No Data

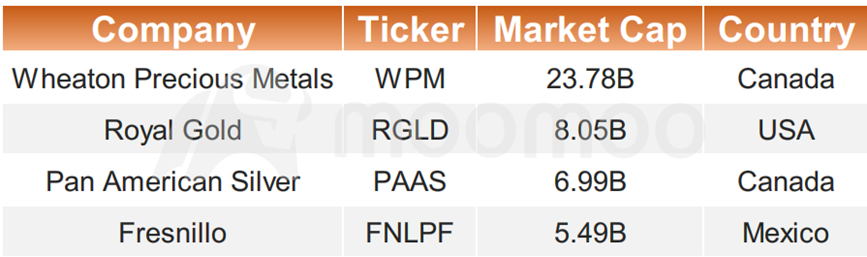

WPM Wheaton Precious Metals Corp

- 107.510

- -0.980-0.90%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Goldman Sachs has raised its year-end gold price target to $3,300, citing that "demand from central banks and ETFs has exceeded expectations."

Goldman Sachs stated that recent ETF inflows have been unexpectedly strong, reflecting an increase in investors' demand for safe-haven assets. In addition, Goldman Sachs expects that major central banks in Asia may continue to rapidly purchase Gold over the next 3-6 years, with countries like China potentially raising their target Gold reserve ratio from the current 8% to 20-30%.

Update: Gold Edges Off a Record High as Safe-Haven Demand Remains Strong

Where Is Gold Headed After A Record Climb?

BofA Upgrades New Gold, Lifts Target by 50% on Growth Potential

Gold Trades at Another Record High as Safe-Haven Demand Remains Strong

Gold Futures End Marginally Lower

Comments

In periods of uncertainty, it is crutial to have defensive positions. No defense, no offense. After we set up defensive postions, we know we will do good even if something bad haapens. With the defensive position set, we are in a good shape to find some...

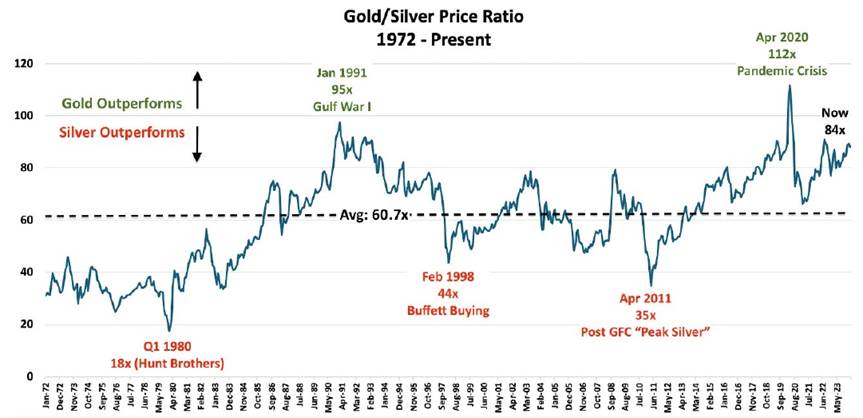

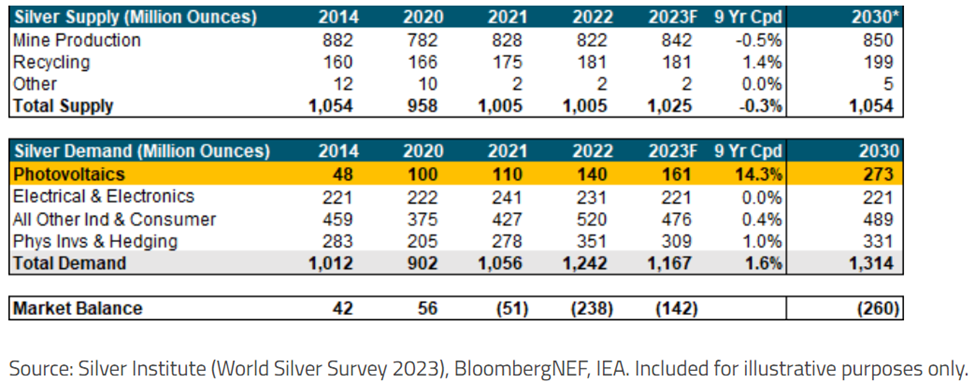

Although gold is considered a better safe-haven asset, silver offers several compelling reasons for consideration. The silver market is smaller and more volatile than gold, which means it has the potential for higher percentage gains.

Moreov...