No Data

TCOM Trip.com

- 64.230

- -0.300-0.46%

- 65.600

- +1.370+2.13%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] CICC: With the further strengthening of stable growth policies, the Consumer sector is expected to gradually welcome a trend market.

According to the report by China International Capital Corporation and based on Wind Statistics, since the beginning of the year, the Consumer and CSI Consumer 360 index have risen by 0.5% and 1.4%, respectively. In the context of significant attention in the Technology growth sector, their overall performance is relatively mild, slightly better than the overall market (CSI 300 Index declined slightly by 0.5% during the same period). The bank indicated that recently, with the policy dividends in the consumer sector and marginal improvements in China's economic growth expectations, attention to the Consumer Sector has increased, but market volatility remains high. Considering the current macro environment, the overall allocation for the Consumer Sector may still be in a left-leaning phase, and there may still be periodic structural opportunities in the short to medium term (3-6 months).

10 Consumer Discretionary Stocks Whale Activity In Today's Session

New narratives in the travel market, a duet of OTAs moving downward and outward.

From this point, looking back at the CSI Consumer 360 index in 2024, the tourism Industry shows explosive growth, making it a leader and gradually establishing an important strategic position for the tourism Industry in the national economy.

Can the AI boom driven by Baidu's open-source large models and Tencent's chip purchases in the Hong Kong stock market continue?

① How does Baidu's strategy of freely opening up and planning to open source large models affect its long-term competitiveness in cloud business and ad monetization? ② Tencent's increased procurement of H20 chips to support the implementation of large models, does it mean that the domestic computing power infrastructure still highly relies on overseas supply chains?

How to grasp the main line in a volatile market? Technology and Consumer dual-driven may be key.

Yesterday, the market fluctuated throughout the day, with a single-day transaction volume shrinking by over 200 billion. After experiencing last Friday's significant rise in volume, the Index's decline in volume and retracement is also reasonable, and the subsequent view will still lean towards a fluctuating upward structure.

Express News | Trump: Xi Will Be Coming “in the Not Too (Not 'to') Distant Future”

Comments

Trip.com has benefited from a travel boom after China's long Covid restrictions were lifted in late 2022.

Now Trip.com Group is poised to gain from catering to senior citizens’ growing interest in travel and travel bookings from lower-tier cities in China...

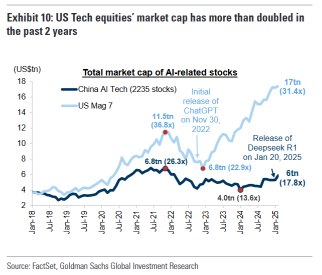

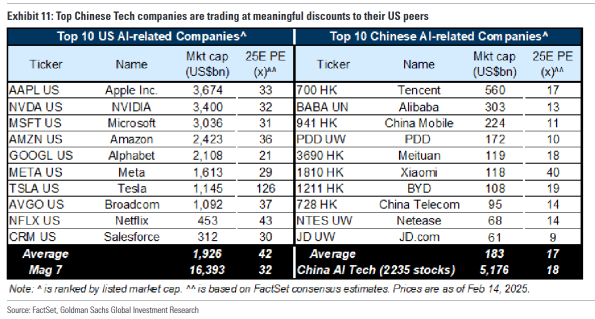

Wall Street banks have issued optimistic reports on Chinese tech stocks, signaling potential revaluation.

Goldman Sachs analyst Kinger Lau published a report titled “AI Changes the Ga...

Unlock the Full List

104383375 : There is no explanation, but it is indeed a time to Buy, as it is possible to speculate on China's 51 Gold Week. The key is to be patient.

Mkme 104383375 : yeah just slowly accumulate, soon money will come back

103625033 OP 104383375 : thanks!

103625033 OP Mkme : thanks!

FrankieSmilez : Q424 results showed a re-acceleration of

top-line growth, but also a surprising surge in Cost of Revenue and Operating Expenses, which combined to drag down core margins." - Daniel Hellberg

View more comments...