No Data

TME Tencent Music

- 11.770

- -0.010-0.08%

- 11.790

- +0.020+0.17%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Zhao Silver International: Remains Bullish on Internet Plus-Related platform economy, prefers MEITUAN-W and others.

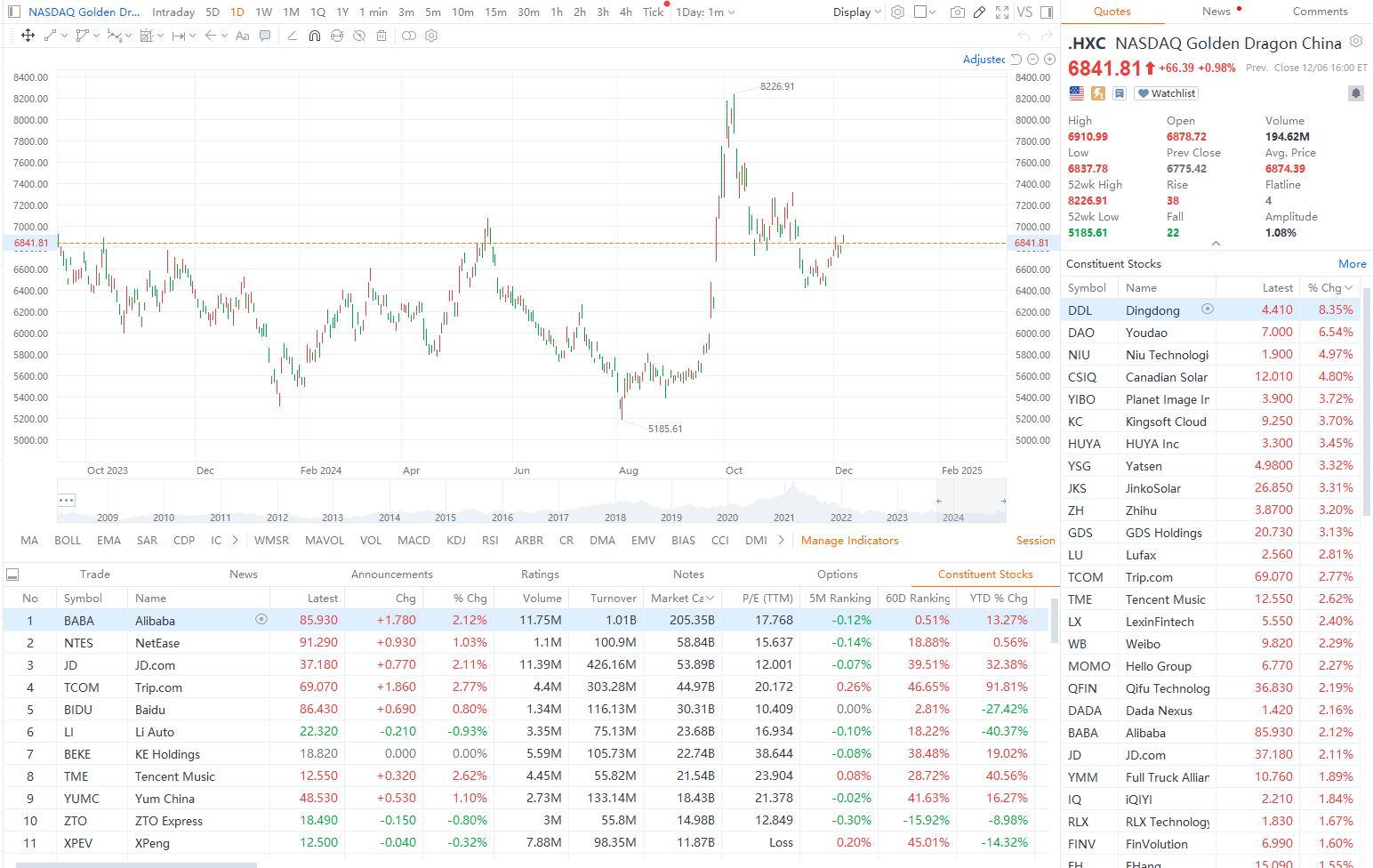

CMB International released a research report stating that the preference for sub-sectors of the Internet Industry is local life services → advertising → games = value-added services → e-commerce → cloud → live streaming. The top picks are MEITUAN-W (03690), TENCENT (00700), Tencent Music (TME.US), and Alibaba (BABA.US). The report indicates that leading platform Internet companies continue to maintain business resilience, benefiting from ongoing cost-cutting and efficiency improvements, healthy profit growth, and stable shareholder returns. The current industry valuation is at a low point, highly defensive, and potential profit upward factors next year come from macro policy stimulation, overseas expansion opportunities, and progress in AI business.

Trending Industry Today: Coinbase Leads Losses In Non-Fungible Tokens Stocks

Pu Yin International: Online music has become an important growth driver in the music market, with the platform's bargaining power gradually increasing.

The increase in penetration rates, subscription fee hikes, and expansion of content beyond music will drive the long-term growth of music streaming platforms in the future.

Before the Federal Reserve's decision, the rally of U.S. stocks faltered, the Nasdaq said goodbye to record highs, the Dow fell for nine consecutive days, Broadcom dropped over 4%, Chinese concept stocks rebounded against the trend, and Bitcoin reached a

The Dow Jones has seen its first nine consecutive declines since 1978; NVIDIA has seen four consecutive declines, while Tesla has risen over 3% against the trend, hitting new highs for three consecutive days. Chinese concept stocks rebounded nearly 2%, with PDD Holdings rising nearly 3% and Bilibili increasing over 4%. Salaries in the United Kingdom have grown faster than expected, with two-year UK bond yields rising 10 basis points in one day. The USD has rebounded; the Canadian dollar has hit a more than four-year low since the pandemic; Bitcoin surged over $0.108 million during trading, hitting a new historical high for two consecutive days. Crude Oil Product has fallen for two consecutive days, with US oil dropping more than 2% at one point; Gold has hit a new low for the week.

Shares of US-listed Chinese Stocks Are Trading Lower Due to Stimulus Concerns and Disappointing Economic Data. The Biden Administration Plans to Raise Tariffs on Solar Wafers, Polysilicon and Some Tungsten Products.

Express News | Shares of US-listed Chinese Stocks Are Trading Lower Due to Stimulus Concerns and Disappointing Economic Data. The Biden Administration Plans to Raise Tariffs on Solar Wafers, Polysilicon and Some Tungsten Products

Comments

What does the Central Economic Work Conference discuss?

The conference typically comprises two main components: evaluating the...

You could have made a lot of money with put options. 😂

$TENCENT (00700.HK)$ $Tencent (TCEHY.US)$ $BABA-W (09988.HK)$ $Alibaba (BABA.US)$ $JD.com (JD.US)$ $JD-SW (09618.HK)$ $BILIBILI-W (09626.HK)$ $Bilibili (BILI.US)$ $NTES-S (09999.HK)$ $NetEase (NTES.US)$ $Li Auto (LI.US)$ $LI AUTO-W (02015.HK)$ $Tencent Music (TME.US)$ $TME-SW (01698.HK)$ $UP Fintech (TIGR.US)$

Business Data

No Data