No Data

UCO241213P27500

- 2.80

- 0.000.00%

- 5D

- Daily

News

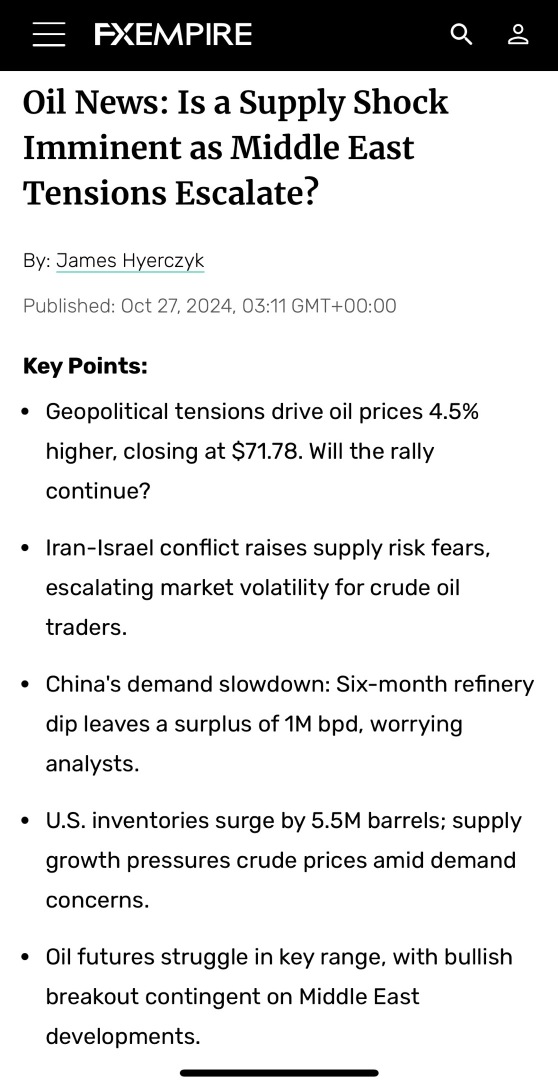

Update: WTI Oil Edges Down as the IEA Sees the Market Over Supplied in 2025

IEA Lifts 2025 Oil Demand View, yet Expects Comfortably Supplied Market

Crude Oil Jumps Back Above $70 as US Inventories Fall to Lowest Level

IEA Monthly Report: Even if OPEC+ delays production increases, there will still be an oversupply of oil next year!

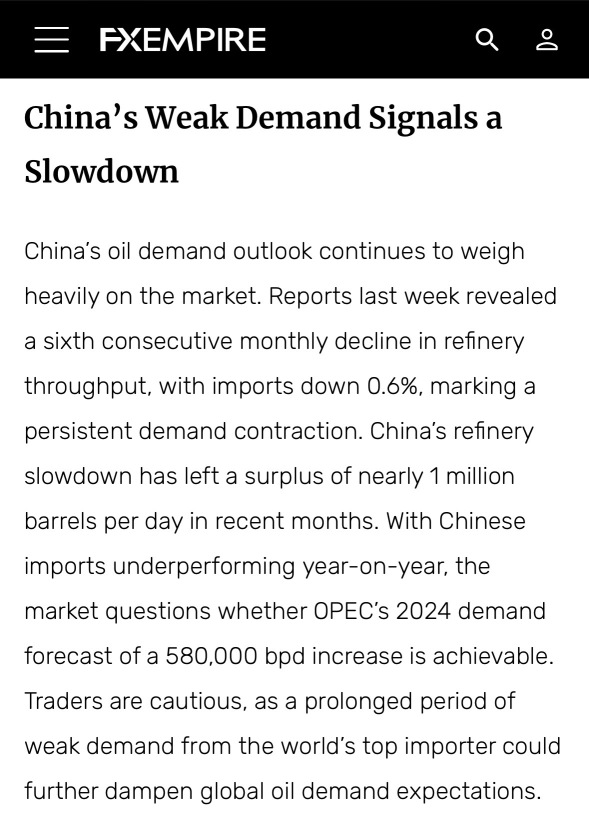

The IEA stated that if OPEC+ implements the production recovery plan starting in April, the Global market will face a surplus of 1.4 million barrels per day. The IEA has raised the forecast for global oil demand growth in 2025 by 90,000 barrels to 1.1 million barrels, mainly due to the economic stimulus measures recently announced by China.

Commodity Roundup: Commerzbank 2025 Copper View; ING Sees Energy Markets Under Pressure

WTI Edges Higher to Near $70.00 on China Stimulus, New EU Sanctions Against Russia

Comments

The shocking fact is that majority of them is still losing money despite some having “Years of experience in the market”.

Below are some of the things that made me understand much deeper about trading/investing through my work and I hope can provide some valuable insight...