No Data

UBS250110P21000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

UBS Could Take Longer to Reap Benefits From Investment Banking Rebound -- Market Talk

UBS Buybacks Could Be Slowed Down by Regulator's Recommendations -- Market Talk

UBS Group: Upgraded Weichai Power rating to "Buy" and raised the Target Price to HKD 15.1.

UBS Group released a research report stating that the rating of Weichai Power (02338) has been upgraded from "Neutral" to "Buy," and the Target Price for the listed in Hong Kong stocks has been raised from 12.3 Hong Kong dollars to 15.1 Hong Kong dollars. The report noted that Weichai Power's stock performance in the second half of last year lagged behind the Hang Seng Index due to electric trucks quickly gaining market share amid higher subsidies and lower operating costs. However, on a quarterly basis, with the cost of Henry Hub Natural Gas (LNG) declining since the fourth quarter of last year, the bank expects market demand for LNG trucks to rebound in the first quarter of this year. Additionally, the bank believes that Weichai Power is advancing through its joint venture with BYD Company (01211).

UBS Group: Maintains SAMSONITE 'Buy' rating, Target Price raised to 29.8 Hong Kong dollars.

UBS Group released a research report stating that it maintains a "Buy" rating for SAMSONITE (01910), raising the Target Price from HK$28 to HK$29.8. The report mentions that due to declining profits, SAMSONITE's stock price dropped approximately 16% last year. However, there is optimism that adverse factors impacting revenue might dissipate in 2024, potentially leading to improved business travel demand, which could drive profit recovery. Additionally, the potential second listing in the USA could expand the Shareholder base and bring about a revaluation in the medium term. UBS Group believes that SAMSONITE has a stable free cash flow level, and there is room for dividend increases. The stock price performance is expected to surpass last year's performance by 2025.

PA GOODDOCTOR received a full purchase offer from the controlling Shareholder, Anxin.

PA GOODDOCTOR (01833) and the offeror Anxin Co., Ltd. jointly announced that based on the stock dividend plan and the choices made under it, a total of 1,042,630,820 new shares will be distributed and issued as special dividends. It is expected that the formal stocks of these new shares will be mailed on January 24, 2025, and they will start trading on the Hong Kong Stock Exchange at 9:00 AM (Hong Kong time) on January 27, 2025. Among these new shares, 698,970,587 new shares will be distributed and issued to the offeror. New shares related to the distribution and issuance as special dividends under the stock dividend plan.

UBS Declares Coupon Payments on 12 ETRACS Exchange Traded Notes

Comments

Watch here: https://youtu.be/jYIV-2f-VP0

loading...

Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included:

- Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year.

- Return on tangible equity ...

The company is best known for bringing innovation to what is considered a very pragmatic field by developing innovative portfolio management software k...

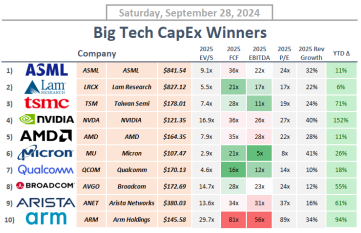

Here are 10 companies positioned to benefit from this anticipated rise in investment 🧐

1. $ASML Holding (ASML.US)$ is the exclusive provider of EUV lithography technology, which is critical for fabricating chips below the 7 nm process node. This technology enables the creation of smaller, more energy-efficient chip...

Buy n Die Together❤ :

Sunny Soh OP : Watch here: https://youtu.be/jYIV-2f-VP0