No Data

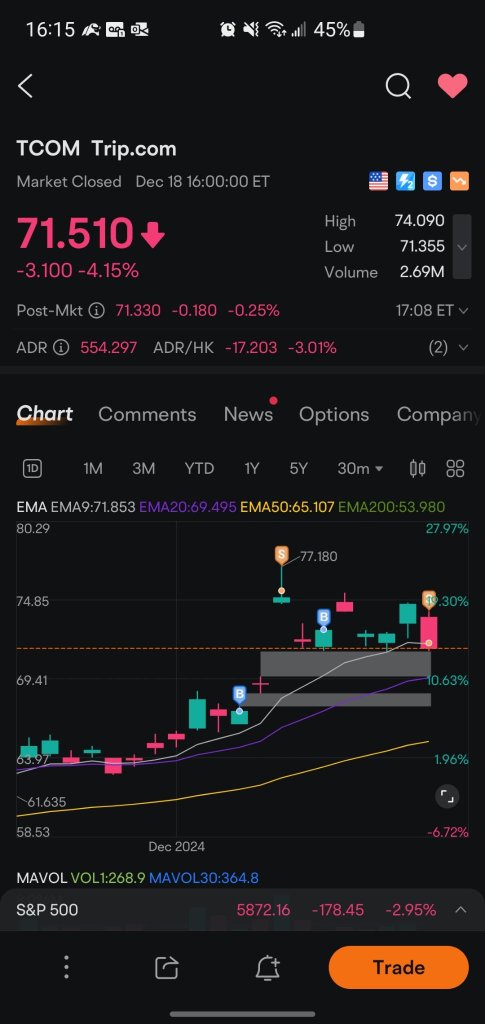

TCOM Trip.com

- 64.900

- -0.100-0.15%

- 64.910

- +0.010+0.02%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Morgan Stanley Downgrades Trip.com(TCOM.US) to Hold Rating, Raises Target Price to $81

China International Capital Corporation's outlook for the 2025 Spring Festival travel period and tourism: steady growth.

Longer holidays allow everyone to return home and go on vacation at the same time, whether the travel demands are domestic or cross-border, both are quite strong.

Major banks rating丨Daiwa: Raised Ctrip's Target Price to HKD 780, the development of inbound tourism Business can become a strong catalyst.

Daiwa published a research report indicating that Trip.com, Ctrip's overseas platform, has been steadily increasing its market share since 2024. It is expected that China's latest visa-free policy will continue to bring inbound tourism opportunities to the company. Currently, the forecast predicts that Ctrip's inbound tourism revenue will double by 2025, accounting for about 28% of Trip.com’s income and approximately 4% of the group’s overall revenue. It is believed that the development of the inbound tourism business can become a strong catalyst. Daiwa continues to list Ctrip as one of its preferred stocks and has raised its revenue and earnings per share forecasts for 2025 to 2026 by 0.2% to 1.2%, reflecting the contribution of inbound tourism revenue.

Trip.com (TCOM) Stock Moves -0.52%: What You Should Know

300 billion Ctrip wants to regain control.

Make a move.

Trip.com Group Limited's (NASDAQ:TCOM) Stock Been Rising: Are Strong Financials Guiding The Market?

Comments

The U.S. stock market, in its second bullish year, repeatedly shattered records. Nvidia claimed the crown, tech giants reigned supreme, and AI continued to fuel the market's ascent. Globally, interest rates took a downturn amidst ongoing g...

100 shares, add 50 = 150

then you can add 75, = 225.

this is how you can rebuild you position and never let the trade turn red.