No Data

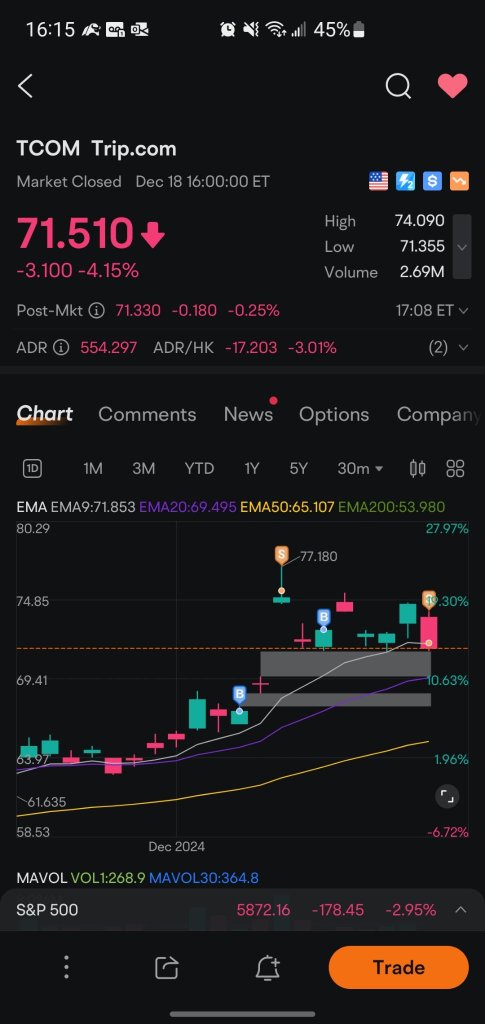

TCOM241220P95000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Top Gap Ups and Downs on Friday: NVO, BABA, INFY and More

The concerns regarding Ctrip still exist for 300 billion.

The competition is fierce.

The Dow barely ended its longest continuous decline in 50 years, Micron fell by 16%, the US dollar reached a two-year high again, and US bonds, oil, and Bitcoin all dropped.

U.S. stock market's other Indexes turned down towards the end, Tesla rose by nearly 4% before closing down, NVIDIA reached a high of 4%, and Micron Technology had its steepest decline in five years. The yield on the 10-year U.S. Treasury bonds briefly increased by nearly 10 basis points approaching 4.60%, close to a seven-month high, while short-term bond yields fell, with the 2/10-year yield spread at its widest in two and a half years. The Bank of England held rates steady, but more officials supported a rate cut, leading to a decline in the British Pound. The Governor of the Bank of Japan suppressed interest rate hike expectations, causing the yen to fall towards 158, and the offshore renminbi briefly dropped below 7.32 yuan to its lowest in 15 months. Bitcoin fell by 5%, approaching $0.096 million. Spot Gold rose by 1.6% before narrowing back below $2,600, while the futures silver fell by 5%, and U.S. crude oil fell below $70.

Trip.com Announces Plans to Explore Four-day Workweek

Trip.com Group Unites Partners to Drive Growth and Explore New Opportunities at the 2024 Global Partner Summit

Shares of Companies Within the Broader Consumer Discretionary Sector Are Trading Lower Amid Overall Market Weakness Following the Fed's Rate Decision to Cut Rates by 25 Basis Points.

Comments

The U.S. stock market, in its second bullish year, repeatedly shattered records. Nvidia claimed the crown, tech giants reigned supreme, and AI continued to fuel the market's ascent. Globally, interest rates took a downturn amidst ongoing g...

100 shares, add 50 = 150

then you can add 75, = 225.

this is how you can rebuild you position and never let the trade turn red.