No Data

UBS UBS Group

- 30.320

- -0.280-0.92%

- 30.430

- +0.110+0.36%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

UBS Group: Gives CHINA TOWER a "Neutral" rating with a Target Price of 1.15 Hong Kong dollars.

UBS Group published a research report stating that it gives CHINA TOWER (00788) a "Neutral" rating with a Target Price of 1.15 HKD. The company previously announced that Shareholders approved the proposal for a share consolidation and capital reduction, which is expected to take effect from February 20. The report mentioned that the potential share consolidation and adjustment of the number of shares per lot should create a more favorable Trade environment for institutional investors. After the consolidation, volatility is expected to become less severe, and the amount per lot will be 2.5 times what it was before, which may create a friendlier Trade environment for institutional investors. In addition, the bank also indicated that CHINA TOWER must allocate 10% of its annual net profit to the statutory.

UBS Boss Warns Against Excessive Banking Regulation Ahead of Overhaul

Top 20 transactions in the US stock market on December 30: Boeing aircraft involved in the accident is under special investigation in South Korea.

On Monday, Tesla, which ranked first in trading volume among US stocks, closed down 3.30% with a transaction volume of 26.673 billion USD. Analysts expect Tesla's delivery volume this year may be slightly lower than in 2023. UBS Group released a report on Monday, predicting that Tesla will announce its fourth-quarter delivery volume for 2024 on January 2, with an estimated number of approximately 0.51 million vehicles, representing a year-on-year increase of 5% and a quarter-on-quarter increase of 10%. UBS Group's forecast is slightly below the consensus estimate of 0.512 million vehicles from Visible Alpha, but aligns with investors' expected range of 0.5 million to 0.51 million vehicles. However, UBS Group analysts noted, "Given the AI-driven narrative surrounding this stock, we acknowledge..."

Sector Update: Financial Stocks Lower Premarket Monday

UBS Chief Warns Against Overregulation in Banking Ahead of Swiss Overhaul, Reuters Reports

Investment Banks Look to 2025 AI Push to Remove Junior Drudge Work -- Financial News

Comments

Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included:

- Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year.

- Return on tangible equity ...

The company is best known for bringing innovation to what is considered a very pragmatic field by developing innovative portfolio management software k...

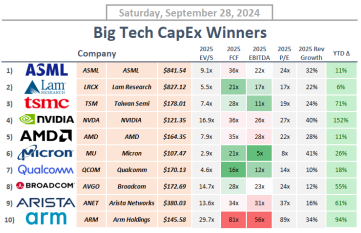

Here are 10 companies positioned to benefit from this anticipated rise in investment 🧐

1. $ASML Holding (ASML.US)$ is the exclusive provider of EUV lithography technology, which is critical for fabricating chips below the 7 nm process node. This technology enables the creation of smaller, more energy-efficient chip...

No Data