No Data

VTI241101C210000

- 74.90

- 0.000.00%

- 5D

- Daily

News

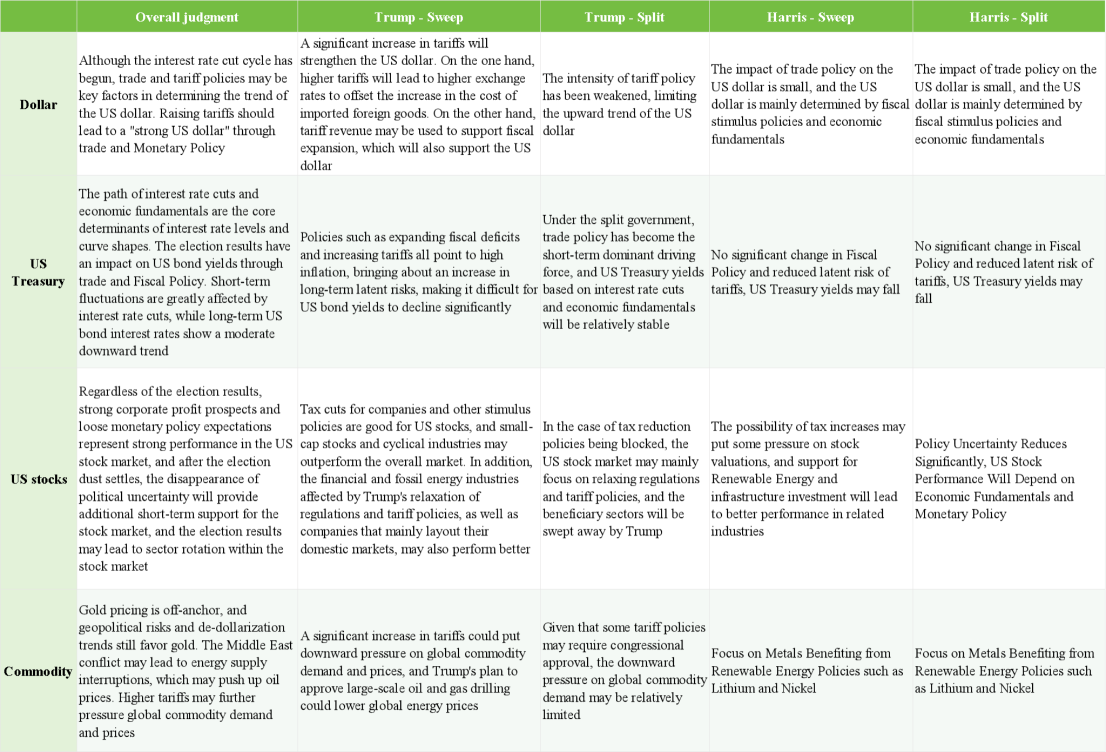

How the U.S. Election Reshaping the Global Asset Landscape?

Analyst warning: Inflation will not disappear, FED is unlikely to make significant interest rate cuts, US stocks are set to plummet by 12% next year!

①A senior financial strategist said that the Federal Reserve will not lower interest rates to very low levels as the market believes, and borrowing costs may indeed start to rise from now on; ② He predicts that the stock markets in the usa and globally may fall by 7% to 12%.

VTI ETF Gains 0.4%

U.S. Third Quarter GDP Shows Slight Decline, But Consumer Resilience Keeps Soft Landing Expectations Intact | Moomoo Research

10/30 [Strength and weakness materials]

[Bullish and Bearish Factors] Bullish factors: Nikkei average is rising (38,903.68, +298.15), Nasdaq Composite Index is rising (18,712.75, +145.56), 1 dollar = 153.20-30 yen, Chicago Nikkei futures are rising (39,170, +200 compared to Osaka), SOX Index is rising (5,332.17, +120.51), VIX Index is falling (19.34, -0.46), expectation of inflation easing in the USA, active share buyback, request from the Tokyo Stock Exchange for improving corporate value. Bearish factors:

Facebook Parent Meta Sees Bullish Put Option Positions Ahead of Earnings

Comments

Stanley Druckenmiller, an experienced hedge fund manager, is known for his keen market insights and bold investment style. With important elections approaching in the United States, Druckenmiller recently shared his perspectives, discussing not only the current market conditions but also predicting how different election outcomes might impact the investment environme...

On September 18, 2024, the Federal Reserve announced a 50 basis point rate cut, a decision that came amid significant fluctuations in market expectations regarding the extent of the cut. Compared to historical preemptive rate cuts, this round's expected magnitude and duration are notably longer, resembling the rate-cut cycle from 1984 to 1986, during which the cut reached 562.5 basis points and lasted ...

Here are some popular ETFs in US!

1. Equity ETFs (Stocks)

a. SPDR S&P 500 ETF (NYSE: SPY) $SPDR S&P 500 ETF (SPY.US)$

Tracks: The S&P 500 Index, which rep...