No Data

TRPMAIN TRP Futures(NOV4)

- 499.38

- -0.49-0.10%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

【Brokerage Focus】Soochow maintains a "buy" rating on Ctrip Group (09961) and is bullish on the company's overseas business growth.

Jingu Financial News | Soochow released research reports stating that Ctrip Group (09961) achieved net income of 15.9 billion yuan in Q3 24, a year-on-year growth of 16%; adjusted EBITDA was 5.7 billion yuan, adjusted EBITDA profit margin was 36%, a year-on-year increase of 2 percentage points; adjusted net income attributable to the parent company was 6 billion yuan, a year-on-year growth of 22%, both revenue and profit exceeded Bloomberg's expectations. The bank stated that domestic hotel ADR is beginning to stabilize, and outbound travel growth continues to lead the csi leading industry index. 1) Q3 domestic hotel ADR has begun to stabilize, with the year-on-year decline narrowing from double digits to low to mid single digits, mainly due to hotel

Guozheng International: Maintaining the "buy" rating for Ctrip Group-S (09961), with the target price raised to 571 HKD.

Guotai Junan International expects Ctrip Group's revenue to increase by 16% year-on-year in 2025.

[Brokerage Focus] Guosen Securities maintains a "outperform the market" rating on Ctrip Group (09961), pointing out that outbound travel and hotel bookings are still important growth drivers.

Jingwu Caixun | Guosen Securities issued a research report stating that Ctrip Group (09961) achieved a third-quarter revenue of 15.87 billion yuan, +15.5% year-on-year, exceeding market expectations (+13.9% year-on-year); Non-GAAP attributable net income was 5.96 billion yuan, +21.8% year-on-year, with adjusted EBITDA of 5.68 billion yuan, +22.9% year-on-year, better than market expectations (-2.5%, +14.4% respectively). The growth rate of revenue in the peak tourism season continued to improve on a high base figure, highlighting the advantages of the leading platform; Q3 adjusted EBITDA margin increased by 2.1 percentage points year-on-year, surpassing market expectations, mainly due to

Open Source Securities: The expansion of domestic demand policy optimization boosts confidence, and the OTA platform is still expected to accelerate on a quarter-on-quarter basis in Q4.

With the new expansion cycle of the underlying supply, destination service system, transportation infrastructure, online booking/traffic channels and other upstream and downstream links are building a new supply system to meet the diverse tourism consumption demands of the general public.

Hong Kong stock concept tracking | China's tourism industry has significantly recovered. OTA platforms continue to see high performance growth (concept stock attached)

On November 12, the State Council issued a decision to amend the "National Holidays and Memorial Days Holiday Regulations", including extending the Spring Festival and May Day holidays by one day each, adjusting and modifying the general work duration to not exceed 6 days before and after statutory holidays.

【Special guest commentator】Guo Jiayao: Investors are waiting to see changes in the external situation, and high bond yields also affect market confidence.

Jinwu Financial News | In the three trading days of the usa stock market, developments varied, as the market awaited geopolitical news and performance of technology stocks. Overall market performance was fluctuating, with the three major indices closing mixed. The dollar showed strong trends, with the usa ten-year bond yield rising to 4.41%, gold prices continued to rise, while oil prices remained under pressure. Hong Kong stock pre-trading securities generally softened, expected the market to open lower in the early session. The mainland stock market rose yesterday, with the Shanghai Composite index opening low and rising, closing up 0.7%, and trading volume in the Shanghai and Shenzhen markets remained active. Hong Kong stocks continued to experience slight ups and downs, with the market opening low and rising, closing with moderate gains, and overall trading remained light. Investors are waiting to see external situations.

Comments

Key drivers include AI-generated content (AIGC) and advancements in advertising t...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We turn bullish as price pushed above 5810 resistance level. As long as price holds above its resistance-turned-support level at 5810, we expect price to continue pushing towards 5860 resistance level. Technical indicators are leaning towards a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5810 sup...

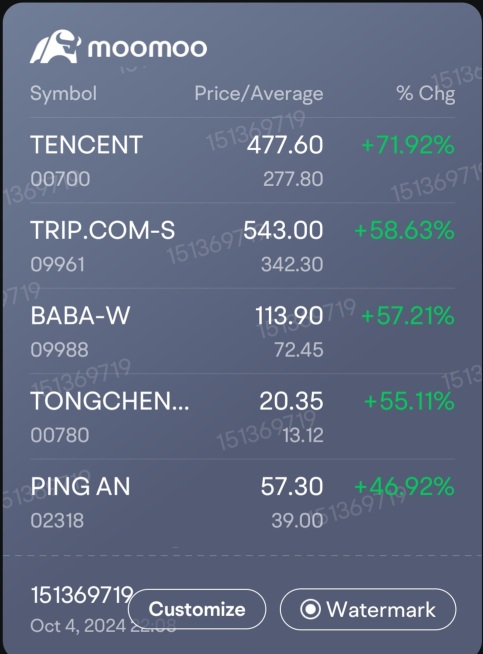

It's time for selection of the laggers that are not so popular or fashionable. Stocks that offer growth, dividend yields, and intrinsic value, and are still undervalued in the lower interest rate environment with more cuts to come.

The Chinese authorities will announce more measures to recover the property sector. Such stocks are still very undervalued.

Tec...

Securities & Brokerage: $HTSC (06886.HK)$ $CMSC (06099.HK)$

Gaming Software: $NTES-S (09999.HK)$ $XD INC (02400.HK)$ $NETDRAGON (00777.HK)$

Digital Solutions: $TENCENT (00700.HK)$ $TRAVELSKY TECH (00696.HK)$ $CHINASOFT INT'L (00354.HK)$

Online Retailer: $BABA-W (09988.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$

Insurer: $PING AN (02318.HK)$ $AIA (01299.HK)$ $CHINA LIFE (02628.HK)$

Telecommunication: $CHINA MOBILE (00941.HK)$ $CHINA TELECOM (00728.HK)$

���������...

102420347 OP : Maybe the officials should stop hosting conferences , better for china stock market

villan : hi simply cannot decide I want see my poin of u that cici can believe this company take came many virus effect people that y I think do otherwise I want see