No Data

TMV241220C37000

- 0.07

- 0.000.00%

- 5D

- Daily

News

Tonight! The last piece of potentially market-exploding data from the USA in 2024 is here.

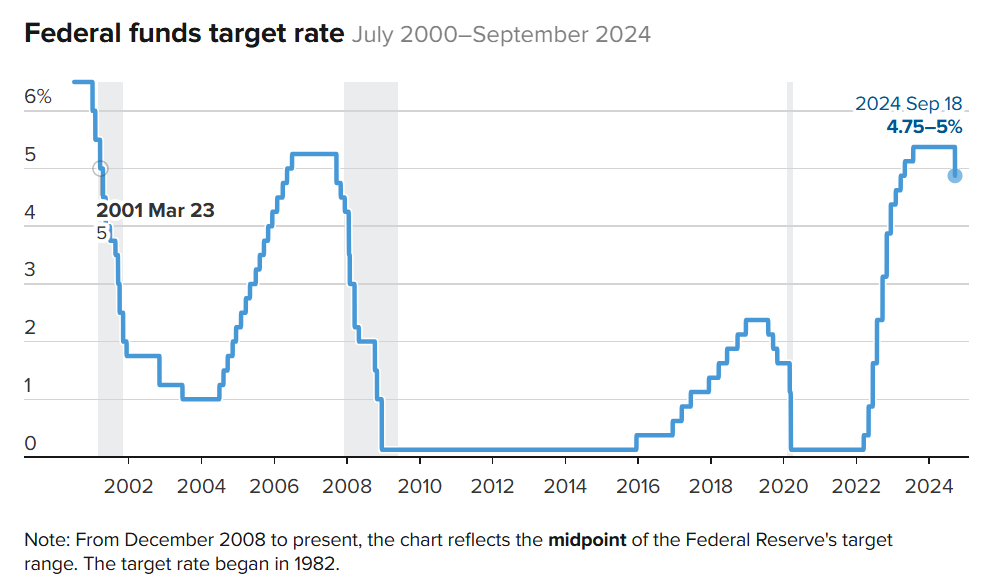

① The USA's November CPI data, which will be released tonight at 21:30 Beijing time, can be metaphorically described as "the last heavyweight economic Indicator of the USA for 2024", which does not seem exaggerated. ② With the Federal Reserve's December monetary policy meeting scheduled for next week, tonight's CPI is expected to serve as an important basis for the Fed's critical decision on whether or not to cut interest rates...

Imminent! A giant has once again issued a warning to the governments of Europe and the United States regarding debt, this time it is the central bank of central banks!

This week, major players intensively warned about the debt issues in Europe and the United States. Following bond giant Pimco and Bridgewater's Dalio, the Bank for International Settlements (BIS), known as the central bank of central banks, recently stated that government borrowing habits pose the greatest danger to Global economic stability. The surge in government debt supply could exacerbate instability in financial markets, and the recent changes in market sentiment should be viewed as warning signals.

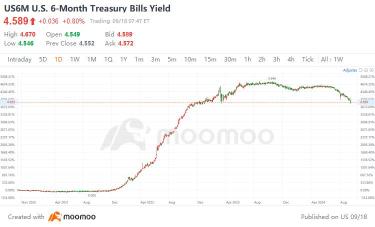

Treasury Yields Rise Ahead of November's Consumer Price Index -- Market Talk

When the U.S. stock market is infatuated with Trump, U.S. bonds have fallen in love with Besant...

① The usa national debt market, which has reached a scale of 28 trillion dollars, seems to be becoming increasingly "politicized"; ② If the continuous record highs of the us stock market after the usa elections indicate that the bull market is "fond of" Trump, then the current bond market seems to have "fallen in love with" Bessent.

The usa stock, bond, and foreign exchange markets are all under pressure: no one dares to act rashly before the non-farm payrolls battle!

Before the key non-farm employment data from the usa is released this Friday, both the rise of US stocks and the dollar showed signs of stalling on Thursday, while the US bond market was also caught in a weak consolidation pattern; for a moment, it seemed that no one on Wall Street dared to take any rash actions.

Global Stocks Rise to Record on Powell, Bonds Gain

Comments

Before these events, we have an important economic announcement this Friday: the U.S. October Non-Farm Payroll (NFP) report.

1. Why is this Non-Farm Payroll report important?

2. What indicators should investors pay attention to?

3. How should t...

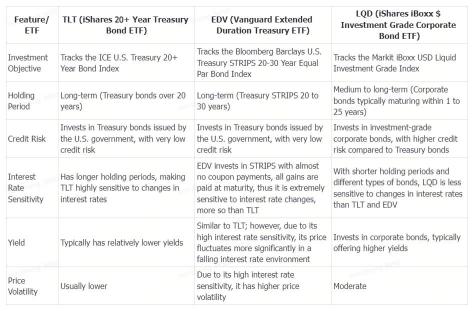

So, what trading strategies can be considered for different rate cut scenarios?

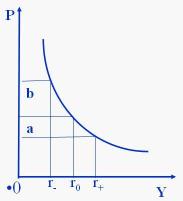

1. Basic Logic: Interest Rates as the "Gravitational Pull" of Asset Prices

Interes...

104437220 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Yowe : lol

大马周瑜 : ok

enfath2022 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103916021 : k

View more comments...