No Data

TCOM Trip.com

- 63.580

- +0.900+1.44%

- 63.250

- -0.330-0.52%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Should You Be Adding Trip.com Group (NASDAQ:TCOM) To Your Watchlist Today?

The pattern of "weak performance of the technology stocks" in the Hong Kong stock market is intensifying. What direction will the market take next?

① Currently, the profit growth of Hong Kong stocks mainly relies on the optimization of profit margins in the Technology Sector rather than revenue expansion. Does this imply that the foundation for sustained market growth in the future is relatively weak? ② For the "Adjustment of Technology Positions + Dividend Hedging" strategy proposed by CICC, how should investors balance the conflict between short-term volatility defense and long-term strategy adherence?

Ctrip: A risk guarantee has been initiated in response to the impact of the earthquake in Myanmar.

Sina Technology reported on March 28 that recently, in response to the potential impact of the earthquake in Myanmar, the Ctrip SOS platform has started collecting demands from affected users. Ctrip urges tourists in Myanmar to be cautious of aftershocks and pay attention to safety. Regarding hotels, for orders of hotel products booked on the Ctrip platform for all regions in Myanmar, Thailand, Laos, and Ruili in Yunnan, with check-in dates from March 28 to April 4, a guarantee has been established where Ctrip will work with merchants to bear the cancellation losses for users who need to cancel their bookings. As for flight tickets, Ctrip will closely monitor the policies of airlines and update relevant information in a timely manner.

TRIP.COM-S (09961.HK) received a Shareholding increase of 0.4437 million shares from The Capital Group.

On March 28, Gelonghui reported that according to the latest equity disclosure information from the Stock Exchange, on March 25, 2025, TRIP.COM-S (09961.HK) was purchased by The Capital Group Companies, Inc. in the market at an average price of HKD 501.0 per share, involving an investment of approximately HKD 0.222 billion for 0.4437 million shares. After the shareholding increase, The Capital Group Companies, Inc.'s latest shareholding number is 68,468,999 shares, with the shareholding ratio rising from 9.95% to 10.02%.

Will Weakness in Trip.com Group Limited's (NASDAQ:TCOM) Stock Prove Temporary Given Strong Fundamentals?

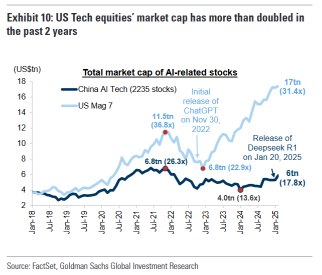

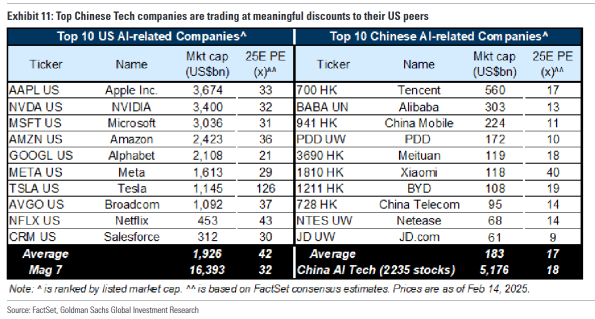

Choosing between A-shares or Hong Kong stocks, Technology or non-Technology? Goldman Sachs' Research Reports respond to two major hot topics in investing in China.

① Currently, should investors continue investing in Hong Kong Stocks or shift to the A-share market? Should the focus be on the Technology Sector or shift to Consumer, Real Estate, and other non-Technology sectors? ② On Wednesday, Goldman Sachs' chief China Stocks strategist, Liu Jinjing, provided an analysis in his report.

Comments

Trip.com has benefited from a travel boom after China's long Covid restrictions were lifted in late 2022.

Now Trip.com Group is poised to gain from catering to senior citizens’ growing interest in travel and travel bookings from lower-tier cities in China...

Wall Street banks have issued optimistic reports on Chinese tech stocks, signaling potential revaluation.

Goldman Sachs analyst Kinger Lau published a report titled “AI Changes the Ga...

104383375 : There is no explanation, but it is indeed a time to Buy, as it is possible to speculate on China's 51 Gold Week. The key is to be patient.

Mkme 104383375 : yeah just slowly accumulate, soon money will come back

103625033 OP 104383375 : thanks!

103625033 OP Mkme : thanks!

FrankieSmilez : Q424 results showed a re-acceleration of

top-line growth, but also a surprising surge in Cost of Revenue and Operating Expenses, which combined to drag down core margins." - Daniel Hellberg

View more comments...