No Data

US OptionsDetailed Quotes

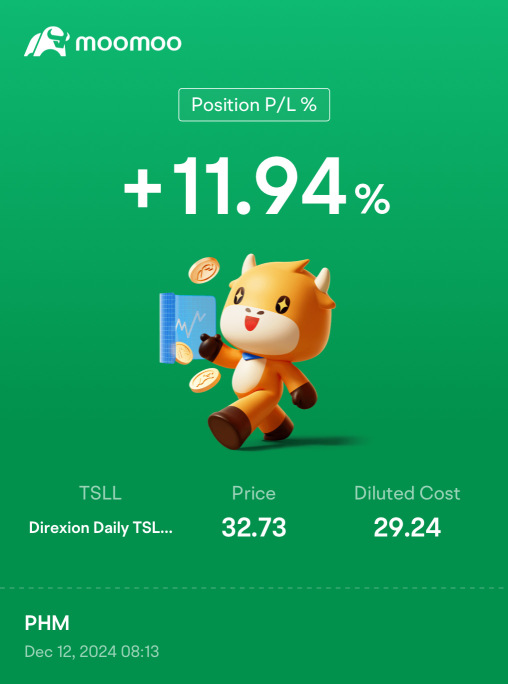

TSLL241213P12000

- 0.01

- 0.000.00%

15min DelayClose Dec 11 16:00 ET

0.00High0.00Low

0.00Open0.01Pre Close0 Volume95 Open Interest12.00Strike Price0.00Turnover698.74%IV60.84%PremiumDec 13, 2024Expiry Date0.00Intrinsic Value100Multiplier1DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type-0.0027Delta0.0008Gamma3062.00Leverage Ratio-0.0410Theta0.0000Rho-8.34Eff Leverage0.0001Vega

Intraday

- 5D

- Daily

News

Trump Team Said to Want to Ease US Rules for Self-Driving Cars

Big Bet On Buffett: Leveraged ETF Coming To Give Investors Extra Exposure To Legendary Investor

Tesla Records Its Best Day in 11 Years: 5 ETF Winners

Tesla's Pre-Market Decline Fuels Gains For These ETFs: TSLQ, TSLZ Rebound After Big Drops

Tesla Is Heading Into a 'Bullish Month'. Is an Annual High in Sight?

Tesla, QuantumScape, Lam Research See Heavy Options Trading After Earnings Beat

Comments

$Direxion Daily TSLA Bull 2X Shares (TSLL.US)$ Live At NYSE, President-Elect Donald Trump Says "Elon Musk Has Alot Of Ideas, Is A Great Guy And Stocks Has Done Really Well", "We're Not Going To Be Abused Anymore, Going To Put America First"

2

1

$Direxion Daily TSLA Bull 2X Shares (TSLL.US)$ Elon Musk First Person Worth $400 Billion As Tesla Stock Hits New All-Time Highs: How 2024 Election Helped, Could Lead To Future Gains

1

$Direxion Daily TSLA Bull 2X Shares (TSLL.US)$ why my tsll options calls delisted ?? what does it mean?

2

7

Read more

, everyone, keep it up.

, everyone, keep it up.

10baggerbamm : I took advantage of the dip also I went in I sold a boatload of puts I collected a premium for 2 days that's quite a bit and then simultaneously bought quite a bit on the morning Low's so far keep my fingers crossed that it goes up from here.. I backed the truck up..

TAKAGISG OP 10baggerbamm : I hold a small amount of put options, waiting for it to go down![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) recent increase is too exaggerated

recent increase is too exaggerated

10baggerbamm TAKAGISG OP : I sell puts on it all the time I don't buy them I sell the puts to collect the premiums. I think literally since the election if I were to add up the total amount of premium that I've collected turn it into dollars it's probably about six and a half to $7 on the stock price. finally really going to show up tsll has weekly options and it's awesome especially when you have a stock trending higher I've got tsll long in size and on any down day I'm out selling puts about a dollar to a $1.50 less than the market if I get put it I don't care because the trend is higher and if they expire worthless it's free money

TAKAGISG OP 10baggerbamm : great strategy![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) , I haven't tried selling puts yet.maybe I need to learn more to run this strategy

, I haven't tried selling puts yet.maybe I need to learn more to run this strategy

10baggerbamm TAKAGISG OP : when you buy calls and you buy puts statistically 90% of the time you lose money because the stock may move but it doesn't move in time so the value of that call or put declines and you lose money.

when you sell puts number one you only want to do it on a company that you want to own so rather than placing a limit order below the market to buy stock in a day or good till cancel order and if it falls there you get triggered you find a put option that is close to that price that you want to own the stock and you sell that strike price money in your account you just got paid.

if the stock does not fall by expiration date you keep that money if the stock falls to the strike price or less you get put the stock so now you own it which you wanted to do anyways. it's a great way to increase Total return on a portfolio but it's important you understand again you don't want to do it on a shit company you can only do this and you should only do this on companies that have a positive outlook that you want to own because you don't want to get stuck garbage companies that are in a downward trend you want to take advantage of a dip if you get put the stock it's fine and then the stock trends back higher and you make money on the long position of the common stock that you now own

View more comments...