No Data

TSM241220P185000

- 0.16

- -0.33-67.35%

- 5D

- Daily

News

Why Big Tech Became a Huge Wreck Across the Nasdaq Last Night

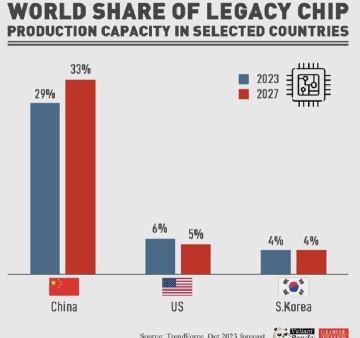

US-China Tensions Escalate Over Chips

Will there be only one interest rate cut next year? The Federal Reserve suddenly releases hawkish signals, causing Wall Street to collectively fall into panic.

The Federal Reserve lowered interest rates by 25 basis points as expected on Wednesday, but this did not stop investors from mass selling off risk Assets.

Express News | Shares of Semiconductor Companies Are Trading Lower Amid Overall Market Weakness Following the Fed's Rate Decision to Cut Rates by 25 Basis Points

Who's Next To Join Tesla, Broadcom In $1 Trillion Club? Over 50% Say The World's Biggest Retailer

Before the Federal Reserve's decision, the rally of U.S. stocks faltered, the Nasdaq said goodbye to record highs, the Dow fell for nine consecutive days, Broadcom dropped over 4%, Chinese concept stocks rebounded against the trend, and Bitcoin reached a

The Dow Jones has seen its first nine consecutive declines since 1978; NVIDIA has seen four consecutive declines, while Tesla has risen over 3% against the trend, hitting new highs for three consecutive days. Chinese concept stocks rebounded nearly 2%, with PDD Holdings rising nearly 3% and Bilibili increasing over 4%. Salaries in the United Kingdom have grown faster than expected, with two-year UK bond yields rising 10 basis points in one day. The USD has rebounded; the Canadian dollar has hit a more than four-year low since the pandemic; Bitcoin surged over $0.108 million during trading, hitting a new historical high for two consecutive days. Crude Oil Product has fallen for two consecutive days, with US oil dropping more than 2% at one point; Gold has hit a new low for the week.

Comments

The US has very little capacity to produce legacy chips at a realistic price. It is a mass-market product that is quickly being dominated by China, which supplies the global electronics industry. The US can't undo this without causing a great deal of harm to itself and its consumers.

Nobody in their right mind will invest tens of billions in legacy chip manufacturing in new loca...

123456FEDCBA : Who?