No Data

US OptionsDetailed Quotes

TLT241127C81000

- 9.45

- 0.000.00%

15min DelayClose Nov 27 16:00 ET

0.00High0.00Low

9.45Open9.45Pre Close0 Volume1 Open Interest81.00Strike Price0.00Turnover2245.32%IV-2.75%PremiumNov 27, 2024Expiry Date12.01Intrinsic Value100Multiplier0DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type0.9966Delta0.0022Gamma7.70Leverage Ratio-11.0596Theta0.0000Rho7.68Eff Leverage0.0000Vega

Intraday

- 5D

- Daily

News

Betsey Stevenson on Inflation, Trump Proposed Tariffs

Yen Strengthens on Dollar as US Bond Yields Fall: Markets Wrap

Wednesday Ends With Index Decline | Wall Street Today

Wall Street Sees 'No Alternative' to U.S. Stocks in 2025. Here's Why

Dow Hits Another Record, Core PCE 2.8% as Expected | Live Stock

Trump's Tariff Threat To Canada May Disrupt Oil Markets, Inflate Prices: 'Would Likely Raise The Price Of Fuels,' Says Analyst

Comments

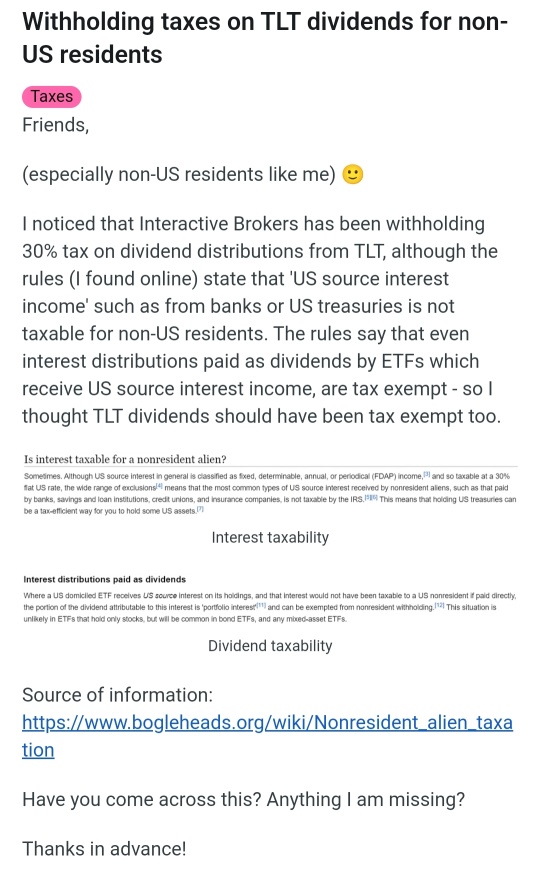

$iShares 20+ Year Treasury Bond ETF (TLT.US)$

Hi. Anyone knows how to claim back TLT 30% Witholding Tax from MooMoo for Malaysian (Non US residents) as it's Tax Exempted.

thanks in advance

Hi. Anyone knows how to claim back TLT 30% Witholding Tax from MooMoo for Malaysian (Non US residents) as it's Tax Exempted.

thanks in advance

2

2

$SPDR S&P 500 ETF (SPY.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ Any ForEx or TLT traders might wanna pay attention to this falling wedge on DXY, which is targeting ~108. Above IC support on both the 4-hour and daily and the apex of the pattern is targeting the top of daily support. Looks like confluence to me. This could absolutely hurt SPY/QQQ as well, at a time when SPY is about to kiss the Res that has never been broken in years, around 603.

1

$Bitcoin (BTC.CC)$ $SPDR S&P 500 ETF (SPY.US)$

The parabolic Res on BTC is holding, Sup on DXY broke, Res on TLT got busted through, SPY rejected off of main Res, and NVDA broke Sup.

I don't want a 🍪, I would just like subs so more people can benefit. 😸

The parabolic Res on BTC is holding, Sup on DXY broke, Res on TLT got busted through, SPY rejected off of main Res, and NVDA broke Sup.

I don't want a 🍪, I would just like subs so more people can benefit. 😸

From YouTube

11

Expand

Expand 30

3

Read more

102785019 : +1

For Non US residents right?

I would like to know How too

Moomoo Buddy : Dear Customer,

Pursuant to U.S. tax regulations, a non-U.S. person is subject to a withholding tax on all U.S. source income, which is payable to Internal Revenue Service (IRS). Most types of U.S. source income received by a non-U.S. person are subject to U.S. tax of 30%. A reduced rate, including exemption, may apply if there is applicable tax treaty between the non-U.S. person's country of residence and the U.S.

As Malaysia does not have a tax treaty with the U.S., the withholding tax is generally applied to Malaysians at a prevailing rate of 30% on the U.S. source income, including interest and dividends.

As Moomoo MY does not provide any tax advice, please consult professional tax adviser should you have questions in relation to the withholding tax.

For more information , please refer to the IRS website: Tax withholding types | Internal Revenue Service