No Data

UBS241122P41000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

ubs group: Maintains want want china 'buy' rating, target price lowered to 5.8 Hong Kong dollars.

ubs group released a research report stating that it has lowered the target price for want want china (00151) by 10.8%, from 6.5 HKD to 5.8 HKD, maintaining a "buy" rating. ubs group has also reduced its net profit forecasts for want want china for 2025 and 2026 by 8% and 7% respectively, reflecting challenges in sales and profit margins. The bank's latest forecast indicates that for the fiscal year 2025, sales and net profit will remain stable, or that sales in the second half of fiscal year 2025 will increase by 3% year-on-year, while net profit will decrease by 6%. For the first half of fiscal year 2025, want want china's sales decreased by 3.5% year-on-year to 10.8 billion RMB (the same applies here), and net profit increased by 7.6% year-on-year to 1.8 billion RMB, gross profit.

UBS Cuts Advisor Pay. Here's Why. -- Barrons.com

Financial Advisor Team Joins UBS Private Wealth Management in Miami

Market analysis: The euro to dollar exchange rate may fall to parity due to the sluggish economy in the eurozone.

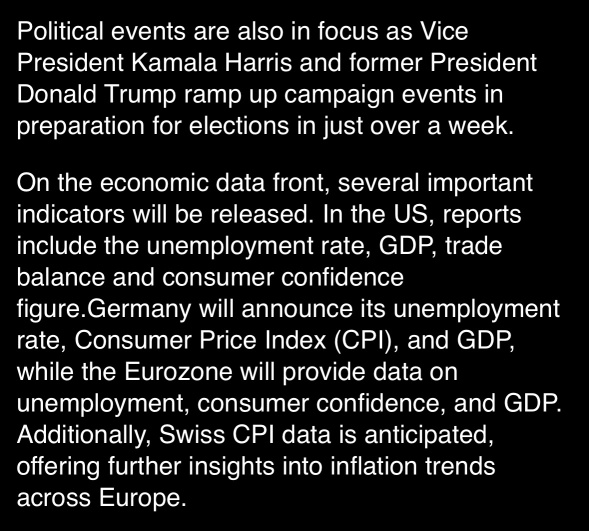

As concerns about the economic outlook of europe continue to worsen, the risk of the euro falling to parity with the usd is rising. Last Friday, the preliminary value of the euro area November Purchasing Managers' Index (PMI) was far below expectations, causing the euro to drop to a two-year low of 1.0336 usd. PMI measures the activity level in the manufacturing and services sectors. Investors are increasingly worried that the trade tariff measures proposed by the newly elected president of the usa, Trump, could have a damaging effect on the export-oriented economy of europe, along with concerns about the escalating tensions between russia and ukraine. The european central bank seems likely to further lower interest rates.

London's Historic Art Scene Is Getting a Tech Upgrade

Overnight news: US stocks closed higher, Dow hit a new high, escalation of Russia-Ukraine conflict boosted oil prices, Tesla is preparing for the Cybertruck to enter the China market

For more global financial news, please visit the 7×24 hours real-time financial news market close: The Dow Jones closed over 400 points higher, setting a new historical high. All three major indices recorded gains this week. On November 22, the top 20 transactions in the US stock market: It is reported that Tesla is preparing for the Cybertruck's entry into the china market. On Friday, china concept stocks showed mixed results, with WeRide rising 9.2% and pdd holdings falling 3.9%. The crude oil in the usa rose 6.5% this week, while the escalation of the Russia-Ukraine conflict pushed oil prices higher. Spot gold rose 5.7% in five days, regaining the $2,700 mark. European stocks all closed higher, with Germany's DAX 30 index up 0.84%. Macro.

Comments

Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included:

- Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year.

- Return on tangible equity ...

The company is best known for bringing innovation to what is considered a very pragmatic field by developing innovative portfolio management software k...

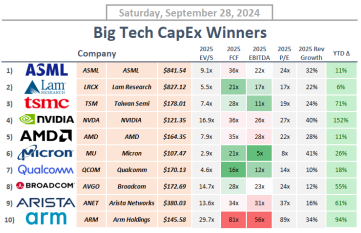

Here are 10 companies positioned to benefit from this anticipated rise in investment 🧐

1. $ASML Holding (ASML.US)$ is the exclusive provider of EUV lithography technology, which is critical for fabricating chips below the 7 nm process node. This technology enables the creation of smaller, more energy-efficient chip...