No Data

TOELY Tokyo Electron (ADR)

- 75.680

- +1.430+1.93%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

ADR Japanese stock ranking ~ Japan Post and others generally showing a slight buy advantage, Chicago is 175 yen higher than Osaka at 38,885 yen ~

Japanese stocks for ADR (American Depositary Receipt), compared to the Tokyo Stock Exchange (calculated at 156.15 yen per dollar), include Japan Post Holdings <6178>, Tokyo Electron <8035>, Toyota Industries <6201>, Honda Motor Co. <7267>, Mitsui & Co. <8031>, Disco <6146>, SoftBank Group <9984>, etc. The stocks that rose include Japan Post Bank <7182>, Seven & I Holdings <3382>, Mitsubishi Corporation <8058>, Nidec <6594>, Kddi Corporation <9433>, JAPAN TOBACCO INC <29.

The NY market rose on the 20th [NY market - close].

[NYDow·NASDAQ·CME (Table)] NYDOW; 42840.26; +498.02 NASDAQ; 19572.60; +199.83 CME225; 38885; +175 (Compared to the Osaka Exchange) [NY Market Data] The NY market on the 20th rose. The Dow average increased by 498.02 points to 42,840.26 dollars, and the Nasdaq closed 199.83 points higher at 19,572.60. Although some technology stocks faced selling pressure first and dropped at the opening,

Developments while keeping an eye on the exchange rate.

The Nikkei average has fallen for six consecutive trading days. It ended the day at 38,701.90 yen, down 111.68 yen (estimated Volume of 2.7 billion 10 million shares). Following the yen's depreciation after Bank of Japan Governor Kazuo Ueda's press conference, there was buying in export-related stocks, such as Automobiles, and the Nikkei average began to rebound. Towards the end of the morning session, it rose to 39,039.68 yen. However, after Finance Minister Katsunobu Kato expressed concerns over the fluctuations in the foreign exchange market, including speculative movements, it was a trigger for short-term Futures.

The immediate stance is to Buy on dips [closing].

The Nikkei Average declined for five consecutive trading days, ending at 38,813.58 yen, down 268.13 yen (estimated Volume of approximately 2.2 billion shares). Following the perception that the results of the USA Federal Open Market Committee (FOMC) were hawkish, the major stock indices in the USA fell the previous day, leading to risk-averse selling. The Nikkei Average dipped to 38,355.52 yen shortly after the market opened. However, as the yen weakened to the mid-154 yen range against the dollar, it provided support for the market, while the Bank of Japan continued its financial measures.

The Nikkei average dropped by 207 points, with interest in U.S. economic Indicators.

The Nikkei average is down 207 yen (as of 14:50). In terms of contributions to the Nikkei average, SoftBank Group <9984>, Advantest <6857>, and Tokyo Electron <8035> are among the top negative contributors, while Fast Retailing <9983>, Terumo <4543>, and Canon Inc-Spons Adr <7751> are among the top positive contributors. In the sectors, Electricity and Gas, Real Estate, Nonferrous Metals, Oil & Coal Products, and Services are at the top of the decline rates, while Marine Transportation, Banking, Insurance, and Warehousing...

The Nikkei average is down 267 yen, while Dow Inc Futures are strong, providing a sense of security.

The Nikkei225 is down by 267 points (as of 1:50 PM). In terms of contribution to the Nikkei225, SoftBank Group <9984>, Advantest <6857>, and Tokyo Electron <8035> are among the top negative contributors, while Fast Retailing <9983>, NINTENDO CO LTD <7974>, and Canon Inc-Spons Adr <7751> are among the top positive contributors. In terms of Sectors, Electricity and Gas, Real Estate, Services, Nonferrous Metals, and Chemicals have experienced the highest rate of decline, while Banking, Marine Transportation, Warehousing and Transportation-related, and Insurance have also seen declines.

Comments

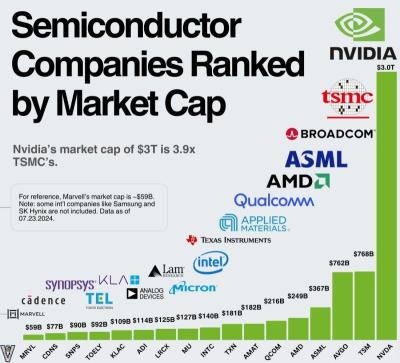

2) Nvidia performance over the last two years has to be one of the best tech stories ever. Incredible how they built their accelerated computing ecosystem for over a decade before the current infrastructure boom

$NVIDIA (NVDA.US)$ $Broadcom (AVGO.US)$ $Advanced Micro Devices (AMD.US)$ $ASML Holding (ASML.US)$ $Qualcomm (QCOM.US)$ $Applied Materials (AMAT.US)$ $Texas Instruments (TXN.US)$ $Intel (INTC.US)$ $Micron Technology (MU.US)$ $Lam Research (LRCX.US)$ $Analog Devices (ADI.US)$ $KLA Corp (KLAC.US)$ $Tokyo Electron (ADR) (TOELY.US)$ $Synopsys (SNPS.US)$ $Cadence Design Systems (CDNS.US)$ $Marvell Technology (MRVL.US)$

China has always been a major exporter of gallium and germanium. For your information , 90% of the world's gallium and 68% of th...

No Data

Space Dust : Nvidia is a great tech story, climax just happened. how far down or hope for sideways..?