No Data

UBS241129C21000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

ubs group: Zhuhai residents will travel to Australia weekly next year, which is a mild bullish factor for gaming stocks, with Sands China being the top choice.

UBS Group released a research report stating that the National Immigration Administration announced that Zhuhai household residents can apply for the 'One Week, One Trip' to Macau starting from January 1st next year; while residents of the Hengqin Guangdong-Macao Deep Cooperation Zone can 'One Permit, Multiple Trips' to Macau. The bank believes that the above actions are moderately bullish for Macau's casino stocks, reflecting the central government's support for Macau, but due to the limited coverage, it is unlikely to bring significant growth to gambling revenue. The bank remains bullish on Macau's gambling industry, with Sands China (01928) as its top pick.

UBS group: Upgrades air china limited and china southern airlines' rating to shareholding, cathay pac air target price raised to 12 Hong Kong dollars.

UBS Group released a research report stating that it has raised the target price for Air China Limited (00753) from HKD 5.1 to HKD 5.9, and for China South Air (01055) from HKD 4.2 to HKD 4.6, with both ratings upgraded from "neutral" to "shareholding." The target price for Cathay Pac Air (00293) has been increased from HKD 10 to HKD 12, with a rating of "shareholding." The bank indicated a more optimistic outlook on the aviation industry in mainland China and Hong Kong driven by several favorable factors. Looking ahead, the slowdown in RBOB gasoline costs is an important bullish factor as it alleviates one of the major expenses for airlines, thereby supporting profit.

ubs group: Maintains a "buy" rating for goldwind science& technology, with the target price raised to 9.5 Hong Kong dollars.

UBS Group released a research report stating an optimistic outlook for China's turbine original equipment manufacturers. Their analysis shows that considering various factors, including supply and demand dynamics, returns on wind power projects, and geopolitical risks, the Middle East and Africa as well as the ASEAN region are the most favorable markets for China's turbine manufacturers. The preference for turbine manufacturers is ranked as follows: Goldwind Science & Technology (02208), Ming Yang Smart Energy (601615.SH), and SANY Heavy Energy (688349.SH). The target price for Goldwind Science & Technology is raised from 6 HKD to 9.5 HKD, maintaining a 'buy' rating. The bank explained.

Week's Best: UBS' Bold Move to Lower Advisor Pay -- Barrons.com

CFRA Predicts That Banks Will Outperform the Benchmark S&P 500 in 2025

Switzerland's Federal Court Clears UBS in Credit Suisse Money Laundering Case

Comments

Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included:

- Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year.

- Return on tangible equity ...

The company is best known for bringing innovation to what is considered a very pragmatic field by developing innovative portfolio management software k...

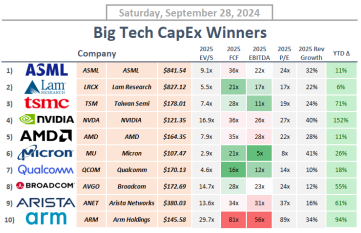

Here are 10 companies positioned to benefit from this anticipated rise in investment 🧐

1. $ASML Holding (ASML.US)$ is the exclusive provider of EUV lithography technology, which is critical for fabricating chips below the 7 nm process node. This technology enables the creation of smaller, more energy-efficient chip...