US ETFDetailed Quotes

VGT Vanguard Information Technology ETF

- 621.920

- -2.550-0.41%

Close Nov 11 16:00 ET

625.890High618.190Low

625.890High618.190Low431.83KVolume625.890Open624.470Pre Close268.31MTurnover0.33%Turnover Ratio--P/E (Static)132.76MShares626.45052wk High--P/B82.56BFloat Cap451.62352wk Low3.73Dividend TTM132.76MShs Float626.450Historical High0.60%Div YieldTTM1.23%Amplitude54.526Historical Low621.335Avg Price1Lot Size

🇺🇸 45% of Americans will run out of money in retirement, per Yahoo Finance.

.

Truth is: It’s actually way more so it wouldn’t hurt to have multiple streams of income and invest in assets 🤷🏽♂️

Hope everyone is having a Wealthy Weekend

Remember 🧠

The MIND and the HEART ♥️ are like a Parachute 🪂

They work BEST

When Open… 🤯

Finances is a Tool to be used

Not a pool to be viewed

Be a River

Not a dam 🦫 reservoir

Let anything and ...

.

Truth is: It’s actually way more so it wouldn’t hurt to have multiple streams of income and invest in assets 🤷🏽♂️

Hope everyone is having a Wealthy Weekend

Remember 🧠

The MIND and the HEART ♥️ are like a Parachute 🪂

They work BEST

When Open… 🤯

Finances is a Tool to be used

Not a pool to be viewed

Be a River

Not a dam 🦫 reservoir

Let anything and ...

+7

73

88

$300 Billion and Counting

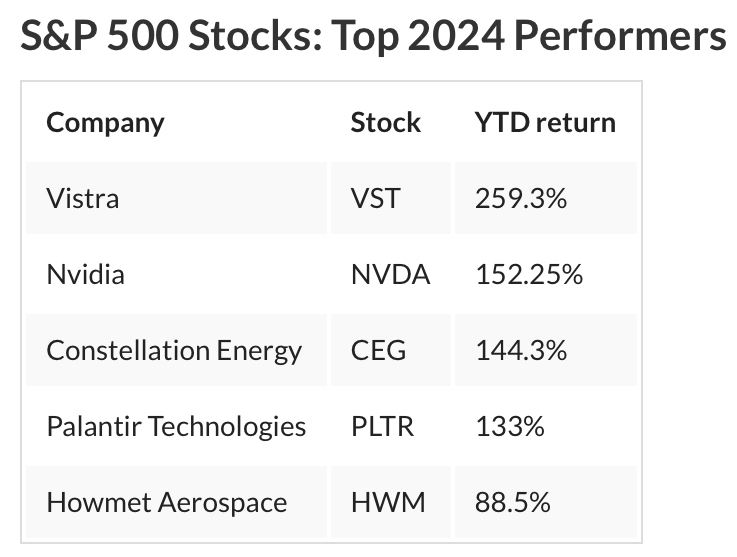

• Why are we so SERIOUS about the S&P 500 📈 and Compound Interest over time⁉️

• Over the last 20 years, through the end of Feb. 2024, the S&P 500 has posted an average annual return of 9.74%, right about in line with its long-term average.

Here’s how much you would have now if you invested in the S&P 500 20 years ago, based on varying starting amounts:

• $1,000 would grow to $2,533

• $5,000 would grow to $12,665

• $10,000 would ...

• Why are we so SERIOUS about the S&P 500 📈 and Compound Interest over time⁉️

• Over the last 20 years, through the end of Feb. 2024, the S&P 500 has posted an average annual return of 9.74%, right about in line with its long-term average.

Here’s how much you would have now if you invested in the S&P 500 20 years ago, based on varying starting amounts:

• $1,000 would grow to $2,533

• $5,000 would grow to $12,665

• $10,000 would ...

+9

52

16

$Vanguard Information Technology ETF (VGT.US)$should I drop a large sum of money now or dollars cost average?

1

$Vanguard Information Technology ETF (VGT.US)$ Why I Will Never Buy Vanguard Technology ETF VGT Again🔥

https://youtu.be/P1FzBPYckXE

https://youtu.be/P1FzBPYckXE

Bears 🐻 skeptics cynics y’all ok⁉️

NVDA won’t hit or go past 130 they say 😏

🗣 Shout out to everybody who executes vs just casually listening 👂🏽

Proud of you 👏🏽

$NVIDIA (NVDA.US)$

132.10 will take us to 135 before 1055 am news lol FOMC . good news will take us to all time high Friday or Tuesday morning .

• Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

- Warren Buffett, Multi-Billionaire

• I like ...

NVDA won’t hit or go past 130 they say 😏

🗣 Shout out to everybody who executes vs just casually listening 👂🏽

Proud of you 👏🏽

$NVIDIA (NVDA.US)$

132.10 will take us to 135 before 1055 am news lol FOMC . good news will take us to all time high Friday or Tuesday morning .

• Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

- Warren Buffett, Multi-Billionaire

• I like ...

+6

43

4

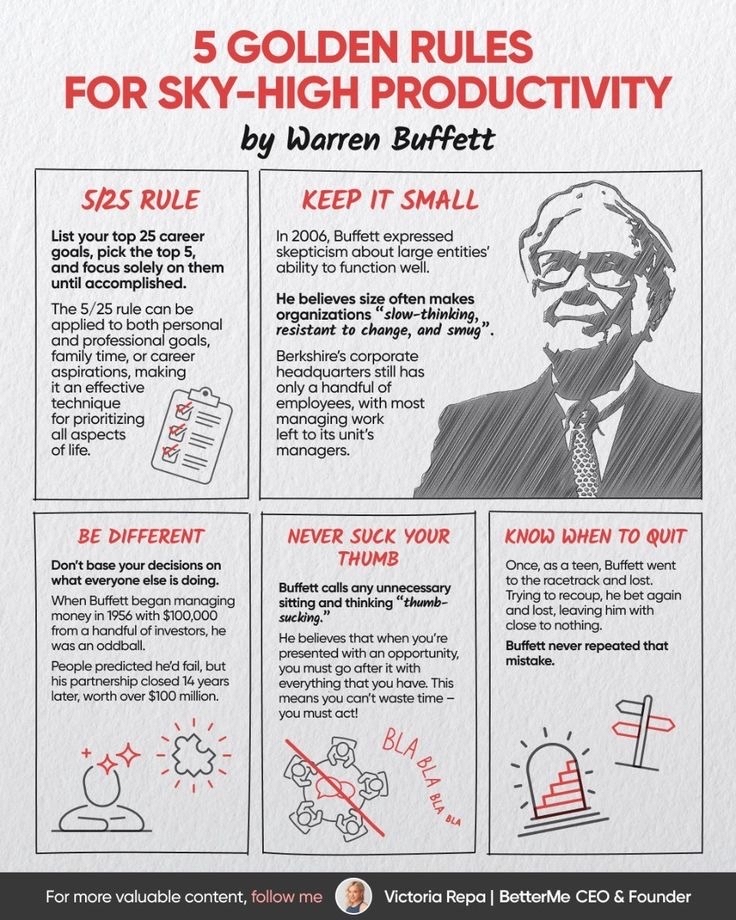

• Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

- Warren Buffett, Multi-Billionaire

• I like these ETFs for long term: SPLG FTEC VOO VGT FHLC FSKAX

• I like these stocks for long term NVDA MSFT META AMZN AAPL GOOGL CEG CVNA PLTR MSTR BRK.B LLY SMCI CRWD

• I like a few shorts as well but the majority is in ETFs and longs that have a 10-100% or more Return on Investment aka CAGR (Compound Annual Growth Rate) *

• ETFs and DCA he...

- Warren Buffett, Multi-Billionaire

• I like these ETFs for long term: SPLG FTEC VOO VGT FHLC FSKAX

• I like these stocks for long term NVDA MSFT META AMZN AAPL GOOGL CEG CVNA PLTR MSTR BRK.B LLY SMCI CRWD

• I like a few shorts as well but the majority is in ETFs and longs that have a 10-100% or more Return on Investment aka CAGR (Compound Annual Growth Rate) *

• ETFs and DCA he...

35

8

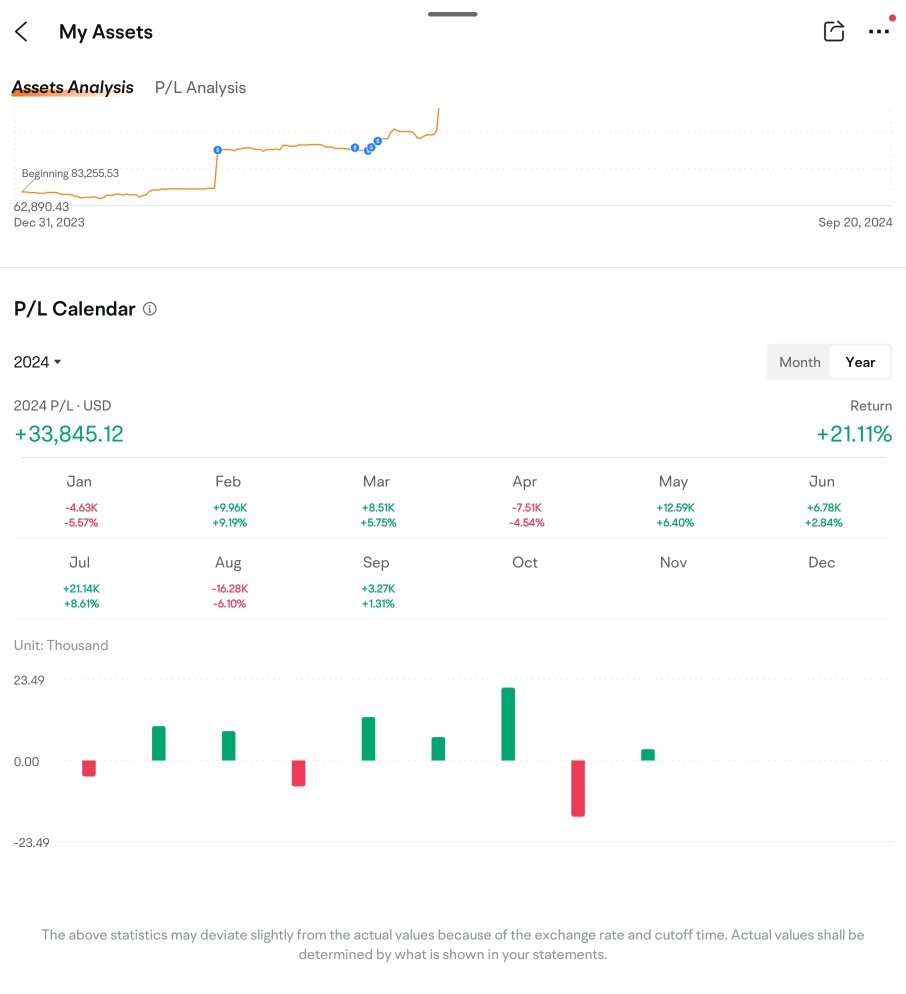

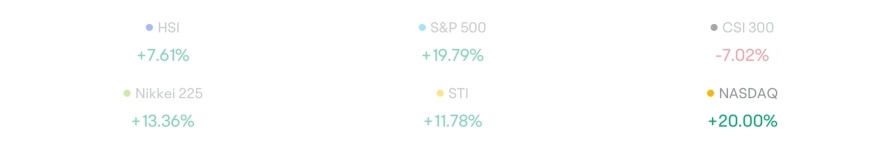

My YTD profit was 21.11% VS 19.79% for S&P500 and 20.00% for NASDAQ respectively as of 19th Sep,2024.

Picture YTD P/L as of 19th Sep, 2024.

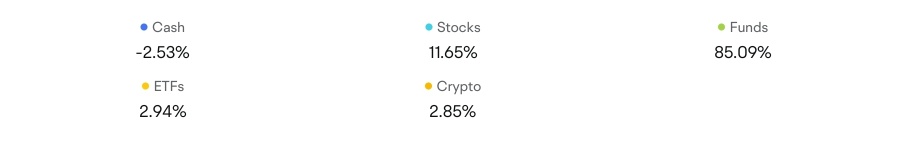

Picture of my portfolio as of 19th Sep, 2024.

As shown in the picture of portfolios, more than 80% of my holdings in my moomoo account currently are Funds, which is moomoo cash plus. In other words, I use moomoo not only for trading but also for parking capitals. Moomoo cash plus return is better than bank fix depo...

Picture YTD P/L as of 19th Sep, 2024.

Picture of my portfolio as of 19th Sep, 2024.

As shown in the picture of portfolios, more than 80% of my holdings in my moomoo account currently are Funds, which is moomoo cash plus. In other words, I use moomoo not only for trading but also for parking capitals. Moomoo cash plus return is better than bank fix depo...

+1

44

16

$NVIDIA (NVDA.US)$ continues to lead the AI chip market, while $Huawei Hongmong (LIST0795.SH)$ faces challenges competing with its Ascend series. Huawei’s software platform Cann struggles to match Nvidia’s CUDA, despite efforts to assist major clients like Baidu and Tencent in the transition.

Nvidia remains strong, with analysts optimistic about its future despite challenges with its new Blackwell chips. Nvidia stock surged 146% in the last 12 mo...

Nvidia remains strong, with analysts optimistic about its future despite challenges with its new Blackwell chips. Nvidia stock surged 146% in the last 12 mo...

4

I apologize for my recent hiatus. There are three main reasons for my absence:

i) I have been enjoying spending time with my two kids.

ii) I have been reading books to sharpen my investing and trading skills, particularly with options.

iii) The main reason is that the recent bull market has made it relatively easy to make money. Given that my investment style tends to be more conservative and less exciting, I felt there might not be...

i) I have been enjoying spending time with my two kids.

ii) I have been reading books to sharpen my investing and trading skills, particularly with options.

iii) The main reason is that the recent bull market has made it relatively easy to make money. Given that my investment style tends to be more conservative and less exciting, I felt there might not be...

+9

37

5

No comment yet

that's why the market is smaller than silver

that's why the market is smaller than silver s come up with these figures. it's not even 3 trillion dollars right now

s come up with these figures. it's not even 3 trillion dollars right now so be like water

so be like water  my friend

my friend

is

is short term when there’s red because everything’s on discount (we scoop up Solid long term ETFs and stocks for the low)

short term when there’s red because everything’s on discount (we scoop up Solid long term ETFs and stocks for the low)

people talking about it

people talking about it

So

So

we can enjoy the journey more

we can enjoy the journey more laugh

laugh  this is as much about us Becoming Better as it is about Asset Accumulation.

this is as much about us Becoming Better as it is about Asset Accumulation. so they control you with fear

so they control you with fear  and make you think it’s logic

and make you think it’s logic

DISCLAIMER

DISCLAIMER

Shout out to everybody who executes vs just casually listening

Shout out to everybody who executes vs just casually listening

. I like your opinions.

. I like your opinions.

I Am 102927471 :

股神只是虚名 : Thrash