No Data

TOELY Tokyo Electron (ADR)

- 72.090

- +0.990+1.39%

- 72.090

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

ADR Japanese stock ranking - toyota motor and others generally favored for buying, Chicago is 255 yen higher than Osaka at 38,595 yen.

ADR (American Depositary Receipt) Japanese stocks, when converted to Tokyo Stock Exchange comparison (1 dollar = 154.85 yen), Orlando <4661>, Toyota Motor <7203>, DISCO <6146>, Itochu Corporation <8001>, SoftBank Group <9984>, Honda Motor Co., Ltd. <7267>, Orix <8591>, etc., are rising, with a general buying preference. Chicago Nikkei 225 futures settlement price is 255 yen higher at 38,595 yen compared to Osaka daytime price. The US stock market continues to rise. The Dow Jones Industrial Average is up 426.16 dollars at 44.

Stocks that moved the previous day part1: Nitto Boseki, Seres, ID&EHD, etc.

Stock name <Code> Closing price on the 22nd ⇒ Change from previous day Tokyo Electron <8035> 22250 +470 On the 21st, nvidia remained stable in the U.S. market, providing reassurance for semiconductor-related stocks. Nishimatsuya <7545> 2262 +136 Same-store sales for November increased by 0.5%, reversing the decrease of 4.1% in October. Broadleaf <3673> 699 +19 Domestic securities have raised their target stock price. Tokyo Metro <9023> 1737 +37 Reports of an interview with the president were also well-received.

Nikkei Stock Average Contribution Ranking (Closing) - Nikkei Average rebounds for the first time in 3 days, with First Retailing and Toshiba Elevator pushing up about 95 yen in two stocks.

At the closing on the 22nd, the Nikkei Average component stocks had 148 stocks up, 74 down, and 3 unchanged. The US stock market rose on the 21st. The Dow Jones Industrial Average closed at 43,870.35, up 461.88 points, while the Nasdaq finished at 18,972.42, up 6.28 points. Geopolitical risks eased and the market rose after the opening. Chicago Fed President Goolsbee indicated that next year's interest rates are likely to be 'below current levels,' prompting buying interest in lower interest rates.

Expanding while keeping an eye on the movements of the USA market.

The Nikkei index rebounded for the first time in three days, closing at 38,283.85 yen, up 257.68 yen (with an estimated volume of 1.6 billion 80 million shares). Following the rebound of nvidia in the previous day's usa market, more stocks rose in the Tokyo market, particularly in the semiconductors sector. Additionally, buying aimed at a self-rebound in response to the previous day's declines contributed to the rise, and the Nikkei index increased to 38,420.63 yen towards the end of the morning session. However, there are movements to adjust positions ahead of the weekend, and investors want to assess the situation in Russia and Ukraine.

Ortoplas, Shimamura Che, Obayashi Construction, etc.

<7545> Shimamura Co., Ltd. surged by 136 points. The company announced its monthly trends for November the previous day. The same-store sales increased by 0.5% compared to the same month last year, turning positive for the first time in 2 months. While the number of customers decreased by 1.7%, the average customer spending increased by 2.2%. With the decrease in temperature, sales of autumn and winter clothing increased. Given that the previous month saw a significant 4.1% decline, this recovery seems to alleviate concerns. In the total for the September-November period, the same-store sales

JP Movers | Credit Saison Rose 6.24%, Leading Nikkei 225 Components, Disco Topped Turnover List

Market sentiment was stable today as Nikkei 225 components continued to trade sideways, with Credit Saison(8253.JP) being the top gainer today, rising 6.24% to close at 3680.0 yen. In addition, the top loser was Taiyo Yuden(6976.JP),falling 2.74% to end at 2149.0 yen.

Comments

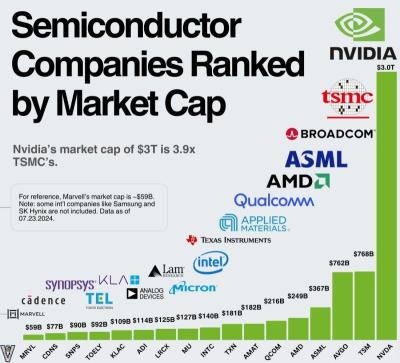

2) Nvidia performance over the last two years has to be one of the best tech stories ever. Incredible how they built their accelerated computing ecosystem for over a decade before the current infrastructure boom

$NVIDIA (NVDA.US)$ $Broadcom (AVGO.US)$ $Advanced Micro Devices (AMD.US)$ $ASML Holding (ASML.US)$ $Qualcomm (QCOM.US)$ $Applied Materials (AMAT.US)$ $Texas Instruments (TXN.US)$ $Intel (INTC.US)$ $Micron Technology (MU.US)$ $Lam Research (LRCX.US)$ $Analog Devices (ADI.US)$ $KLA Corp (KLAC.US)$ $Tokyo Electron (ADR) (TOELY.US)$ $Synopsys (SNPS.US)$ $Cadence Design Systems (CDNS.US)$ $Marvell Technology (MRVL.US)$

China has always been a major exporter of gallium and germanium. For your information , 90% of the world's gallium and 68% of th...

Analysis

Price Target

No Data

No Data

Space Dust : Nvidia is a great tech story, climax just happened. how far down or hope for sideways..?