No Data

UBS241122C39000

- 0.01

- 0.000.00%

- 5D

- Daily

News

Overnight news: US stocks closed higher, Dow hit a new high, escalation of Russia-Ukraine conflict boosted oil prices, Tesla is preparing for the Cybertruck to enter the China market

For more global financial news, please visit the 7×24 hours real-time financial news market close: The Dow Jones closed over 400 points higher, setting a new historical high. All three major indices recorded gains this week. On November 22, the top 20 transactions in the US stock market: It is reported that Tesla is preparing for the Cybertruck's entry into the china market. On Friday, china concept stocks showed mixed results, with WeRide rising 9.2% and pdd holdings falling 3.9%. The crude oil in the usa rose 6.5% this week, while the escalation of the Russia-Ukraine conflict pushed oil prices higher. Spot gold rose 5.7% in five days, regaining the $2,700 mark. European stocks all closed higher, with Germany's DAX 30 index up 0.84%. Macro.

Overview of csi commodity equity index: Oil prices rise, geopolitical tensions intensify, gold prices increase, copper prices have fallen for eight consecutive weeks.

Crude oil prices rose due to escalating geopolitical tensions from Russia to Iran, while stock market strength increased the attractiveness of risk assets. Gold prices also received a boost in safe-haven demand, aiming to achieve the largest weekly gain since March last year. London copper is expected to set a record for the longest consecutive weekly decline since 2019, as the rising US dollar creates pressure on commodities priced in dollars. Crude oil: WTI rose more than 6% this week, with geopolitical tensions between Iran and Russia intensifying, leading to the increase in crude oil prices due to escalating geopolitical tensions from Russia to Iran, while stock market strength increased the attractiveness of risk assets. WTI rose by over 1%.

ubs group: There is a huge potential risk of a strike at volkswagen.

If Volkswagen autoworkers go on strike next month, some automotive suppliers will face even tougher conditions. UBS Group analysts stated in a research report that for investors in North American automotive suppliers, the risks of a Volkswagen strike are mostly unknown: suppliers with global business operations may face significant potential shutdown risks. They pointed out that companies such as Gentex, Mobileye Global, and Magna receive over 10% of their revenue from Volkswagen. Volkswagen and IG Metall union failed to reach an agreement in the third round of negotiations, and according to previous reports, the union may go on strike starting in December.

Apple's IPhones Sales Aren't Getting an AI Boost. How and When That Could Change.

Swiss Private Bank EFG Aims to Win More Wealthy Clients -- Interview

Boosted by the safe-haven demand, the gold price is moving towards the largest weekly gain in 13 months.

Gold prices are heading toward the largest weekly gain since October of last year, driven by the escalating Russia-Ukraine conflict that has increased gold's appeal as a safe haven. Traders are also assessing the prospect of further easing by the Federal Reserve. At 14:37 Singapore time, gold prices rose by 0.7% to $2,687.71 per ounce. Ukraine previously reported that Russia launched a 'new type' of ballistic missile at the city of Dnipro, serving as a warning signal to Kyiv's Western supporters. Heightened geopolitical tensions often prompt investors to flock to safe haven assets like gold. Traders are also weighing comments from Chicago Federal Reserve President Austan Goolsbee, who expects interest rates.

Comments

Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included:

- Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year.

- Return on tangible equity ...

The company is best known for bringing innovation to what is considered a very pragmatic field by developing innovative portfolio management software k...

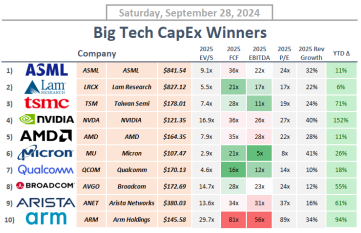

Here are 10 companies positioned to benefit from this anticipated rise in investment 🧐

1. $ASML Holding (ASML.US)$ is the exclusive provider of EUV lithography technology, which is critical for fabricating chips below the 7 nm process node. This technology enables the creation of smaller, more energy-efficient chip...