No Data

TLT iShares 20+ Year Treasury Bond ETF

- 90.505

- +0.365+0.40%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Goldman Cuts S&P 500 Target, Sees Higher Risk of Recession Amid Tariffs

Dow Edges Higher, Global Markets Drop on Tariff Concerns -- WSJ

10-year Treasury Yield Falls Below Key Level as Calm Over Trade War Unravels

Trump is recklessly swinging the tariff stick, Blackrock CEO: Global concerns about the economy have reached an unprecedented level.

① Since Trump's return to the White House in January, he has announced several tariff measures and will introduce a so-called reciprocal tariff plan on Wednesday to further increase trade barriers; ② Blackrock CEO Larry Fink stated that Trump's trade war has pushed investors' anxiety about the Global economy to its highest point in recent years.

Can the Federal Reserve replicate the interest rate cuts of 2019 this time?

Guan Tao believes that the current USA is in the later stage of high inflation returning to trend values, and the intensity of the Trump 2.0 economic and trade friction has already exceeded that of Trump 1.0, which will increase the stickiness of inflation and even raise the risk of a secondary inflation. The policy space for the Federal Reserve is likely to be limited.

USA tariffs and non-farm payrolls are approaching! A crucial week for the interest rate market as Goldman Sachs urgently gives advice.

The interest rate market is entering a crucial week, as the USA will announce tariff announcements on April 2, and two days later, the non-farm payroll report will also have a significant impact.

Comments

His reciprocal tariffs will go into effect on that day.

Investors are already feeling the jittery as overnight trading is so red now.

Side note, what didn’t help the stock market during this nervy moment is that the latest PCE index came in hotter than anticipated last Friday.

$Advanced Micro Devices (AMD.US)$ $Palantir (PLTR.US)$ $Super Micro Computer (SMCI.US)$ $Trump Media & Technology (DJT.US)$ $Morgan Stanley (MS.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR Gold ETF (GLD.US)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $Intel (INTC.US)$ $Lululemon Athletica (LULU.US)$

ever hit my feed.

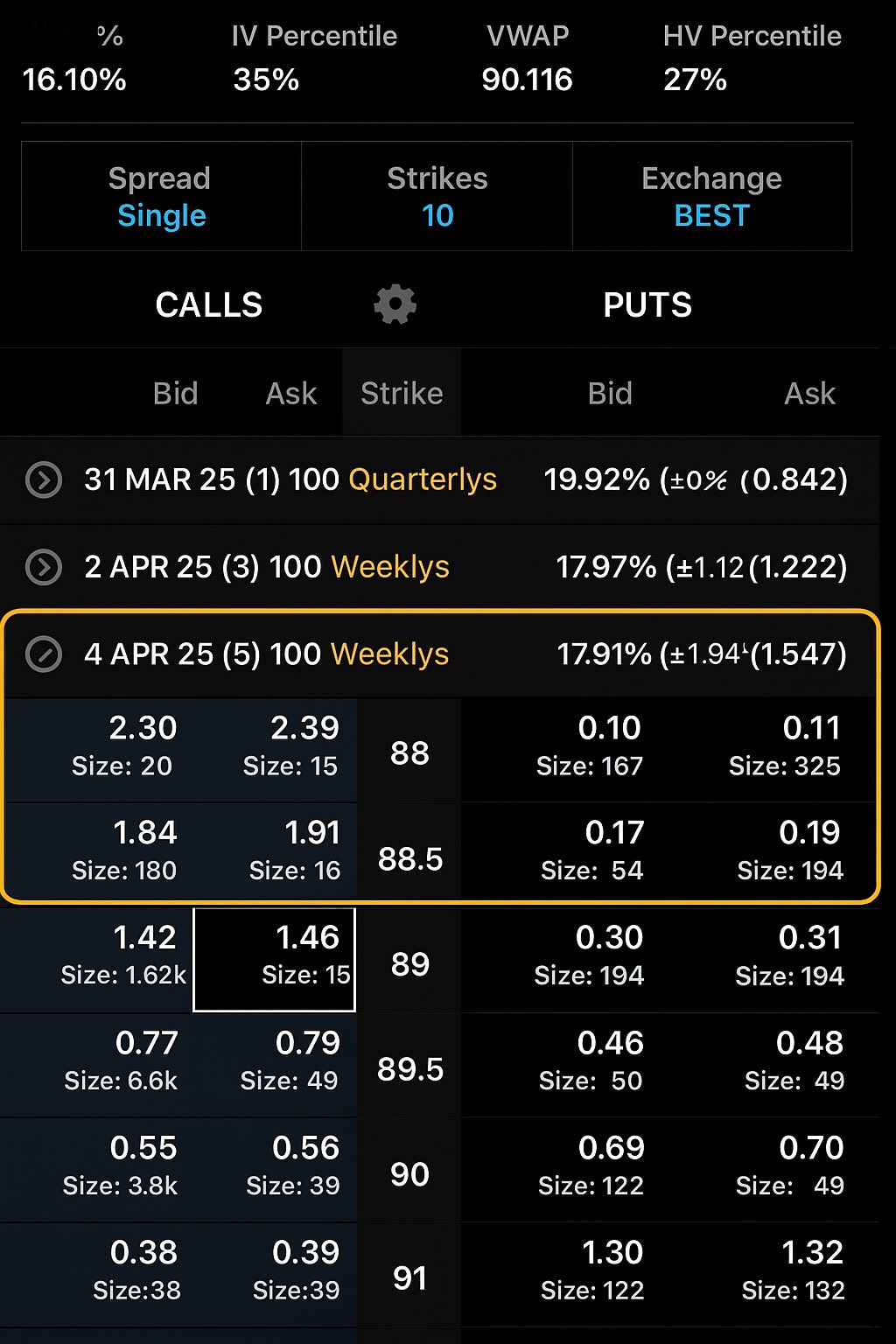

$3.3 million flowed into TLT April 4th $89 Calls—executed just 42 seconds before the Friday close. That wasn’t a casual bet. That wasn’t “smart money” making a quiet macro play.

That was fear—urgent, leveraged, and desperate.

You see, I cut my teeth on the CEC floor in New York during the 80s, back when real volume made real noise. When something cracked, you didn’t need a news feed—...

101843152 : basically you are saying, if not up, then will go down

Buy n Die Together❤ :

Dan’l : Excellent technical analysis of where we’re at and where we’re likely to go, nd my bet? Down.

That said? Markets eventually recover… those that don’t panic will be buying at bargain prices.

The Nut Buy n Die Together❤ : Love your username