explained my reasoning (same as Sir Jensen’s, but also others,) and it seemed that those in disagreement had none. I should think that a few hours of reading on the technology and examination of valuations and other fundamentals would have prompted caution at the least? I feel bad that the trade worked, but also, wish I saw more reasoning behind strong conviction trades from others. Unless trading purely junk pennys with TA, these things do matter, I think.