No Data

USDCHF USD/CHF

- 0.89316

- -0.00573-0.64%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Dovish Federal Reserve officials: Inflation has significantly decreased and a moderate rate cut is expected next year.

① The Chicago Federal Reserve Chairman Goolsbee stated on Friday that he slightly lowered his forecast for next year's interest rate cuts but still expects the Federal Reserve to moderately cut rates next year; ② As a dovish official, Goolsbee will replace Cleveland Federal Reserve President Harmack next year and become a new voting member of the Federal Open Market Committee (FOMC).

Oil prices have dropped by 2.5%! With the Federal Reserve's interest rate hike expectations conflicting with demand, what will the future trend be?

This week, the international crude oil market closed stable, with Brent crude oil Futures rising by 0.08% to $72.94 per barrel, while WTI Crude Oil Futures increased by 0.12% to $69.46 per barrel. For the week, the two major Indicators of crude oil Futures cumulatively dropped by about 2.5%. The market is weighing the expectations of interest rate cuts in the USA and the demand outlook, while the dollar's pullback has provided some support for the crude oil market. The cooling of inflation in the USA has led to a softening of the dollar, which theoretically is Bullish for crude oil prices. However, the hawkish signals released by the Federal Reserve after the year-end meeting have weakened market expectations for significant rate cuts in 2025. Although the dollar has retreated from two-year highs,

The only official who voted against at the Federal Reserve's December meeting explains: Why is there no support for lowering interest rates? (Full text attached)

Federal Reserve Chair Hammack indicated that based on her determination that monetary policy is currently close to a neutral stance, she tends to keep policy stable until more evidence shows that inflation is returning to the target path of 2%. The momentum of the USA economy and the recent high inflation data prompted her to raise the inflation forecast for next year. She believes her decision is a tough choice.

Overview of opinions: After the Federal Reserve cut interest rates by 25 basis points, the Fed chairman made several statements.

After the Federal Reserve made its latest interest rate decision this week, several officials voiced their insights on outlook and inflation issues intensively on Friday. San Francisco Fed President expects fewer rate cuts next year than anticipated. Daly feels "very comfortable" with the median estimate of two rate cuts next year. Mary Daly, President of the San Francisco Federal Reserve Bank, stated that she is "very comfortable" with the median estimate of the decision-makers for two rate cuts next year, emphasizing that the Federal Reserve can shift to a slower pace. Chicago Fed President raises rate outlook but still expects lower borrowing costs. Austan Goolsbee, President of the Chicago Fed, mentioned that he slightly raised his rate outlook for 2025, but...

The Federal Reserve's "third-in-command": It is expected that interest rate cuts will continue in the future and considerations have begun regarding the impact of Trump's policies.

①Williams stated that he expects the Federal Reserve to implement more interest rate cuts, but the decision on rate cuts will depend on subsequent data, as monetary policy still suppresses economic growth momentum; ②Williams acknowledged that the impact of Trump's policy agenda has begun to influence his economic outlook.

Multiple Federal Reserve officials support relying on data for cautious interest rate cuts next year, while Powell's "dovish allies" rarely make hawkish statements.

Analyses have pointed out that although San Francisco Fed Chair Daly and New York Fed Chair Williams both acknowledge that interest rate cuts will continue next year, they also stated that there is no rush to lower rates. All Federal Reserve officials emphasized the importance of data and acknowledged the uncertainty in the outlook. However, the Chicago Fed President, who will be a voting member next year, made more dovish comments, believing that inflation is still cooling and that interest rates need to be significantly lowered within a year and a half, which boosted U.S. stocks to open low and rise high while Treasury yields fell.

Comments

🚩 8pm: Building Permits 8pm

🚩 10pm: Conference Board Consumer Confidence (Sept)

🚩 10pm: New Home Sales (Aug)

Watch out $EUR/USD (EURUSD.FX)$ $USD/JPY (USDJPY.FX)$ $GBP/USD (GBPUSD.FX)$ $USD/CHF (USDCHF.FX)$

$E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$

Forex

$GBP/USD (GBPUSD.FX)$

Stocks

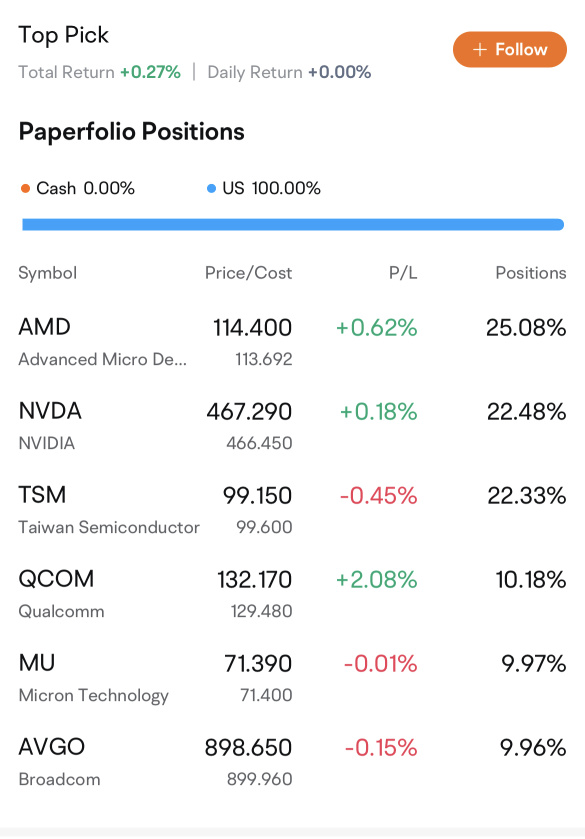

$Advanced Micro Devices (AMD.US)$

$E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$

Forex

$GBP/USD (GBPUSD.FX)$

Shares

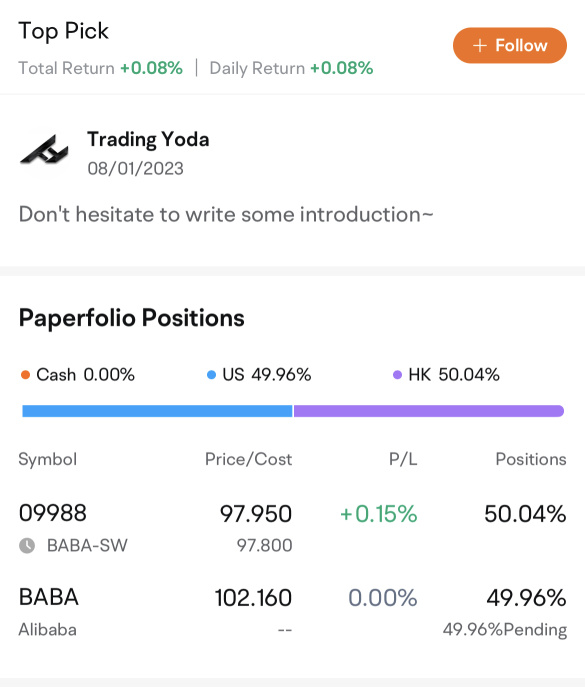

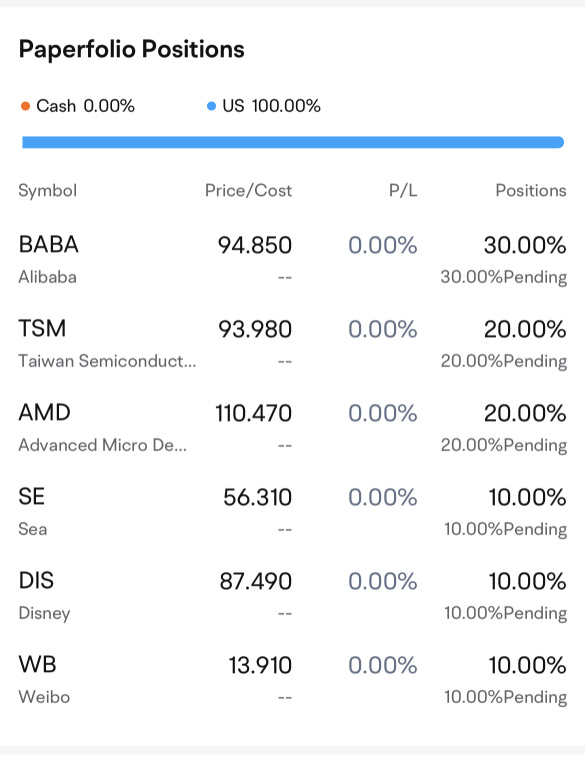

$Alibaba (BABA.US)$