Forex MarketDetailed Quotes

USDCNH USD/CNH

- 7.24855

- +0.00487+0.07%

Trading Mar 6 20:42 CT

7.25349High7.24216Low

7.24369Open7.24369Pre Close0.16%Amplitude7.3697552wk High7.24825Bid100000Multiplier6.9712952wk Low7.24885Ask

USD/CNH Forum

$USD/CNH (USDCNH.FX)$ Run! Forrest!! Run!!!

1

Columns Trader’s Look at Market – “Tough Market Tests Survivors; Analysis of NVDA option” (3 Feb 2025)

Global markets

$Dow Jones Industrial Average (.DJI.US)$ DJ -0.75%, $S&P 500 Index (.SPX.US)$ S&P500 -0.50%, $NASDAQ 100 Index (.NDX.US)$ Nasdaq -0.28%

US President Trump imposes 25% tariffs on Mexico, Canada, and 10% on China, heightening geopolitical tension and derail global economic growth.

Last week, risk sentiment was dampened by the emergence of China’s DeepSeek AI model. $CBOE Volatility S&P 500 Index (.VIX.US)$ VIX spike...

$Dow Jones Industrial Average (.DJI.US)$ DJ -0.75%, $S&P 500 Index (.SPX.US)$ S&P500 -0.50%, $NASDAQ 100 Index (.NDX.US)$ Nasdaq -0.28%

US President Trump imposes 25% tariffs on Mexico, Canada, and 10% on China, heightening geopolitical tension and derail global economic growth.

Last week, risk sentiment was dampened by the emergence of China’s DeepSeek AI model. $CBOE Volatility S&P 500 Index (.VIX.US)$ VIX spike...

+2

5

2

$USD/CNH (USDCNH.FX)$

7.39 to 7.50 upside

7.39 to 7.50 upside

3

1

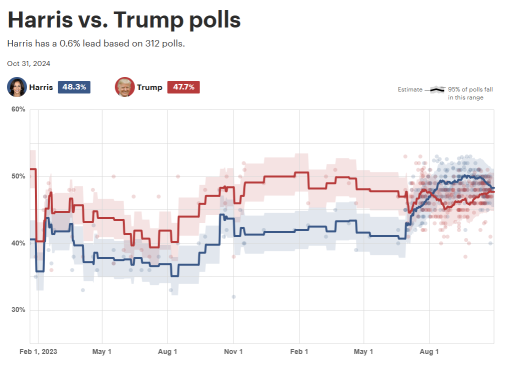

$Kamala Harris (LIST22990.US)$

Harris Trade Investment Opportunities:

1. Core Concept Stocks:

- Clean Energy Leaders: $First Solar (FSLR.US)$ , $NextEra Energy (NEE.US)$, $Bloom Energy (BE.US)$

- Electric Vehicle Supply Chain: $Tesla (TSLA.US)$ , $Rivian Automotive (RIVN.US)$ , $Lucid Group (LCID.US)$

- ESG-themed ETFs: $iShares Global Clean Energy ETF (ICLN.US)$ , �������...

23

14

17

On Lan’s remarks that local governments have 2.3 trillion yuan of funds from special bonds that they can use by the end of this year -- That’s NOT fresh stimulus, because he said that comprised of bonds that have been issued but not used yet, plus bonds that haven’t been issued but within this year’s quota. So it’s all within the budget previously known.

So I think AFP's report about issuing $325 billion in bonds was not precise.

$BANK OF CHINA (03988.HK)$ $CNH/CNY (CNHCNY.FX)$ $USD/CNH (USDCNH.FX)$ $Hang Seng Index (800000.HK)$ $NASDAQ Golden Dragon China (.HXC.US)$

So I think AFP's report about issuing $325 billion in bonds was not precise.

$BANK OF CHINA (03988.HK)$ $CNH/CNY (CNHCNY.FX)$ $USD/CNH (USDCNH.FX)$ $Hang Seng Index (800000.HK)$ $NASDAQ Golden Dragon China (.HXC.US)$

4

2

China is considering removing some of the largest remaining restrictions on home purchases, allowing 1st-tier cities to relax restrictions for non-local buyers.

Authorities are also mulling fresh measures to shore up the sluggish stock market.-Bloomberg

$SSE Composite Index (800146.HK)$ $Hang Seng Index (800000.HK)$ $USD/CNH (USDCNH.FX)$ $CNH/CNY (CNHCNY.FX)$ $USD/CNY (USDCNY.FX)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $iShares China Large-Cap ETF (FXI.US)$

Authorities are also mulling fresh measures to shore up the sluggish stock market.-Bloomberg

$SSE Composite Index (800146.HK)$ $Hang Seng Index (800000.HK)$ $USD/CNH (USDCNH.FX)$ $CNH/CNY (CNHCNY.FX)$ $USD/CNY (USDCNY.FX)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $iShares China Large-Cap ETF (FXI.US)$

9

2

The creator of the "Dollar Smile Theory" predicts that a U.S. rate cut could trigger a $1 trillion repatriation of Chinese funds, leading to a 10% appreciation of the yuan.

With the year-end peak of corporate forex settlements approaching, China Securities expects $10 billion in settlements to support the yuan by 1,000 basis points.

However, Morgan Stanley believes that for large-scale corporate settlements to occur, the yuan would need to strengthen further to the 6.9 or 6.8 level, which is c...

With the year-end peak of corporate forex settlements approaching, China Securities expects $10 billion in settlements to support the yuan by 1,000 basis points.

However, Morgan Stanley believes that for large-scale corporate settlements to occur, the yuan would need to strengthen further to the 6.9 or 6.8 level, which is c...

2

6

1

1

No comment yet

RENE MBAH MBAH : run

for real

for real