No Data

UBS241213C43000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Trump Advisers Seek to Shrink or Eliminate Bank Regulators

On Thursday, Crude Oil in the USA slightly declined as the market focused on the international oil supply and demand relationship.

In the early hours of the 13th in Peking time, the price of Crude Oil futures in the USA experienced a slight decline on Thursday. The International Energy Agency (IEA) predicted that the oil market would have sufficient supply, which offset the rising optimism regarding expectations for interest rate cuts in the USA. The price of Brent crude oil futures for February delivery on the European Intercontinental Exchange fell by 11 cents, settling at $73.41 per barrel. The price of West Texas Intermediate (WTI) crude oil for January delivery on the New York Commodity Exchange decreased by $0.27, a decline of 0.38%, closing at $70.02 per barrel. The International Energy Agency (IEA) stated on Thursday that it anticipates a sufficient supply in the oil market next year, but it slightly revised its forecast upward.

Goldman Selectively Constructive on European Banks -- Market Talk

Trump's rise to power disappoints ESG investors UBS Wealth Management believes concerns have been exaggerated

UBS Global Wealth Management said Donald Trump's return to the White House is unlikely to weaken environmental, social, and governance (ESG) investments. Strategists, including Amantia Muhedini, said in a customer report that although traditional ESG stocks such as solar and wind energy were suddenly sold off after Trump won the election on November 5, long-term demand for continued investment in fields from renewable infrastructure to electrification will remain strong. “Leaving politics and geopolitics aside, the economic prospects for renewable energy, electrification, and infrastructure remain attractive, and long-term demand is visible,” they

UBS Plans Wealth Business Shake-Up to Boost Affluent Client Outreach

Three UBS Advisor Teams Named to the Forbes America's Top Wealth Management Teams Private Wealth List

Comments

Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included:

- Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year.

- Return on tangible equity ...

The company is best known for bringing innovation to what is considered a very pragmatic field by developing innovative portfolio management software k...

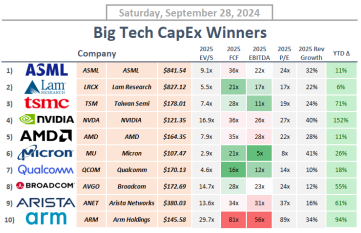

Here are 10 companies positioned to benefit from this anticipated rise in investment 🧐

1. $ASML Holding (ASML.US)$ is the exclusive provider of EUV lithography technology, which is critical for fabricating chips below the 7 nm process node. This technology enables the creation of smaller, more energy-efficient chip...