No Data

UBS UBS Group

- 31.630

- -0.050-0.16%

- 31.630

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Morgan Stanley: The upward trend of investment banks in the usa after the election is expected to continue.

J.P. Morgan believes that this momentum will continue in the short term, supported by a favorable stock market and crediting trade environment so far in the fourth quarter.

J.P. Morgan Sees Investment Banks' Post-election Momentum Continuing

This Little-Known AI and Games Company Is Worth $100 Billion. How Did We Miss It?

ubs group: assigns bosideng a "buy" rating with a target price of 5.92 Hong Kong dollars.

UBS Group released a research report stating a "buy" rating on Bosideng (03998), believing that the valuation is attractive, and expecting a 13% average annual growth rate in net income for the fiscal years 2025 to 2026, with a dividend yield of 7%. Although its growth potential is higher, the current trading price is still below the industry median, with a target price of 5.92 Hong Kong dollars. The bank expresses optimism towards Bosideng's diversified business strategy, involving outdoor and sun protection products, aimed at capturing sales growth in the summer and autumn over the long term. The bank expects this strategy to enhance the company's profit stability, reduce its dependence on winter, and potentially boost.

UBS Group: assigns a "buy" rating to Cathay Pac Air with a target price of 10.8 HKD.

Ubs Group released a research report stating a 'buy' rating for Cathay Pac Air (00293), still considering Cathay Pac Air as one of the preferred stocks in the Asia-Pacific aviation sector, with a target price of 10.8 Hong Kong dollars. Following Cathay Pacific Aviation's recent repurchase of warrants, it is now being recommended to repurchase the 6.7 billion yuan convertible bonds due in 2026 based on factors such as market conditions, investor demand, and dealer management agreements. Assuming a conversion price per share of 7.92 yuan, and full conversion, the dilution of equity may be as high as 12%. The bank expects a positive market reaction to Cathay Pacific's planned repurchase of convertible bonds. From a fundamental perspective, the bank believes that the market is undervaluing the Cathay Pac Air.

Market Chatter: UBS Fills Investment Banking Roles

Comments

Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included:

- Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year.

- Return on tangible equity ...

The company is best known for bringing innovation to what is considered a very pragmatic field by developing innovative portfolio management software k...

Here are 10 companies positioned to benefit from this anticipated rise in investment 🧐

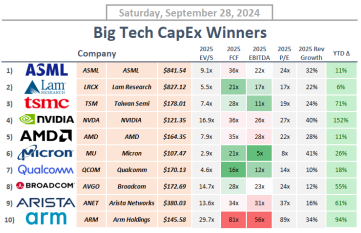

1. $ASML Holding (ASML.US)$ is the exclusive provider of EUV lithography technology, which is critical for fabricating chips below the 7 nm process node. This technology enables the creation of smaller, more energy-efficient chip...

Analysis

Price Target

No Data

No Data