No Data

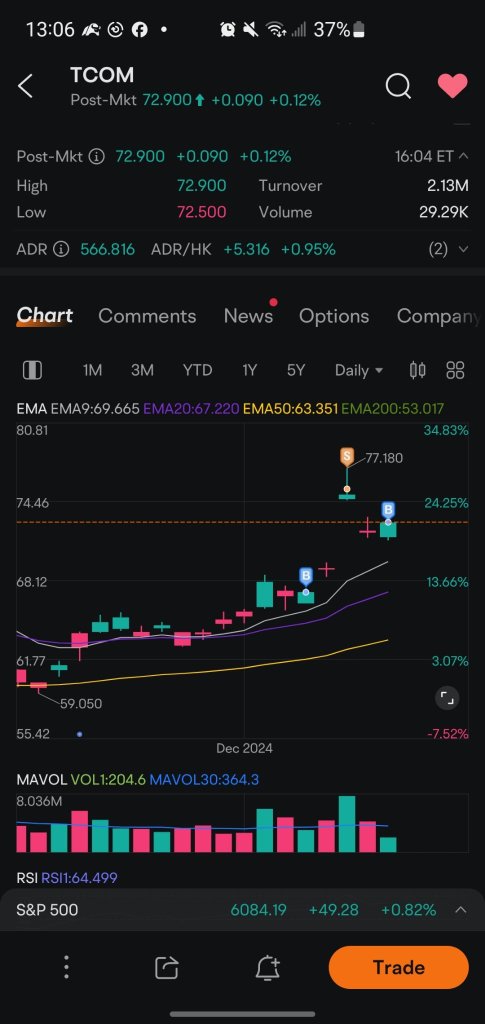

TCOM241220C42000

- 30.37

- 0.000.00%

- 5D

- Daily

News

Shares of US-listed Chinese Stocks Are Trading Lower Due to Stimulus Concerns and Disappointing Economic Data. The Biden Administration Plans to Raise Tariffs on Solar Wafers, Polysilicon and Some Tungsten Products.

Express News | Shares of US-listed Chinese Stocks Are Trading Lower Due to Stimulus Concerns and Disappointing Economic Data. The Biden Administration Plans to Raise Tariffs on Solar Wafers, Polysilicon and Some Tungsten Products

The Nasdaq fell to 0.02 million points, Adobe plummeted more than 13%, the China concept Index rose against the trend, and Bitcoin dropped below 0.1 million dollars.

In November, USA PPI inflation exceeded expectations, with the market betting on a pause in interest rate cuts in January next year. The Dow has fallen for six consecutive days, with NVIDIA experiencing the largest drop of 2.5%. Tesla, Meta, Google, and Amazon have moved away from their highs, uranium mining stocks have declined, but Apple reached a new high. Broadcom rose nearly 5% in after-hours trading, and Chinese stocks Baidu and PDD Holdings increased by over 1%. Bond yields in Europe and the USA have risen significantly, and after the European Central Bank cut interest rates, the euro fell to a one-week low, before rebounding. The dollar reached a two-week high, while the offshore yuan once rose over 200 points, breaking through 7.26 yuan. Commodities generally fell, with spot gold down over 2% and spot silver down over 4% during the session.

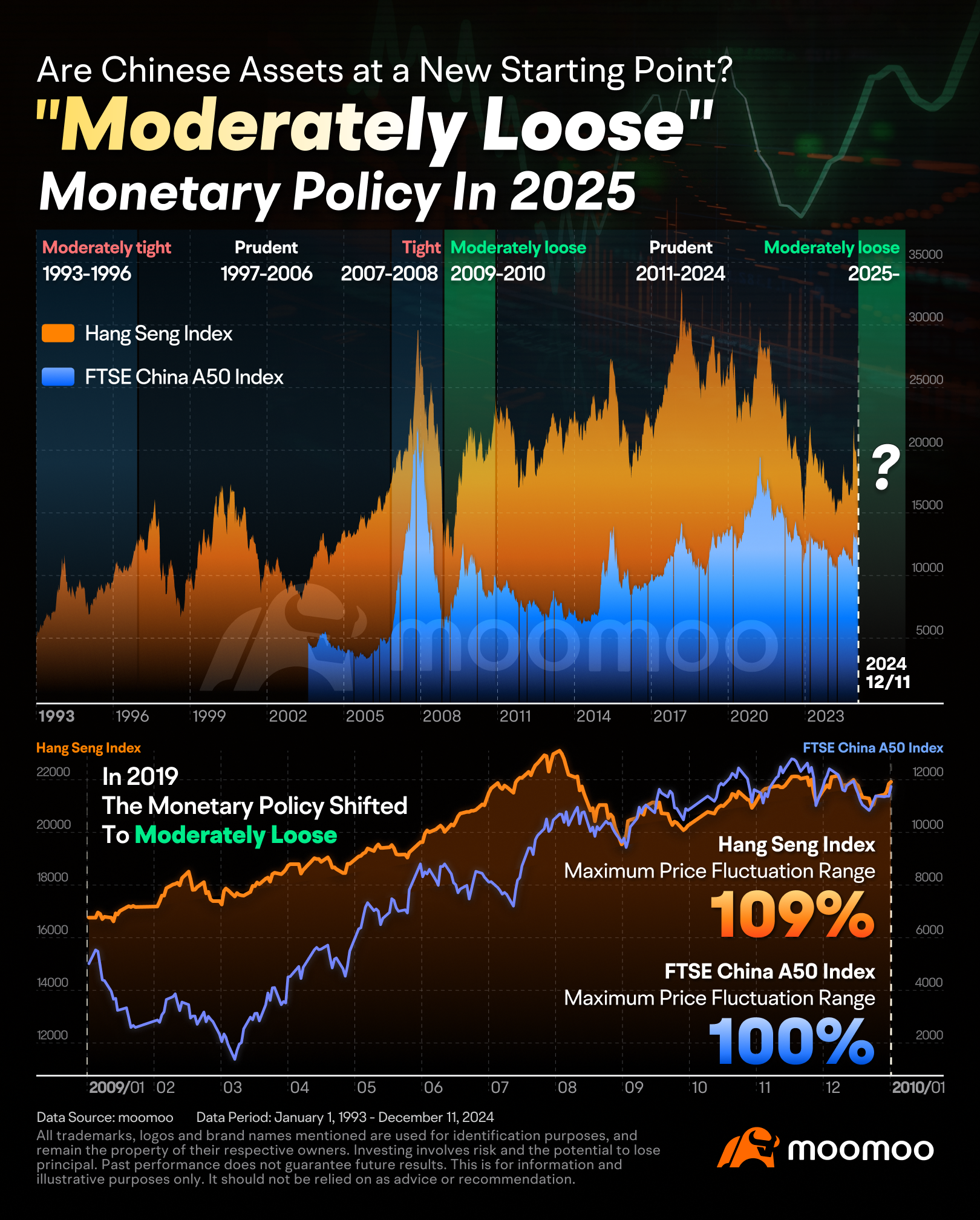

China to Lift Fiscal Spending to Boost Economy

China Central Economic Work Conference: A Key Indicator for Future Market Trends

Top Gap Ups and Downs on Monday: NVDA, BABA, AMD and More

Comments

100 shares, add 50 = 150

then you can add 75, = 225.

this is how you can rebuild you position and never let the trade turn red.

What does the Central Economic Work Conference discuss?

The conference typically comprises two main components: evaluating the...