No Data

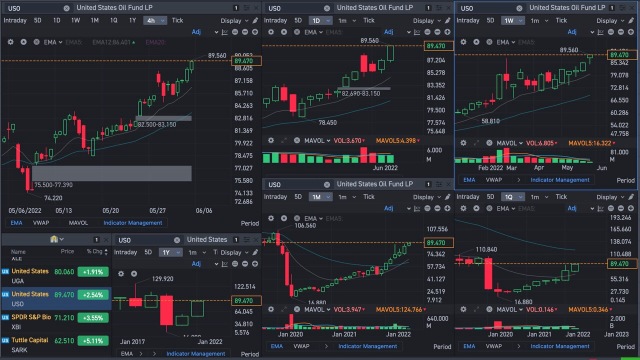

UGA United States Gasoline Fund Lp

- 62.250

- -1.040-1.64%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

OPEC+ has extended the duration of production cuts, the decrease in supply is helping the oil price bottom rebound.

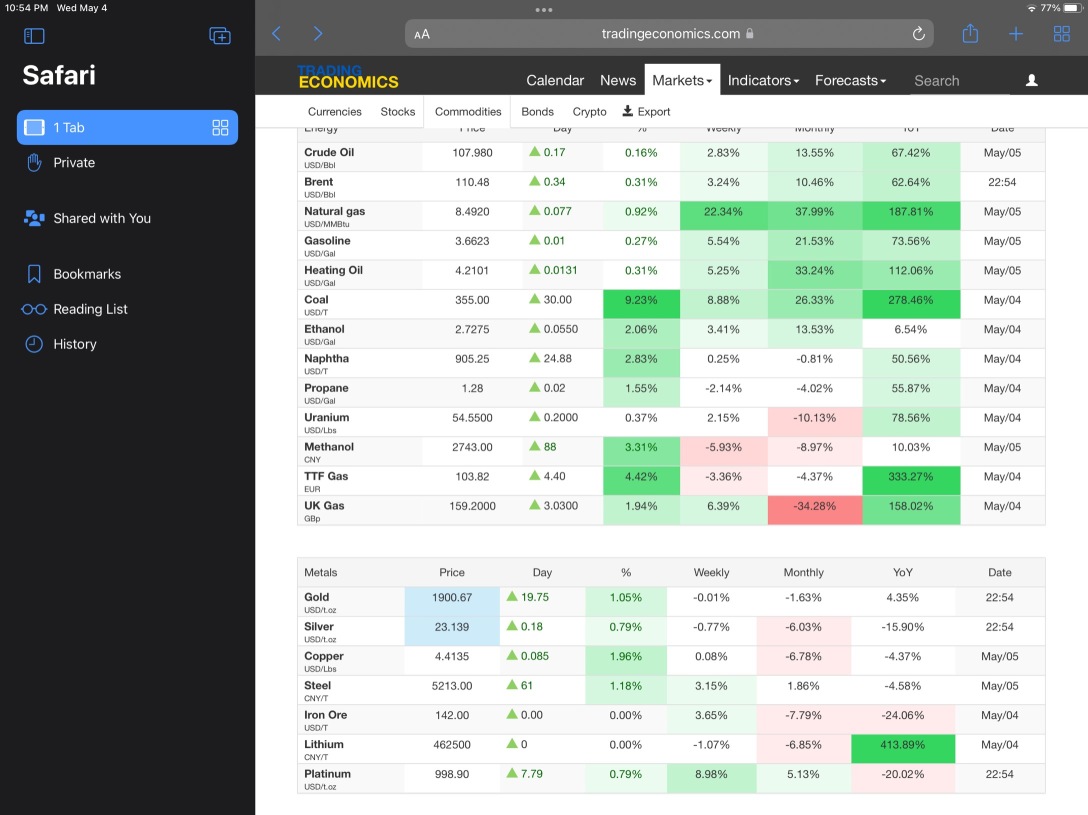

The overall trend of crude oil is showing a volatile upward trend. The average price of WTI this week is $70.78 per barrel, up $1.75 per barrel, or 2.53%, from the previous week. During the week, the main factors boosting oil prices include: OPEC+ extending production cuts, hurricanes leading to a reduction in US oil production, and ongoing uncertainty in the Middle East geopolitical situation. The main factors putting pressure on oil prices include: EIA's increase in crude oil and petroleum product inventories.

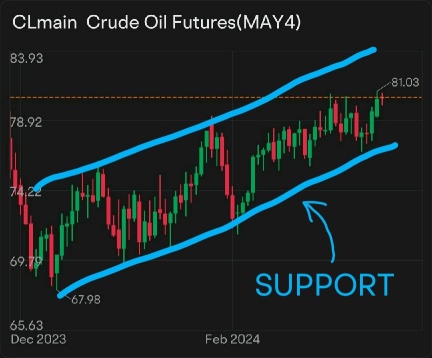

WTI Price Forecast: Breaks Below $71.50, Ascending Channel Pattern

usa crude oil fell slightly on Wednesday, investors are concerned about the impact of the election.

USA crude oil futures edged lower on Wednesday. Investors are weighing the impact of a strong US dollar and Trump's foreign policy on global oil supply.

Update: WTI Crude Falls as the Dollar Surges Following Donald Trump's Re-Election as U.S. President

US Total Crude Oil Stocks Rise in Week Ended Nov. 1

Oil Falls as Trump Win Projections Boost U.S. Dollar

Comments

With interest rates and inflation being the main concern for investors these days, all eyes will be on the Federal Reserve's interest rate decision coming this Wednesday.

Many analysts are calling for a resurgence in inflation. While the Federal Reserve has been standing by their word, saying that inflation is under control and we are on the path towards rate cuts this year.

If the Fed believes that inflation is no longer...

$Crude Oil Futures(DEC4) (CLmain.US)$ $Brent Last Day Financial Futures(JAN5) (BZmain.US)$ $RBOB Gasoline Futures(DEC4) (RBmain.US)$ $United States Oil Fund LP (USO.US)$ $United Sts Brent Oil Fd Lp Unit (BNO.US)$ $United States Gasoline Fund Lp (UGA.US)$

Natural Gas is Starting to Look More Bullish

Nat gas has had a rough go since November this year. It has lost over 20% of its value since. The unseasonably warmer than usual weather in the norther hemisphere and the slow global economic growth has held down the commodity.

More recently nat gas was consolidating near its lows with a bear flag type of wedge pattern. It seemed as if the commodity was forming a...

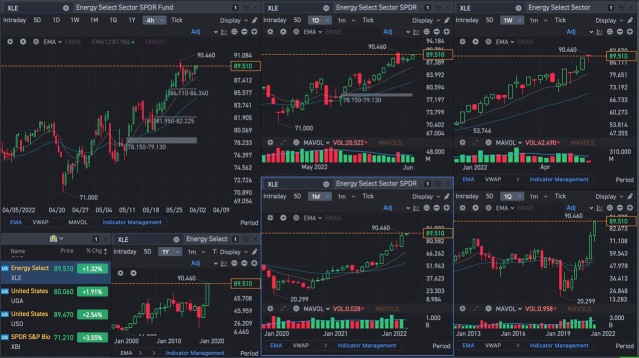

$Energy Select Sector SPDR Fund (XLE.US)$ $United States Oil Fund LP (USO.US)$ $United States Gasoline Fund Lp (UGA.US)$ $SPDR S&P 500 ETF (SPY.US)$

What’s gonna happen? Where are my commodity bulls at? I...

BelleWeather : I think proper portfolio positioning vis a vis inflation is important. The concern I have is stagflation, so I’m trying to be defensive to that. This is difficult. And timing the market is impossible and crazy-making, so I personally am taking each day as it comes.

I don’t think anyone is going to sell off over these concerns, and Powell is not about to fan those flames either!

SpyderCall OP BelleWeather : They might not sell over these concerns. But when these variables are present, then any negative catalyst will likely catalyze a selloff. For example, if we get bad rhetoric from Powell next week, then we might see extra volatility. That being said, in the current environment, any selloff will be a good buying opportunity until something breaks in the economy.

SpyderCall OP BelleWeather : So far, wages and employment numbers have held up, so stagflation is not a concern until inflation picks back up. With the way oil and gasoline prices have been climbing, we could possibly see a stagflationary environment soon, but not yet. Things are almost perfect in the economic data currently. We are in a goldilocks zone for the Fed right now. And if things get worse, then the Fed has already mentioned cutting rates. That would be even more accomodative for equities as the "Fed Put" will be in play at that point. So, if we do see stagflation, it shouldn't last long as the Fed will accommodate markets when the inflation, wages, or employment situation changes negatively.

BelleWeather : Agreed on the Goldilocks zone vis a vis the Fed mandate save one issue - the reserve bank balance is almost out - won’t they have to move to correct that?

SpyderCall OP BelleWeather : They have been greatly decreasing the balance sheet since march 2022. This is done through selling treasury bonds or mortgage securities. Short-term treasuries, like bills, have been the biggest culprits for the runoff of the balance sheet. This has been unwinding the massive amount of asset purchases since the 2008 financial crisis.

They purchased all of these assets back then as a form of quantative easing to boost the economy. Right now, they are selling treasury notes at sky-high yields to provide liquidity to banks essentially. This is putting more liabilities onto the balance sheet, which brings the balance down.

I don't think the balance sheet runoff is such a big deal at the moment.

Once the economy is showing signs of trouble, then I think we will need to worry about the Fed balance sheet. If they start buying assets, essentially quantative easing, then they might think that there is weakness in the economy.

You might think that with the Fed balance falling like it is, then long-term treasuries should be falling along with the balance. But that has not been the case since last November as these treasuries have been climbing.

This tells me that the balance sheet is now falling because the Fed is adding liquidity through short-term bond sales, which inject liquidity into the economy, which is good for an economy and equities.

View more comments...