No Data

USDindex USD

- 109.026

- +0.327+0.30%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

FOMC Members Signal Policy 'At or Near Peak' for Tightening Cycle

Federal Reserve meeting minutes: Officials tend to slow the pace of interest rate cuts as inflationary risks increase.

The minutes from the Federal Reserve's December meeting show that officials decided to slow the pace of interest rate cuts in the coming months due to high inflation risks; participants expect inflation to continue approaching 2%, but it may take longer than expected, and the process of returning inflation to target may have temporarily stalled; regarding interest rate cuts, officials emphasized that future policy actions will depend on the development of data rather than a fixed timetable.

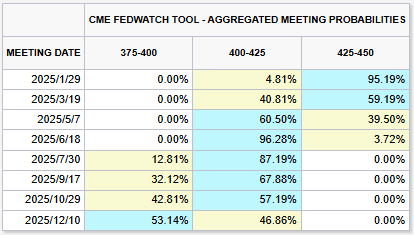

The initial claims for unemployment benefits have dropped to the lowest level in 11 months! The market is beginning to bet that the Federal Reserve will not cut interest rates in 2025.

Last week, the number of first-time jobless claims in the USA unexpectedly decreased, reaching the lowest level in 11 months.

In December, ADP employment in the USA increased by 0.122 million, indicating that the resilience of the labor market may lead the Federal Reserve to gradually lower interest rates.

Employment growth in the private sector in the USA slowed down in December, but the labor market still shows sufficient resilience, which may prompt the Federal Reserve to gradually lower interest rates in 2025.

Fed's Waller Sees More Rate Cuts in 2025 -- Barrons.com

Fed's "hot" committee member Waller: Inflation is declining, supporting further interest rate cuts.

On Wednesday, Fed "super voter" and long-time FOMC voting member, Fed Governor Waller stated that he believes inflation will continue moving towards the central...

Comments

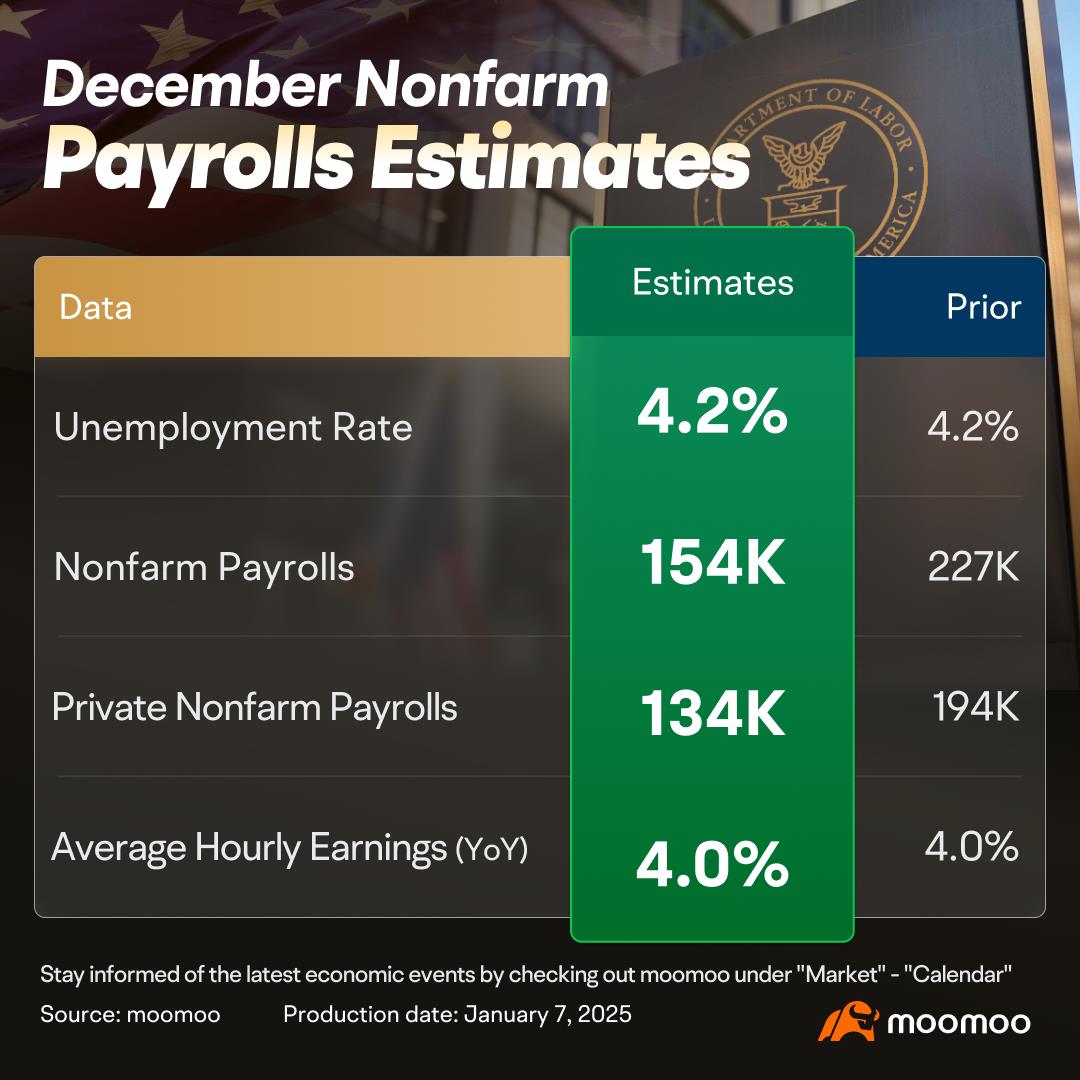

Benefiting from the dissipation of the negative impacts of hurricanes and strikes, the November US nonfarm payrolls data indicated a robust growth in the labor market. The US Bureau of ...

Benefiting from the dissipation of the negative impacts of hurricanes and strikes, the November US nonfarm payrolls data indicated a robust growth in the labor market. The US Bureau of ...