No Data

WDAY Workday

- 253.630

- -0.940-0.37%

- 253.630

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The U.S. stock market's Technology Sector has had an unfavorable start to the year. BMO offers advice: relying on this "select strategy" can still generate profits against the trend.

BMO suggests that investors consider adopting a "Growth at a Reasonable Price" (GARP) investment strategy, looking for well-performing stocks in the Technology Sector, as this strategy often performs well when the correlation among individual stocks decreases or is below average.

Tech Is Floundering – but 'Critical' Selectivity Can Still Offer You Outperformance – BMO

Trintech Sigue Fortaleciendo Su Liderazgo En El Mercado Y Generando Reservas De Ventas Récord

Live Stock News: -2.8% GDP, Trade War Sends Market Lower, Tesla Sales Punished

Workday To Present At Morgan Stanley Conference; Webcast At 10:45 AM ET

Should You Think About Buying Workday, Inc. (NASDAQ:WDAY) Now?

Comments

Reinstate the dividend with the stock buybacks started under BK === Watch the shorts/haters shrivel up. Hire people who distrust fascists and fascist CEOs -- assign big bonus points to the ones who distrust MorGANN Stanley sabotaging American tech workers so Nvidia shorts (Zuckerbe...

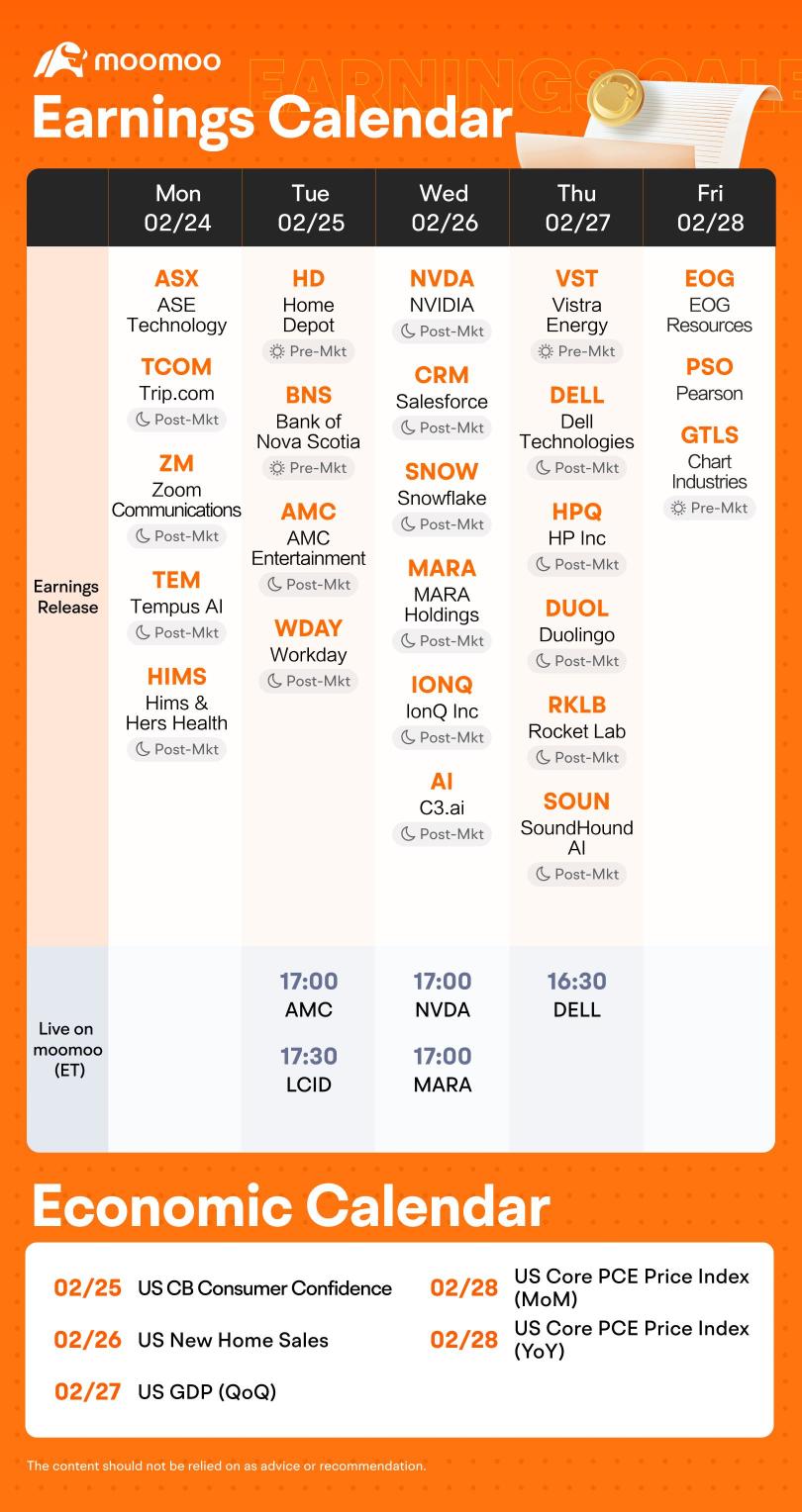

The earnings calendar for the upcoming week features a lineup of significant players and AI-related companies in the stock market.

$NVIDIA (NVDA.US)$ is set to release its Q4 2025 financial results, with analysts forecasting $38.13B in revenue (up 72.52% YOY) and $0.80 EPS (up 61.83% YOY). The company's AI-driven data center growth remains a key focus, despite geopolitical concerns abou...

The earnings calendar for the upcoming week features a lineup of significant players and AI-related companies in the stock market. Most investors place a heavy focus on NVIDIA's earnings this week.

$NVIDIA (NVDA.US)$ is set to release its Q4 2025 financial results, with analysts forecasting $38.13B in revenue (up 72.52% YOY) and $0.80 EPS (up 61.83% YOY). The company's AI-driven data cente...

The core innovation of DeepSeek lies in the significant improvement in algorithm efficiency and the substantial reduction in costs. This provides a new approach for small and medium-sized enterprises to enter the field of ...

NO BUY NO WIN = NO KAO NO NA 🤔