No Data

CA Stock MarketDetailed Quotes

TD The Toronto-Dominion Bank

- 86.505

- +0.135+0.16%

15min DelayTrading Mar 31 14:26 ET

151.54BMarket Cap18.33P/E (TTM)

86.525High85.600Low1.72MVolume85.690Open86.370Pre Close148.20MTurnover87.65052wk High0.10%Turnover Ratio1.75BShares70.86552wk Low4.72EPS TTM148.18BFloat Cap94.813Historical High18.33P/E (Static)1.71BShs Float1.550Historical Low4.72EPS LYR1.07%Amplitude4.11Dividend TTM1.40P/B1Lot Size4.75%Div YieldTTM

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Scotiabank Cut to Neutral at BofA on Heightened Trade Tensions

Buy Canadian: Stocks to Defend Your Wealth in a Trade War

Daily short sale tracking: CoreWeave's short volume increased by 10 million, with a short sale ratio of 26%

TD Bank Ranks No. 1 in Florida in J.D. Power Retail Banking Study

Daily short sale tracking: NVIDIA's short volume increased by 12 million, with a short sale ratio of 8%

Opinion: 3 Best Dividend Stocks in Canada Right Now

Comments

1

The tariffs imposed by the Trump administration have introduced considerable uncertainty for Canada's export-driven economy. Bank of Canada Governor Tiff Macklem has cautioned that these tariffs could significantly hinder Canada's economic growth, particularly affecting the export sector. As a key trading partner of the U.S., Canada exports substantial quantities of oil, gas, automotive components, and minerals. Should th...

5

13

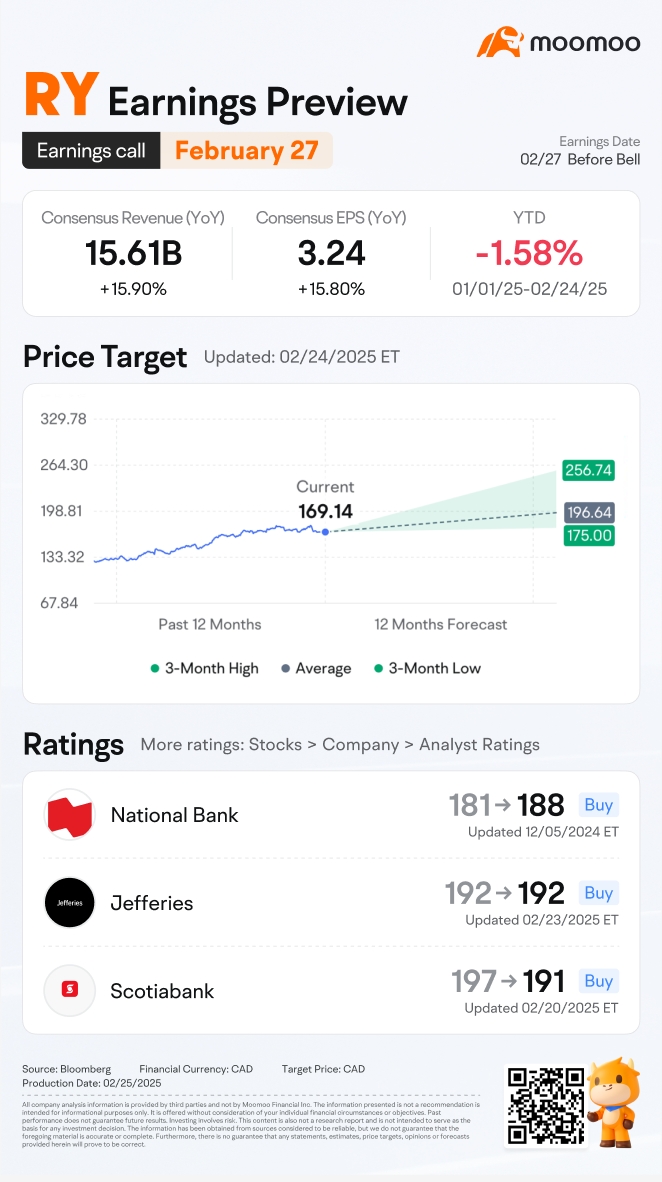

The Royal Bank of Canada is set to release its earnings for fiscal Q1 2025, ending January 31, on February 27. Bloomberg data shows that analysts expect RY's revenue to grow by 15.9% to C$15.61 billion, and EPS to increase by 15.8% to C$3.24. Notably, analyst forecasts for RBC have consistently leaned conservative, with the bank outperforming market expectations in all quarters of 2024.

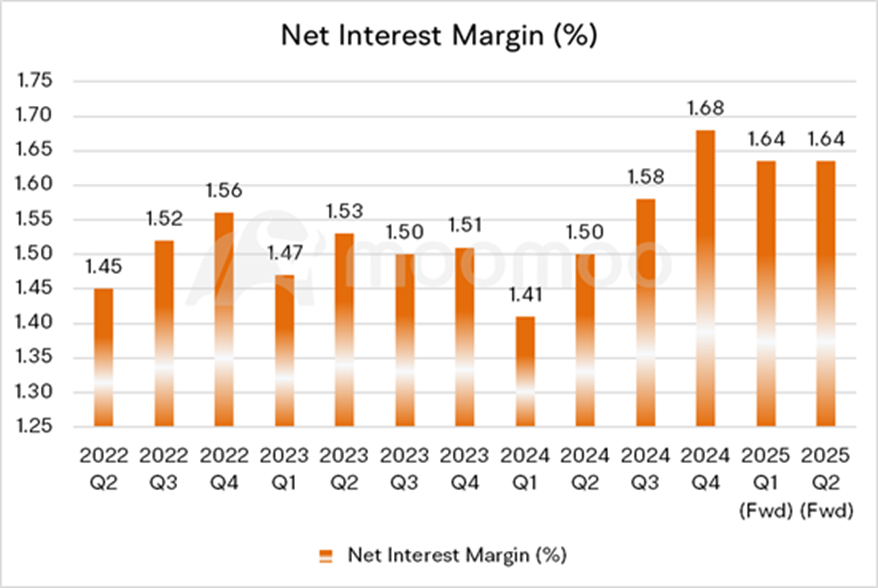

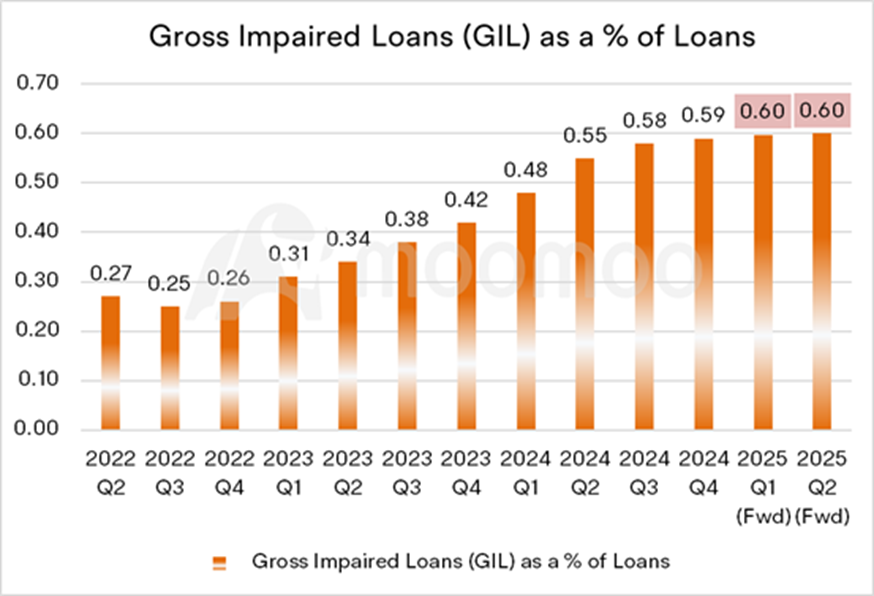

Investors will be closely monitoring the f...

Investors will be closely monitoring the f...

+3

7

3

Read more