No Data

USDEUR USD/EUR

- 0.9596

- -0.0005-0.05%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

It is reported that Trump will not immediately impose new tariffs, the dollar plummeted in response, and emerging currencies rose.

Trump may postpone the immediate imposition of tariffs, causing the dollar to plummet.

The biggest market surprise on Trump's first day: the dollar plummeted.

On his first day in office, Trump did not announce specific tariff measures. The Bloomberg Dollar Spot Index fell 1.1% on Monday, marking the largest single-day drop in 14 months. Currencies sensitive to USA tariff policies, such as the Canadian Dollar and the Mexican Peso, rose at least 1%. The Emerging Markets MMF Index increased by 0.3%, achieving the best single-day performance since last September.

After Trump took office as president, the US dollar plummeted, while the three major US stock index futures and Assets in China collectively rose!

① The three major U.S. stock index futures are all rising, with Dow futures up 0.38%, S&P 500 Index futures up 0.36%, and Nasdaq futures up 0.41%; ② The USD has fallen more than 1.2% during the day, while A50 index futures have risen over 1%.

Ping An Securities: Structural clues and direction of inflation in the USA.

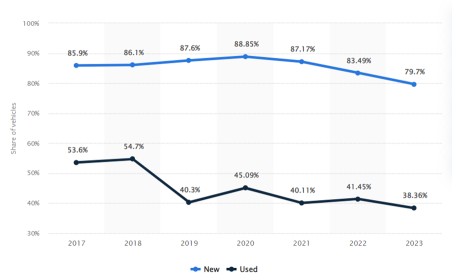

In terms of structure, housing inflation is expected to benefit from already stable market rents and continue to improve, while Transportation service inflation is also anticipated to benefit from the stabilization of Autos prices and the slowdown in the growth of Autos premiums.

Temporary Relief on U.S. Trade Policy Triggers Dollar Correction, ING Says -- Market Talk

Stocks Set to Open Higher on Tuesday, Dollar Slides as Trump Takes Office -- Barrons.com

Comments

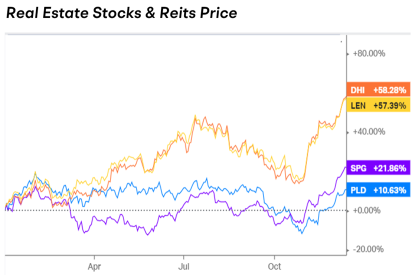

Fidelity and JPMorgan Bet on Stronger Dollar

● The Rest of World Struggle with Inflation and High-Interest Rates

This view ...

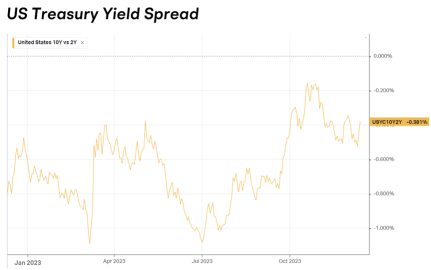

■ How Low Treasury Yields Can Go?

The benchmark 10-year yield slipped a further five basis points Thursday to as low as 3.97%, down from a peak of 5...